- 20 Marks

FR – Nov 2023 – L2 – Q3 – . Preparation of Financial Statements

Prepare the statement of profit or loss and other comprehensive income and the statement of financial position for Sompa Plc.

Question

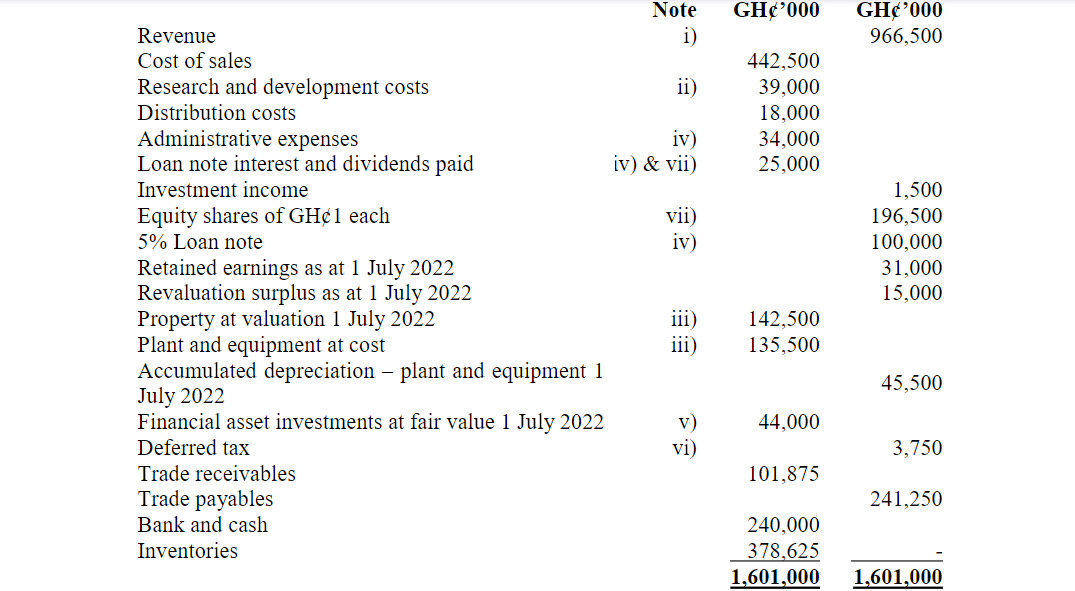

The following trial balance relates to Sompa Plc (Sompa) as at 30 June 2023:

Additional information:

i) Revenue includes a GH¢15 million sale made on 1 January 2023 of maturing goods, which are not biological assets. The cost of the goods at the date of sale was GH¢10 million.

Sompa is still in possession of the goods (but they have not been included in the inventory count). Sompa has the option to repurchase the goods at any time within three years of the sale at a price of GH¢15 million plus interest of 10% per annum. On 30 June 2023, the option had not been exercised but it is likely that it will be exercised before the date it lapses.

ii) Sompa commenced a research and development project on 1 January 2023. It spent GH¢5 million per month on research until 31 March 2023. The project then passed on into the development stage with an GH¢8 million per month spending from 1 April 2023 to 30 June 2023, when the development of the project was completed. However, on 1 May 2023, the directors of Sompa were confident that the new product would be a commercial success. Expensed research and development costs should be charged to cost of sales.

ii) Non current assets:

Sompa’s property is carried at fair value which at 30 June 2023 was GH¢145 million. The remaining life of the property at the beginning of the year (1 July 2022) was 15 years. Sompa does not make an annual transfer to retained earnings in respect of excess depreciation on revaluation. The company pays tax on profits at the rate of 25%. Plant and equipment is depreciated at 15% per annum using the reducing balance method. No depreciation has yet been charged on any non current asset for the year ended 30 June 2023. All depreciation is charged to cost of sales.

iv) The 5% loan note was issued on 1 July 2022 at its nominal value of GH¢100 million incurring direct issue costs of GH¢2.5 million which have been charged to administrative expenses. The loan note will be redeemed after three years at a premium which gives the loan note an effective finance cost of 8% per annum. Annual interest was paid on 30 June 2023.

v) At 30 June 2023, the financial asset equity investments had a fair value of GH¢48 million. There were no acquisitions or disposals of these investments during the year.

vi) A provision of GH¢6 million for current tax for the year ended 30 June 2023 is required.

Additionally, GH¢4 million increase in the deferred tax provision is to be charged to profit or loss.

vii) Sompa paid a dividend of GH¢0.20 per share on 30 March 2023, which was followed by an issue of 50 million equity shares at their full market value of GH¢1.70. At 1 July 2022, Sompa had in issue 100 million shares at full market value of GH¢1 each.

Required: Prepare for Sompa Plc:

a) The Statement of Profit or Loss and other Comprehensive Income for the year ended 30 June 2023.

b) The Statement of Financial Position as at 30 June 2023.

(10 marks)

Find Related Questions by Tags, levels, etc.