- 20 Marks

ATAX – May 2016 – L3 – Q3 – Petroleum Profits Tax (PPT)

Analyze the taxation effects of incentives on Joint Ventures vs. Sole Risk operations, compute Tax Inversion Penalty, and explain Mineral Rights Acquisition Costs.

Question

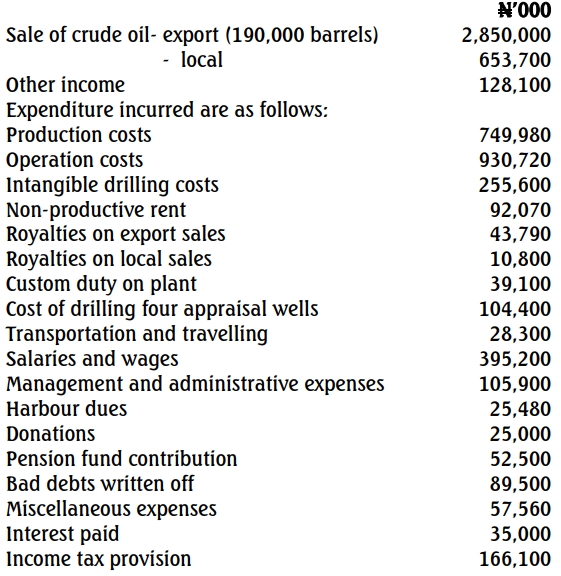

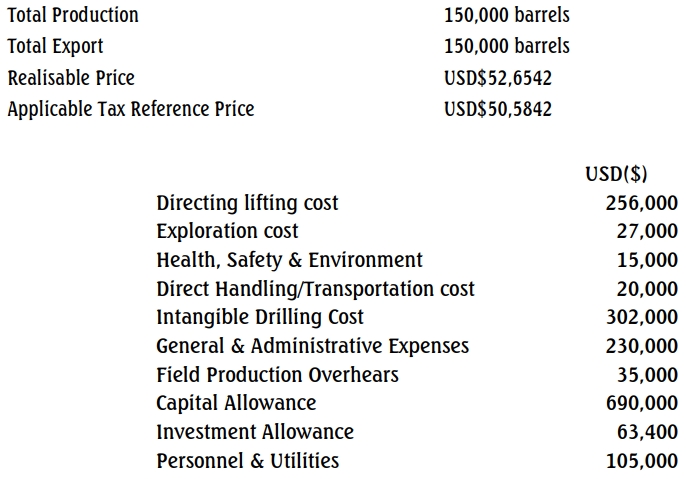

Ugheli Limited is operating a Joint Venture with NNPC under the Year 2000 Memorandum of Understanding, while Eket Limited operates under the Sole Risk Operation agreement.

The following information reflects the two companies’ operations for the month of July 2014:

Required:

(a)

i. Using the above information, compare the effects of Incentives on Joint Venture Operation as against the Sole Risk Operation using the two companies’ operations. (7 Marks)

ii. What is the purpose of Tax Inversion Penalty (TIP)? (4 Marks)

iii. Determine the Tax Inversion Penalty and the Revised Government Take from the operations of the two companies. (Tax Inversion Rate is 35%) (3 Marks)

(b) Explain the term “Mineral Rights Acquisition Costs.” (3 Marks)

(c) Explain briefly the differences between Joint Venture and Sole Risk Agreements under the Year 2000 Memorandum of Understanding. (3 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Joint Ventures, Sole Risk Operations, Tax Incentives, Tax Inversion Penalties

- Level: Level 3

- Topic: Petroleum Profits Tax (PPT)