Sunny Oil Producing Nigeria Limited is engaged in petroleum exploration in the deep sea off the coast of Bight of Benin in the Niger delta region since 2005. It is involved in a production sharing contract with the Nigerian National Petroleum Corporation. In order to consolidate its position in the Nigerian oil and gas sector, the company intends to diversify its operations into the ocean-going oil tanker transportation business in the next few months.

The company submitted its annual returns and statement of tax computation in respect of the year ended December 31, 2018, to the Federal Inland Revenue Service office in April 2019, but there was a disagreement between the amount raised by the tax office and that of the company. A check by the financial accountant of the company revealed that capital allowances on plant and equipment acquired for N120.5 million during the year, as well as a donation of N50 million made to an institution of higher learning, were not taken into consideration in the determination of assessable profit. A letter explaining this discrepancy was written by the Managing Director to the FIRS, but instead of the issue being resolved, a notice, giving the company date and time for hearing before the Tax Appeal Tribunal was received.

In order for the company to be properly guided in the pursuit of the case before the tribunal, it was resolved that a competent firm of Chartered Accountants with a bias in oil and gas accounting and taxation should be engaged.

Your firm has been appointed as the company‘s tax consultants with the mandate of representing the company at the sittings of the Tax Appeal Tribunal. Relevant documents in respect of the acquisition of the plant and equipment and donation were made available to you.

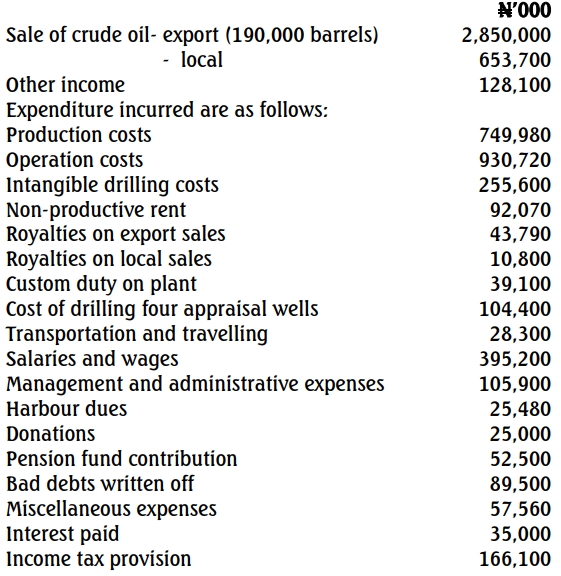

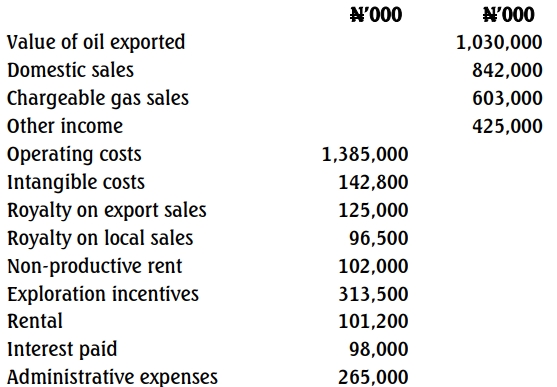

The extract from the books of accounts of the company for the year ended December 31, 2018 revealed the following:

(i) Export sales:

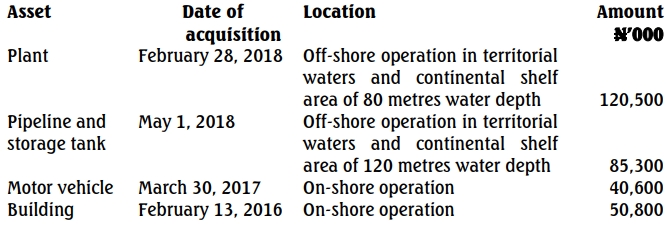

- Bonny light 150,000 barrels exported at 37° API

- Forcados 100,000 barrels exported at 36° API

- Bonny medium 90,000 barrels exported at 35° API

Price per barrel at 36° API:

- Bonny Light: $63.03

- Forcados: $65.00

- Bonny medium: $64.53

(ii) Actual realised price is arrived at after adjusting for the variance in API. For every API, $0.03 is the variance in price at 36°.

(iii) Domestic sales: 80,000 barrels at N720 per barrel.

(iv) Expenses incurred include:

| Description |

Amount (N’000) |

| Operating expenses |

255,000 |

| Production and exploration |

1,100,600 |

| Intangible drilling cost |

420,800 |

| Administrative expenses |

225,500 |

| Non-productive rent |

80,700 |

| Bad debts written off |

20,150 |

| Repairs and renewals |

92,600 |

| Transportation and traveling |

73,200 |

| Royalties |

222,900 |

| Miscellaneous expenses |

63,800 |

| Salaries and wages |

830,700 |

| Pension fund contribution |

74,450 |

| Customs duty (non-essentials) |

10,400 |

| Harbour dues |

3,300 |

| Stamp duties on debenture |

2,500 |

| Interest on loan |

52,350 |

| Cost of 3 appraisal wells |

120,000 |

| Income tax provision |

750,000 |

| Transfer to special reserves |

255,000 |

Additional Information:

(i) Production and exploration include N80 million incurred on tangible drilling operation and depreciation of N200.2 million.

(ii) Royalties include an amount of N22.5 million in respect of royalties on domestic sales.

(iii) Miscellaneous expenses include, among others, N12.75 million spent on obtaining information on the existence of oil in the Middle-Belt and N50 million donation to a public university in one of the states in the Niger delta region.

(iv) The Joint Tax Board gave approval for the operation of the pension fund contribution in the company.

(v) Interest on the loan includes N12.3 million paid to a subsidiary company. The transaction was made at the prevailing market rate.

(vi) The company entered into a gas contract with the following:

| Company |

Load factor |

Amount (N’000) |

| Akin Gas Limited |

66 |

220,000 |

| Bollah Limited |

71 |

350,000 |

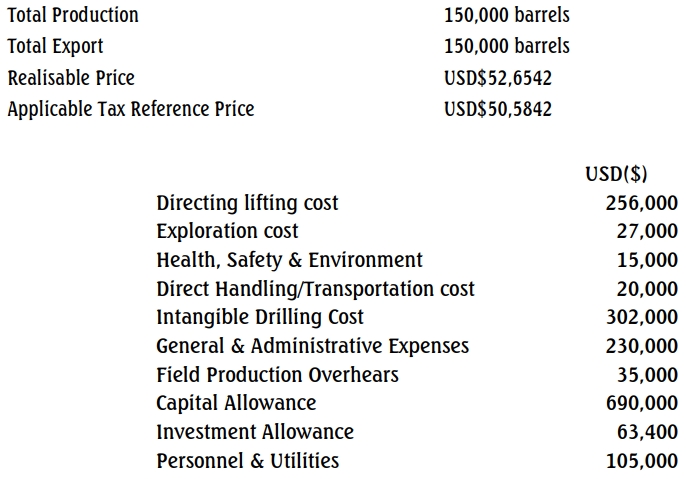

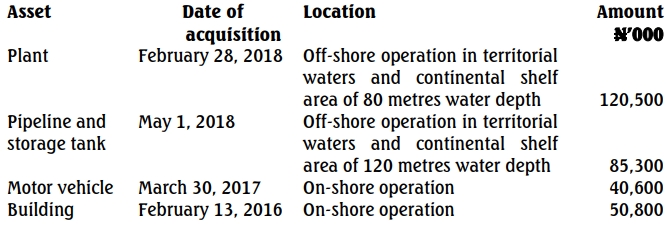

(vii) Schedule of qualifying capital expenditure:

(viii) Unutilised capital allowance and loss brought forward from the previous year were N12.5 million and N750 million, respectively.

(ix) Capital allowance as agreed with the relevant tax authority was N130.25 million.

(x) The amount stated in respect of transfer to special reserves was approved by the company’s Board of Directors to be utilised for future investment opportunities.

(xi) Assume N305 is equivalent to US $1.

(xii) Profits from petroleum exported or sold domestically are taxable at 85%.

Required:

a. As the company‘s tax consultant, you are to draft a report to the Managing Director explaining the following:

i. The preparation which you and the company should make before the commencement of the proceedings at the tribunal. (2 Marks)

ii. Steps to be taken by the company if the decision of the tribunal is not acceptable to it. (2 Marks)

iii. The tax implication of the company‘s proposed transportation business. (1 Mark)

b. Re-computing the following:

i. Assessable profit (8 Marks)

ii. Chargeable profit (3 Marks)

iii. Assessable tax (1 Mark)

iv. Chargeable tax (1 Mark)

v. Total tax payable (2 Marks)