- 8 Marks

AT – Nov 2018 – L3 – Q5a – Petroleum operations, Capital allowance

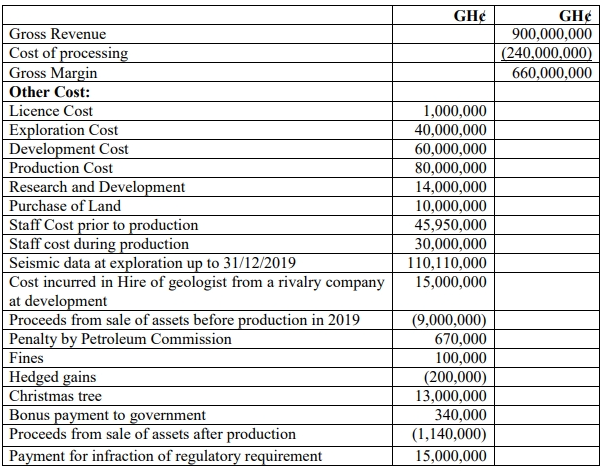

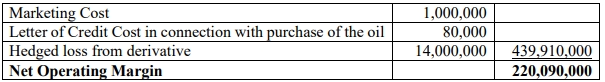

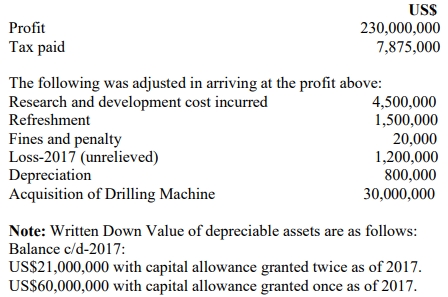

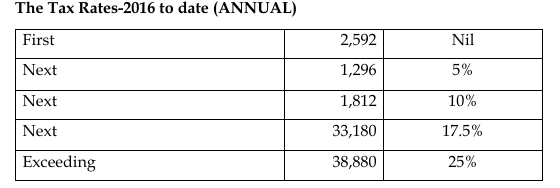

Computation of tax payable for a petroleum company, including adjustments for financial gains, costs, and capital allowances.

Question

The following is relevant for the operation of AB Ltd, operating in the upstream petroleum sector for the 2017 year of assessment:

| Details | $ |

|---|---|

| Revenue | 100,000,000 |

| Cost | 80,000,000 |

| Profit | 20,000,000 |

The following additional information forms part of the above:

- The revenue includes financial gain from swaps of $1,000,000.

- The financial cost of $1,200,000 was added to the cost.

- The cost includes depreciation of $200,000.

- Research and development (R&D) of $100,000 was added to the cost of operation.

- Revenue on 20,000 barrels of oil sold was added to revenue. The price used on the 20,000 barrels was $70 in its tax returns, but the agreed price is now $67, certified by the Petroleum Unit of the Ghana Revenue Authority.

- Written down value (WDV) as of 31/12/2016 was $1,800,000 after granting capital allowance the second time as of 2016 year-end. This information is yet to be adjusted.

Required:

i) Compute the tax payable. (6 marks)

ii) Comment on the deductibility of financial cost in petroleum operations. (2 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Capital Allowance, Financial Costs, Petroleum taxation, Tax computation, Taxable Income

- Level: Level 3

- Topic: Capital allowance, Petroleum operations

- Series: NOV 2018

Report an error