- 20 Marks

PM – May 2022 – L2 – SA – Q3 – Performance Evaluation

Evaluate Uzochuks' financial performance using ARR and EVA, and assess the NPV of a solar project.

Question

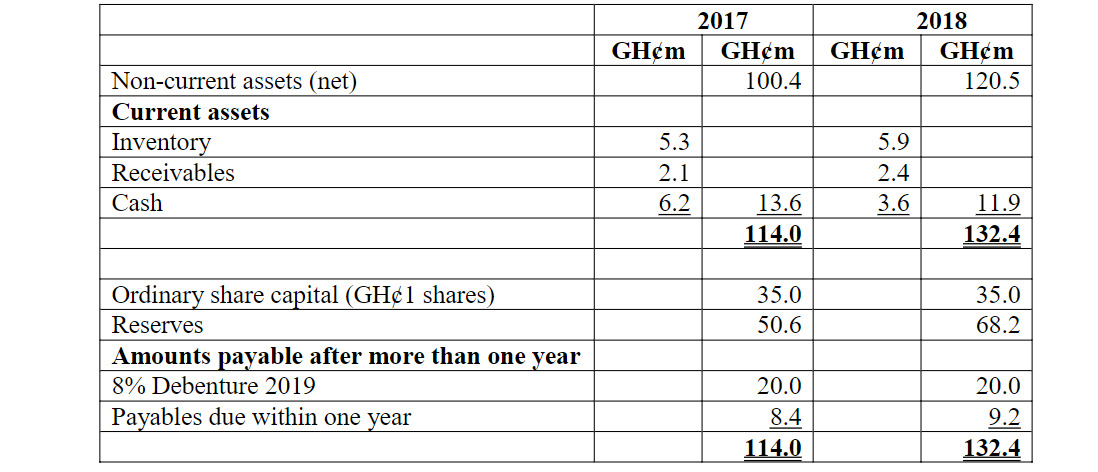

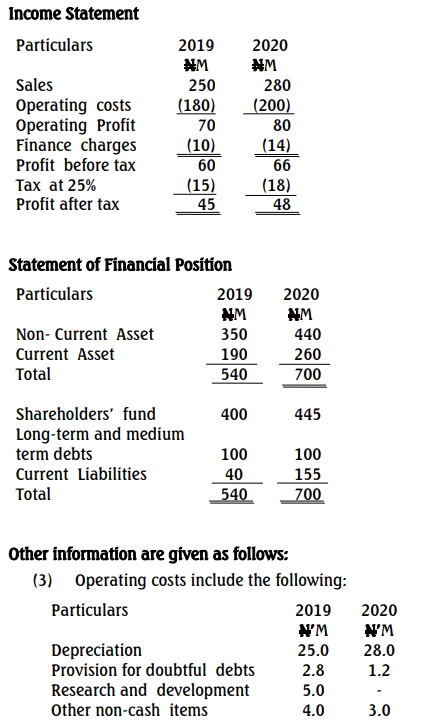

Uzochuks Nigeria Limited is a company established four years ago to produce medical equipment. The income statement and statement of financial position for 2019 and 2020 are as follows:

(ii) Economic depreciation is assessed to be N50.5million in 2020. Economic depreciation includes any appropriate amortisation adjustments. In previous years, it can be assumed that economic and accounting depreciation were the same.

(iii) Tax is the cash paid in the current year (N16 million) and an adjustment of N2 million for deferred tax provisions. There was no deferred tax balance prior to 2020.

(iv) The provision for doubtful debts was N2.5million on the 2020 statement of financial position.

(v) Research and development is not capitalised in the accounts. It relates to a new project that will be developed over five years and is expected to be of long-term benefit to the company. 2020 is the first year of this project.

(vi) The company had a non-capitalised leased assets of N18million in January 2020. These assets are not subjected to depreciation.

(vii) Cost of capital of Uzochuks:

Equity 18%

Debt (pre-tax) 6%

(viii) Capital structure of Uzochuks:

Equity 60%

Debt 40%

(ix) The company had the opportunity to invest in a solar project that will require the procurement of an equipment worth N3million in January 2020 and run for a period of 5 years with a salvage value of N0.50million, generating a stable net cash flow of N0.85 million. The applicable cost of capital is the associated weighted average cost of capital of the company.

Required:

a. i. Compute and evaluate the company’s performance using the average rate of return (ARR). (4 Marks)

ii. Compute and evaluate the company’s performance using the economic value added (EVA) parameter. (9 Marks)

b. Calculate the net present value (NPV) of a solar project that will require the procurement of equipment worth N3 million in January 2020, generating a stable net cash flow of N0.85 million annually for five years with a salvage value of N0.50 million. The applicable cost of capital is the associated weighted average cost of capital of the company. (7 Marks)

Find Related Questions by Tags, levels, etc.