- 6 Marks

PT – April 2022 – L2 – Q3a – Income Tax Liabilities

Explain the tax treatment for overtime allowance and bonus payments in Ghana.

Find Related Questions by Tags, levels, etc.

Report an error

Find Related Questions by Tags, levels, etc.

b) Maame Agyeiwaa is a junior staff member of KayDee Ltd. Her monthly basic salary is GH¢800. She was paid an overtime allowance totalling GH¢100 during the month of January 2021. In February 2021, Maame Agyeiwaa was paid overtime allowance totalling GH¢500.

Required:

i) Compute her tax liability on the overtime allowance for the month of January 2021.

(2 marks)

ii) Compute her tax liability on the overtime allowance payments for the month of February 2021.

(3 marks)

Find Related Questions by Tags, levels, etc.

c) Bawa is a junior staff member of Blinks Ltd. Her monthly basic salary is GH¢2,000. She was paid an overtime allowance totalling GH¢500 during the month of February 2021.

Required:

What is the tax implication of the overtime allowance paid?

(3 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

d) Mrs. Akoto has been engaged by Madane Ltd as the Marketing Manager for 30 years on an annual salary of GH¢20,000.

The following information relates to Mrs. Akoto:

i) Throughout her working life, she earned her best salaries from Madane Ltd.

ii) She has 408 months’ contribution to her credit.

iii) She retired on 31 March 2020 at the age of 60.

Required:

Compute her monthly pension entitlement.

(5 marks)

Find Related Questions by Tags, levels, etc.

The information below relates to individuals who earned income in the 2022 year of assessment:

Resident individuals:

Mr. Agandi and Mr. Yonny are resident employees in Ghana. The chargeable income earned per annum by Mr. Agandi and Mr. Yonny amounts to GH¢300,000 and GH¢650,000 respectively.

Non-Resident individuals:

Mrs. Zindana and Mrs. Maleda are non-resident individuals. Mrs. Zindana and Mrs. Maleda have earned chargeable incomes to the tune of GH¢300,000 and GH¢650,000 per annum respectively.

Required:

Compute their respective taxes payable for the 2022 year of assessment.

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Lord Pakro was seconded to Ghana from the Crops Scientists Institute in USA as a Crop Scientist to Crop Research Institute in Ghana, for a period of 5 months, starting from 1 August, 2018. He was based at Nyankpala (Northern part of Ghana), one of the farming sites of the Crop Research Institute.

His conditions of service were as follows:

GH¢

Salary: 6,000 per month

Expatriate allowance: 2,000 per month

Risk allowance: 1,000 per month

He was provided with a furnished bungalow and a Toyota Pick-up vehicle with driver and fuel for both official and private activities.

In addition to the above, the parent company agreed to meet his commitment at home during his six-month stay in Ghana at $1,200 per month. The average exchange rate has been $1=GH¢5.00.

Required:

Determine Lord Pakro’s chargeable income and tax liability, if any, during his stay in the country. Produce the related notes guiding your determination.

(6 marks)

Find Related Questions by Tags, levels, etc.

Amos is a Senior Staff member of Sims Company Limited. His monthly basic salary is GH¢1,490.00. He was paid an overtime totalling GH¢650.00 during the month of January, 2019.

Required:

What is the tax implication? (3 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

The table below shows the incomes of three employees of Agana Ltd in 2022 year of assessment.

| Income Details | Adom | Aseda | Ayeyie |

|---|---|---|---|

| Basic Salary (GH¢) | 120,000 | 160,000 | 180,000 |

| Medical Allowance (5% of Basic Salary) | 6,000 | 8,000 | 9,000 |

| Rent Allowance (10% of Basic Salary) | 12,000 | 16,000 | 18,000 |

| Fuel Allowance (15% of Basic Salary) | 18,000 | 24,000 | 27,000 |

| Total Cash Emoluments | 156,000 | 208,000 | 234,000 |

Besides the cash emoluments stated above, the employees received loans from the employer as follows:

i) Adom received a loan of GH¢24,000 at a rate of 5% payable within 12 months.

ii) Aseda received a loan of GH¢48,000 at a rate of 8% payable within 24 months.

iii) Ayeyie received a loan of GH¢100,000 at a rate of 10% payable within 36 months. This loan is in addition to an outstanding loan of GH¢50,000 with the same terms and conditions during the previous twelve months. (Assume that the statutory rate is 30% per annum).

Required:

Determine the loan benefits applicable to each of the three employees for the 2022 year of assessment. (16 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

The following details were taken from the records of KK Company Limited for the 2020 year of assessment.

| Item | GH¢ |

|---|---|

| Profit before tax | 132,000 |

| Total Financial Gain from derivatives | 42,000 |

| Total Financial Cost from derivatives | 300,000 |

Required:

i) State what constitutes financial cost from derivatives? (3 marks)

ii) Explain the tax treatment of financial cost from derivatives under a company such as KK Company Limited that is neither a mining nor petroleum company. (2 marks)

iii) Compute and explain the allowable financial cost from derivatives. (3 marks)

iv) Assume all facts are the same except that Financial gain from derivatives is GH¢60,000 and Financial Cost from derivatives is GH¢30,000. Compute and explain the allowable financial cost from derivatives.

Find Related Questions by Tags, levels, etc.

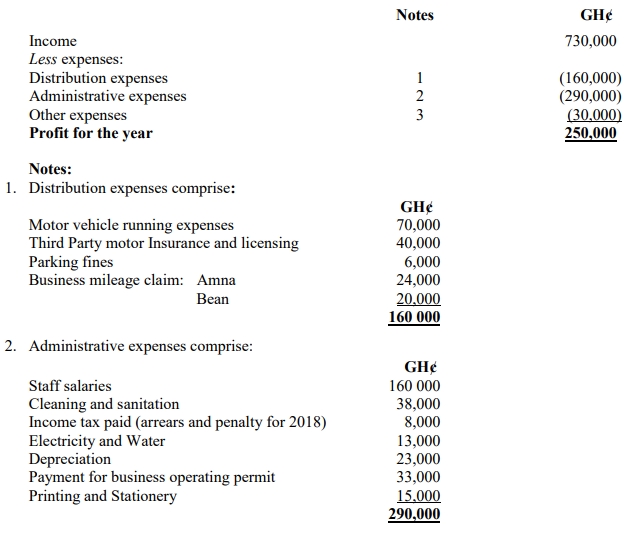

Amna and Bean are brothers and equal partners in their partnership business, A&B General Wholesale Merchants Limited. The partnership is in its second year of trading and operates from an office premises owned by Amna. The cost of the premises as at 1 January, 2019 was GH¢200,000. Bean provided all the office furniture and equipment used by the partnership, valued at GH¢80,000 as at 1 January, 2019.

Amna and Bean use their own personally acquired motor vehicles for the partnership business and charge the partnership for the business mileage incurred for fuel and maintenance. The cost of the two motor vehicles as at 1 January, 2019 was GH¢120,000. The partnership has employed three staff in addition to the partners.

The partnership’s income statement for the year ended 31 December 2020 is detailed below:

3. Other expenses comprise penalties for late filing of tax returns and payment of taxes.

Amna and Bean are both married. Amna has two children, both in accredited senior high schools in Ghana. Bean has one child who is currently attending university in the United Kingdom. Amna takes full care of her aged mother. Bean, who is currently undertaking a training course in Wholesaling Risks, is certified as handicapped in one of his legs through an accident. Bean paid GH¢3,300 for the training course.

Required:

Find Related Questions by Tags, levels, etc.

An individual who is required to furnish the Commissioner-General (CG) with a return in relation to a gift has to do so to enable the CG subject it to appropriate tax.

Required:

Explain the treatment of a gift not received under employment or business.

Find Related Questions by Tags, levels, etc.

Elorm and Eyram entered into a partnership on 1 January 2018 to produce hair products. They agreed to share profit and losses equally after charging:

Required:

Compute the chargeable income of Elorm, Eyram, and Elinam for the 2018, 2019, and 2020 years of assessment. (14 marks)

Find Related Questions by Tags, levels, etc.

Abotsi has been in employment at Asempa Ltd since 1 August 2019 as Finance Manager on a salary scale of GH¢32,000 by GH¢8,000 to GH¢48,000.

His service conditions include the following:

i) Responsibility allowance of 18% of basic salary

ii) Utilities allowance per annum of 10% of basic salary

iii) Risk allowance of 20% on basic salary and car maintenance allowance of 5% of basic salary

iv) Leave allowance of GH¢1,900 per annum

v) Medical allowance per annum of GH¢3,500

vi) Meals allowance of GH¢700 per month

vii) Two house helps on GH¢500 wages per month each. The amount is paid to Abotsi in cash directly by the company

viii) Bonus of 25% of annual basic salary

ix) Annual Overtime allowance of GH¢18,000

x) Unaccountable entertainment allowance of GH¢2,000 a year

xi) Provision of a well-furnished bungalow in respect of which he pays GH¢400 per month as rent by way of deduction at source

xii) Provision of a vehicle with driver and fuel for both official and private purposes

xiii) Special retirement package by way of a provident fund of which he contributes 9% of his basic salary, while the company contributes 11%. (The scheme is approved by the regulatory body)

xiv) Social Security and National Insurance Trust contribution of 5.5% and the employer contributes 13% of basic salary

xv) On 1 January 2021, he was given a car loan of GH¢20,000 to purchase a car for his mother at a simple interest rate of 15% per annum. The institution gives similar facilities to other customers at the rate of 28% but the statutory rate (Bank of Ghana rate) is 25%. The loan is to be paid within the period of 24 months

xvi) He is married to Abotsiwaa and Abotsimaa who are unemployed and contribute little or no financial support to their husband. Their responsibilities are limited to the management of the house

xvii) He has six (6) children, four (4) of whom are in Silicon Valley International School, Accra-Ghana, while the rest are working

xviii) He is also responsible for the upkeep of four (4) aged relatives of his

xix) He is currently pursuing MPHIL in Finance at UPSA where he incurred GH¢25,000 by way of educational expenses in 2021

xx) He is a director of Adwoa Mansa Ltd and receives a director’s emolument of GH¢24,450 (net of taxes)

xxi) He received a dividend of GH¢20,000 (net of taxes) from the Afia Manu Bank. The dividend was taxed at 8%.

Required:

Calculate his chargeable income for the 2021 Year of Assessment. (20 marks)

Find Related Questions by Tags, levels, etc.

Find Related Questions by Tags, levels, etc.

Mr. John Romeski worked for Aligidon Company Ltd for 25 years and retired at the age of 60. In the last 3 years of his working life, he earned annual salary as follows:

| Year | Annual Salary (GH¢) |

|---|---|

| 58th | 93,000 |

| 59th | 96,000 |

| 60th | 99,000 |

He has 300 months’ contribution to his credit.

Required:

Assuming he retired under the National Pension Act, 2008 (Act 766), compute his pension benefit and his monthly pension pay. (5 marks)

Find Related Questions by Tags, levels, etc.

Elevate your professional expertise across key business domains with our comprehensive training programs

Follow us on our social media and get daily updates.

This feature is only available in selected plans.

Click on the login button below to login if you’re already subscribed to a plan or click on the upgrade button below to upgrade your current plan.

If you’re not subscribed to a plan, click on the button below to choose a plan