- 15 Marks

PM – Nov 2014 – L2 – Q7 – Decision-Making Techniques

Analyze profit for Omola Industries under various price and demand forecasts for a new product based on market research.

Question

Omola Industries Limited is introducing a new product. The original information, available to the company from its archive, suggests that the product will sell for N190 per unit. Other information from the initial source is as follows:

- Variable cost per unit: N100

- Fixed cost: N20,000,000

- Annual production and sales estimate: 700,000 units

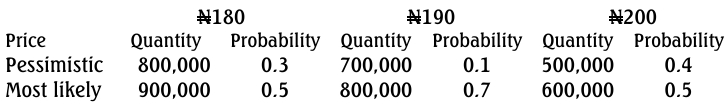

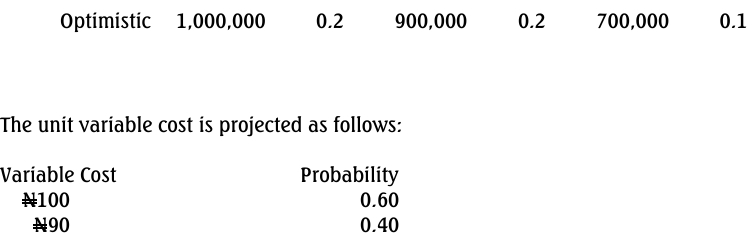

To source credible information, the board inaugurated a market research team to assess sales volume, sales price, and variable cost. The research results are as follows:

- Selling Price Regimes: N180, N190, and N200

- Sales Demand Forecasts: Provided with pessimistic, most likely, and optimistic forecasts, along with subjective probabilities.

The company also committed to an annual contract cost of N5,000,000.

Required:

(a) Compute the initial profit achievable by the company. (2 Marks)

(b) Calculate the profit achievable under the three price scenarios based on the credible information. (7 Marks)

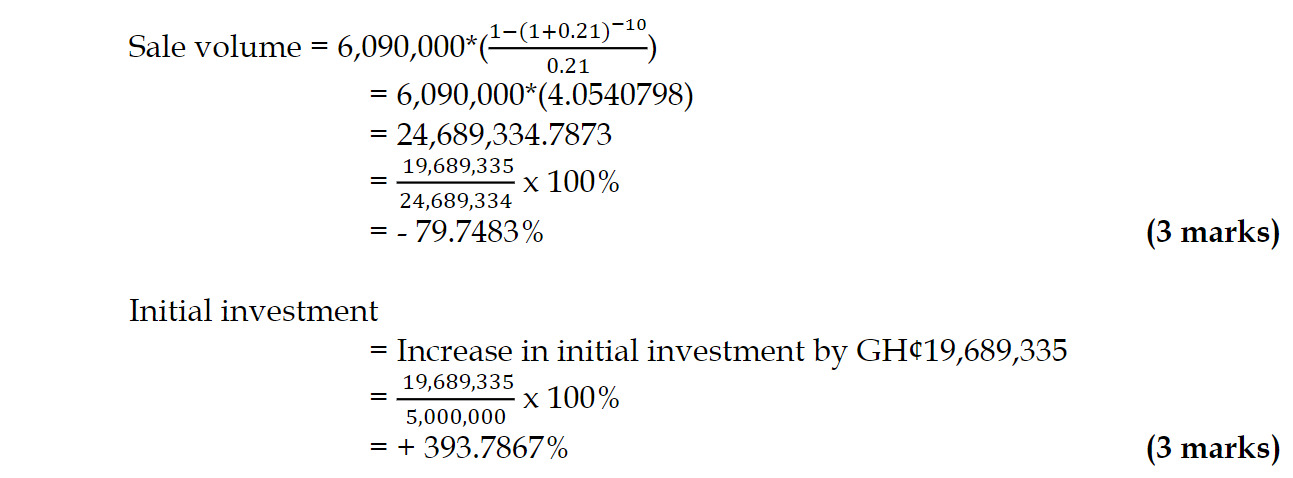

(c) Determine the value of the new information obtained from market research. (3 Marks)

(d) Identify three other sources of information available to an organization. (3 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Contribution analysis, Market Research, Probability Forecast, Profit Variance

- Level: Level 2

- Topic: Decision making techniques

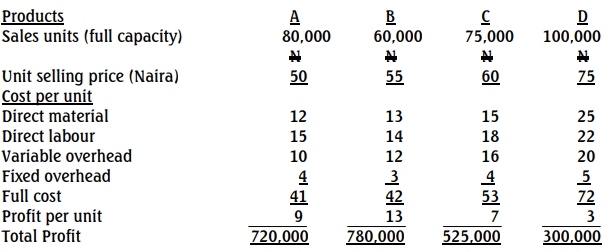

The following data relates to the planned activity of three products of Parlour Plc:

The following data relates to the planned activity of three products of Parlour Plc: