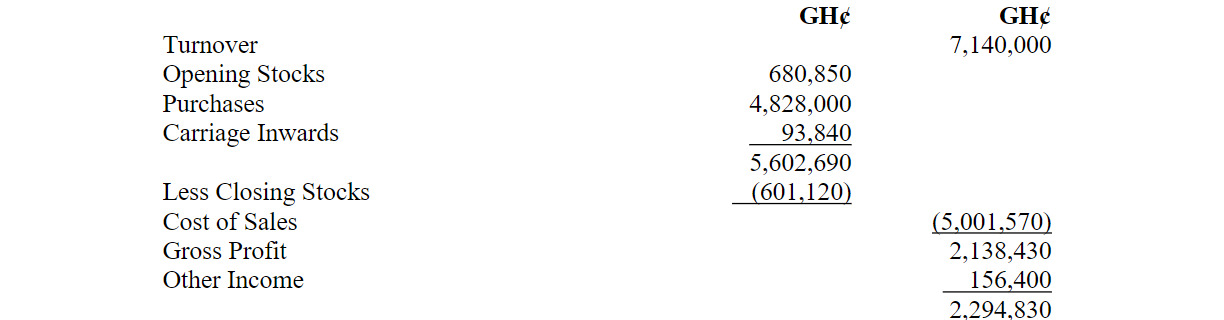

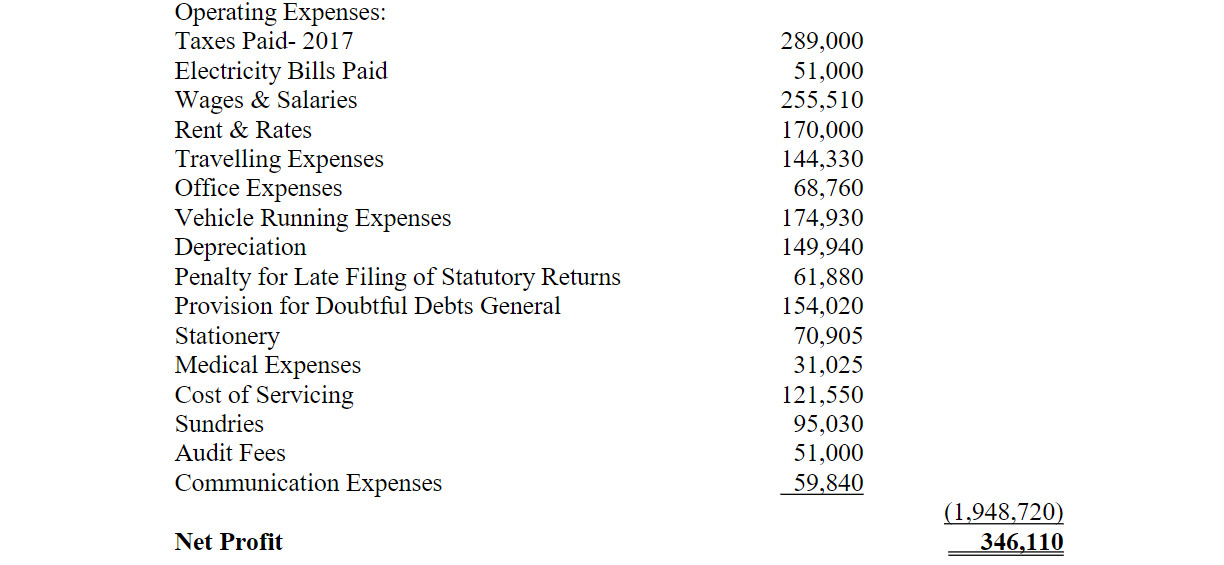

Stella-VD Company Limited, manufacturers of fruit juice for local consumption, commenced business on 1/10/2017, with an accounting year-end at 31 December. The company submitted its accounts for 2017 and was assessed accordingly. The company submitted its tax returns for the 2018 year of assessment to the Ghana Revenue Authority on 30/04/2019. Below are the details:

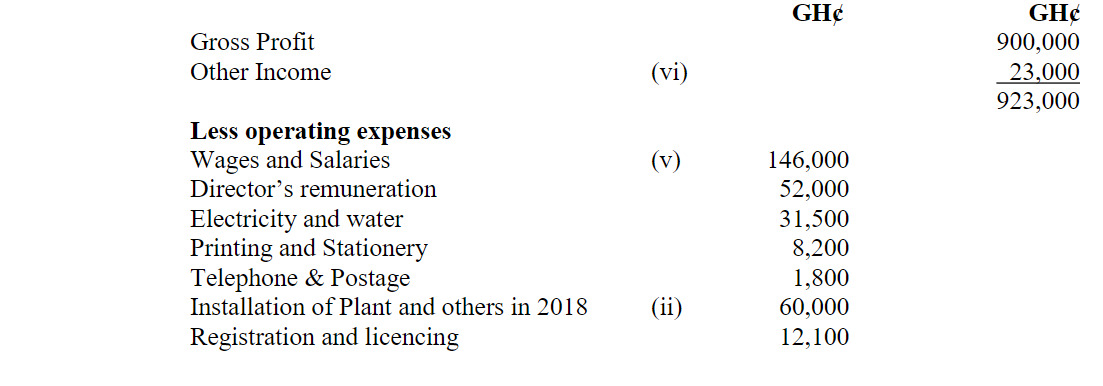

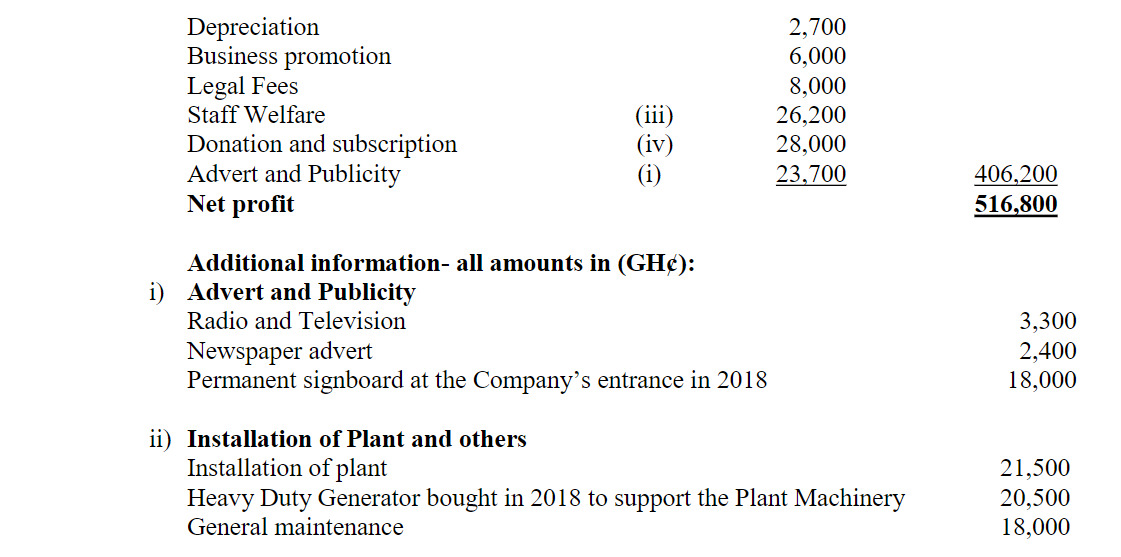

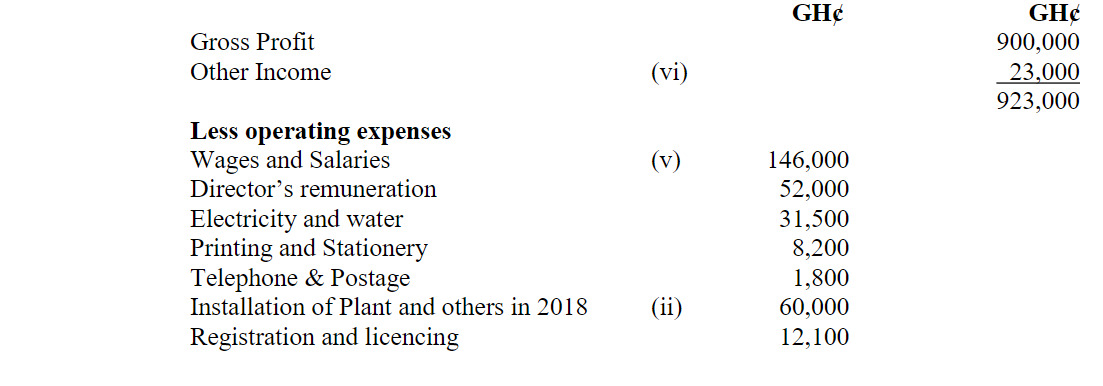

iii) Staff Welfare

Staff Medical Bills: 3,700

Safety Wear for Staff: 10,500

Canteen Equipment purchased on 30/11/2018: 12,000

iv) Donation and Subscription

Goods given as Gratis to Customs Officials: 13,000

Donation of Goods to SOS Children Village: 10,000

Subscription to Association of Ghana Industries: 5,000

v) Wages and Salaries

Old Staff: 120,000

Fresh Graduates employed by Stella-VD Ltd: 26,000

Fresh Graduates constitute 0.9% of the total workforce

vi) Other Income

Compensation from a Customer for Cancellation of Sale Order: 8,000

Compensation for Loss of Trading Stock of the Company: 10,000

Compensation for Cancellation of Purchase Order by Supplier: 5,000

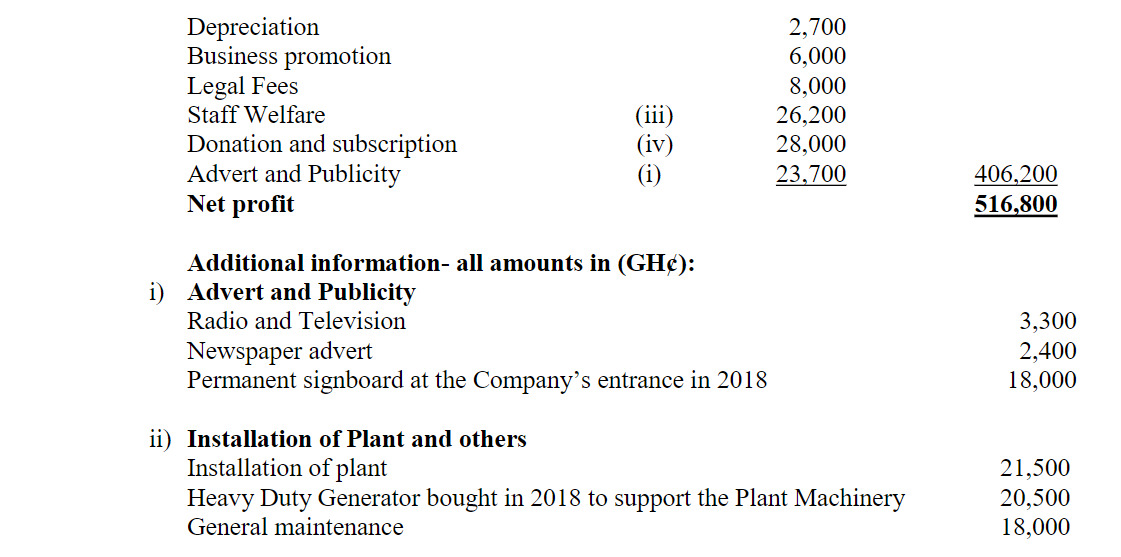

The Company’s assets include the following:

Type of Assets Date of Acquisition Cost (GH¢)

Factory Building 01/10/2017 300,000

Plant and Machinery 25/10/2017 171,000

Delivery Van 01/11/2017 50,000

Computers 01/10/2017 40,000

Furniture and Fittings 10/12/2017 150,000

Other Office Equipment 01/10/2017 200,000

Office Building 30/06/2018 500,000

Required:

a) Compute the appropriate capital allowance for the 2017 and 2018 years of assessment.

(8 marks)