- 15 Marks

AT – May – 2018 – L3 – SC – Q6 – Companies Income Tax (CIT)

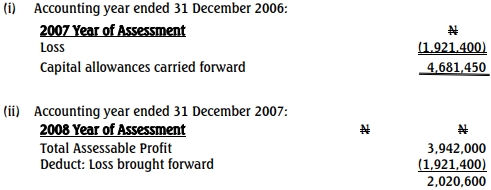

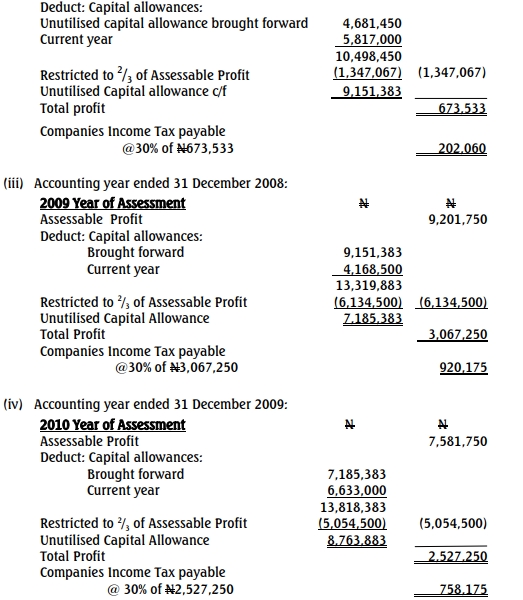

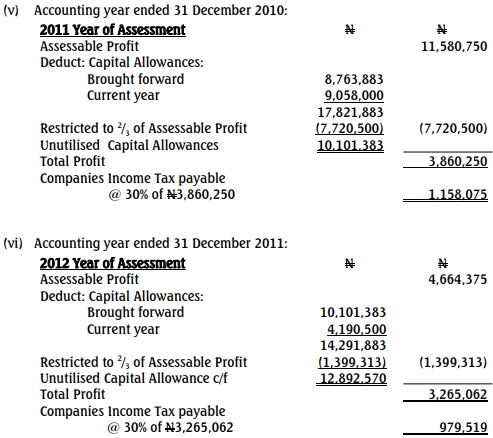

Tax computation for Obi Airlines Limited operating in Ethiopia, including Total Profits and tax liabilities in Nigeria for income sourced from Nigeria.

Question

Chief Bonny Chizaram is the Chairman/CEO of Chizaram group of companies. The conglomerate operates in several states of Nigeria, with business interests in supply of building materials, transport, and banking.

In 2012, under the Chairman’s directive, the group decided to diversify its business into some African countries by establishing Obi Airlines Limited, incorporated in Ethiopia.

On May 25, 2016, as Chief Chizaram was in the executive lounge of Murtala Mohammed International Airport, Lagos, awaiting departure, he met his long-time friend and business colleague, Chief Roger Menkiti, who is also an entrepreneur.

During their discussion, Chief Menkiti expressed interest in understanding the benefits of investing in Ethiopia, with concerns about Companies Income Tax and Tertiary Education Tax payable in Nigeria if he started an airline business in Ethiopia.

The financial results of Obi Airlines Limited for the year ended December 31, 2015, are as follows:

| Description | Amount (₦) |

|---|---|

| Income from passenger flights on other routes | 213,668,750 |

| Income from cargo loaded into aircraft on other routes | 218,280,000 |

| Income from passenger flights from Nigeria | 54,401,275 |

| Income from cargo loaded into aircraft from Nigeria | 49,938,180 |

| Total Income | 536,288,205 |

| Deduct: | |

| Depreciation | 1,974,125 |

| Staff salaries | 14,373,968 |

| General provision | 215,050 |

| Other expenses | 579,913 |

| Total Deductions | 17,143,056 |

| Net Profit | 519,145,149 |

Additional Information:

- Capital allowances were agreed with the relevant authority at 110% of the depreciation charged.

- Other expenses include disallowable expenses amounting to ₦425,000.

Required:

As the Tax Consultant, prepare computations showing:

a. Total Profits of Obi Airlines Limited for Nigerian tax purposes. (12 Marks)

b. Companies Income Tax Liability for the relevant year of assessment. (2 Marks)

c. Tertiary Education Tax Liability. (1 Mark)

(Total 15 Marks)

Find Related Questions by Tags, levels, etc.