- 1 Marks

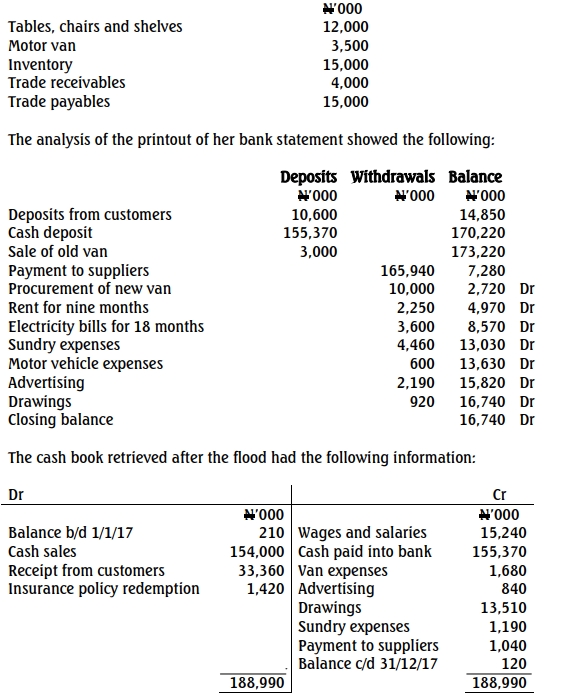

FA – May 2012 – L1 – SA – Q25 – Accounting from Incomplete Records

Calculating the portion of joint costs attributable to a department.

Find Related Questions by Tags, levels, etc.

- Tags: Cost Allocation, Joint Costs

- Level: Level 1

- Topic: Accounting from Incomplete Records

- Series: MAY 2012

Report an error