- 20 Marks

Determine the optimal transfer pricing for consulting services between divisions within KayCee Ltd based on varying capacity scenarios.

Question

The Management Information System (MIS) division of KayCee Ltd provides consulting services to its clients as well as to other divisions within the group. Consultants always work in teams of two on every consulting day. Each consulting day is charged to external clients at GH¢750, which represents cost plus a 150% profit markup. The total cost per consulting day has been estimated to be 80% variable and 20% fixed.

The director of the Human Resources (HR) division of KayCee Ltd has requested the services of two teams of consultants from the MIS division on five days per week for a period of 48 weeks, and has suggested that she meets with the director of the MIS division in order to negotiate a transfer price. The director of the MIS division has responded by stating that he is aware of the limitations of using negotiated transfer prices and intends to charge the HR division GH¢750 per consulting day.

The MIS division always uses Internal video-conference equipment on all internal consultations which would reduce the variable costs by GH¢50 per consulting day.

Note: The conference equipment can only be used when providing internal consultations.

Required:

a) Calculate and discuss the transfer prices per consulting day at which the MIS division should provide consulting services to the HR division in order to ensure that the profit of KayCee Ltd is maximized in each of the following situations:

i) Every pair of consultants in the MIS division is 100% utilized during the required 48-week period in providing consulting services to external clients, i.e. there is no spare capacity.

ii) There is one team of consultants who, being free from other commitments, would be available to undertake the provision of services to the HR division during the required 48-week period. All other teams of consultants would be 100% utilized in providing consulting services to external clients.

iii) A major client has offered to pay the MIS division GH¢264,000 for the services of two teams of consultants during the required 48-week period.

(14 marks)

b) Explain THREE (3) limitations of negotiated transfer prices.

(6 marks)

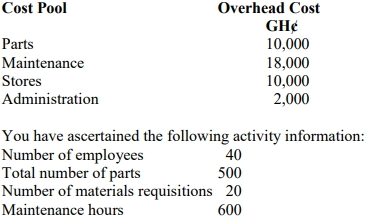

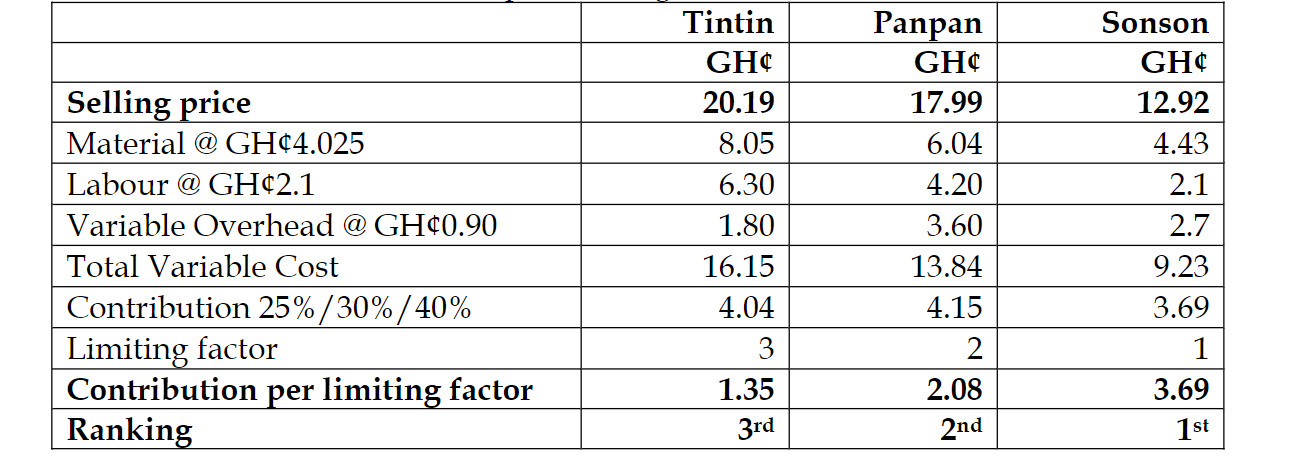

The following data relates to the planned activity of three products of Parlour Plc:

The following data relates to the planned activity of three products of Parlour Plc: