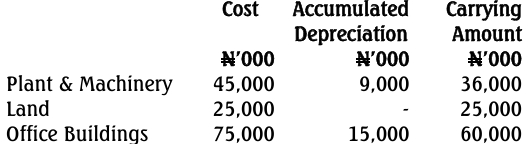

b. The following details are extracted from the non-current assets register of Kwali

Nigeria Plc at the year ended 30 September 2013:

Additional information:

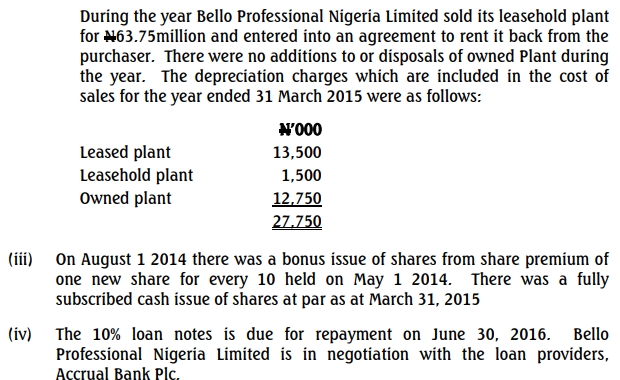

(i) During the year ended 30 September 2013, the company incurred the

sum of N106,000,000 on the construction work in progress and this

resulted in the completion of a warehouse costing N325,000,000. The

warehouse was put to use on 1 June, 2013. The freehold property is

depreciated at a flat rate of 15% per annum on a straight-line basis.

(ii) The leasehold property was acquired on 1 October 2011 on 15 years

lease at a cost of N300,000,000. The company’s policy is to revalue the

property at market value at each year end. At 30 September 2013, the

property was valued at N204,600,000.

(iii) Plant acquired is depreciated at 25% per annum using the reducing

balance method while the leased plant is also depreciated at 25% using

the straight-line method.

(iv) One item of plant acquired for N48,000,000 on 1 October 2010 was

disposed on 30 September, 2013 for N36,000,000 while a new plant with

a higher capacity was acquired as a replacement for N65,000,000 on the

same date.

(v) All the additional pieces of information above are yet to be adjusted for

in the books of Kwali Nigeria Plc.

Required:

Prepare a statement of changes in Property, Plant and Equipment for inclusion in the

Financial Statements for the year ended 30 September 2013. (10 Marks)