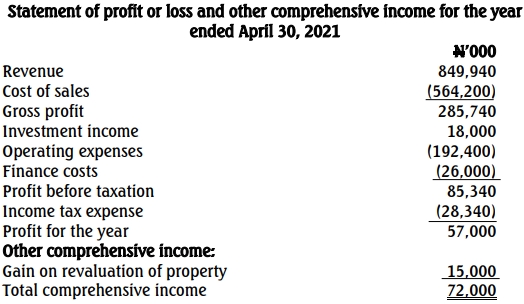

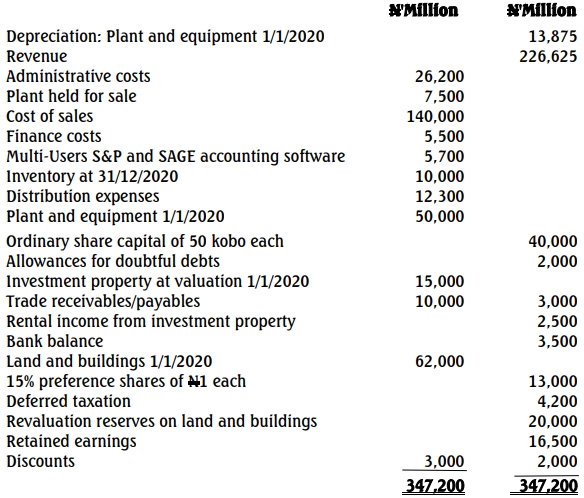

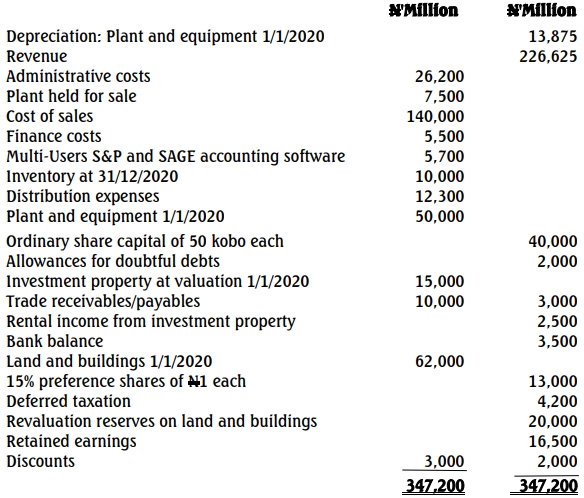

Endtime PLC is a company based in Benin with the following trial balance for the year ended December 31, 2020:

Additional Information:

(i) Finance costs include full year dividends on preference shares and ordinary share dividends of 2½ kobo paid at the end of the year. Allowances for 4 doubtful debts are no longer necessary as customers paid as at when due from time to time in the past 2 years.

(ii) Severely damaged inventories, which cost N790,000,000 were included in the inventories in the trial balance. This will need to be repaired at a cost of N440,000,000 before a knowledgeable buyer will be interested to pay N940,000,000 at arm’s length transaction.

(iii) As at December 31, 2020, a valuer based in Victoria Island in Lagos was contacted by the company to review its land and buildings. The land and buildings was revalued upward by N13,000,000,000 and a certificate was issued to this effect. The board of directors approved the valuation but it has

not yet been accounted for in the trial balance. The valuer advised that the remaining useful life of the asset is reasonably and reliably estimated to be 20 years. Depreciation is on straight-line basis.

(iv) Depreciation on plant and equipment is charged at 15% on reducing balance basis. The multi-users S&P and Sage was bought on September 30, 2020. The amortisation is at the rate of 12.5% annually. The amortisation is evenly distributed over the year. Besides, software installation, customisation and

handling cost of N800,000,000, training costs of N900,000,000, consultancy fee of N600,000,000 and other general overheads of N850,000,000 on the new software were included in administrative expenses. All depreciations are treated as administrative costs.

(v) On December 30, 2020, a chartered surveyor valued investment property at N14,000,000,000 and the company uses fair value model in IAS 40 – Investment Property.

(vi) Current income tax has been estimated for the year ended December 31, 2020 at N9,000,000,000 and deferred tax provision as at December 31, 2020 is to be adjusted in the income statement to reflect the tax base of the company’s net assets of N12,000,000,000 less than the carrying amounts. The current

company income tax rate is 30%.

vii) The plant held for sale is valued in the trial balance at its carrying amount. A broker is readily available to buy the plant for N6,000,000,000 at a fee of 6% of sales proceed. The sale would take place in January, 2021. Any necessary adjustment is to be treated as cost of sales.

You are required to prepare:

a. Statement of profit or loss and other comprehensive income for the year ended December 31, 2020. (13 Marks)

b. Statement of changes in equity for the year ended December 31, 2020. (4 Marks)

c. Statement of financial position as at December 31, 2020. (13 Marks)