- 20 Marks

Question

You are the portfolio manager of an asset management company based in Kano. Your company has in its portfolio 27,750,000 shares of Yaro Plc., a company listed on the Nigerian Stock Exchange. The shares are currently trading at N3.60 per share.

Your company plans to sell the shares in six months’ time to pay dividends, and you plan to hedge the risk of Yaro’s shares falling by more than 5% from their current market value. A decision has therefore been taken to buy an over-the-counter option to protect the shares. A merchant bank has offered to sell an appropriate six-month option to your company for N1,250,000.

Yaro’s share price has an annual standard deviation of 13%, and the risk-free rate is 4% per year.

Required:

a. Evaluate whether or not the price at which the merchant bank is willing to sell the option is a fair price.

b. Explain briefly (without any calculations) how a decrease in the value of each of the following variables is likely to change the value of a call option:

i. Volatility of the stock price

ii. Risk-free rate

(Total: 15 Marks)

Answer

a) Put options are required to hedge the price of the shares.

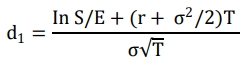

Step 1: Determine d1 and d2

S = 360

E = 360 × 0.95* = 342

* The exercise price is 5% lower than the market price as that is the protection required.

r= 0.04

= 13% = 0.13

T = 6/12 = 0.5

Step 2: Determine N(d1) and N(d2)

N(d1) = N(0.8215) = 0.2939 + 0.15(0.2967 – 0.2939) = 0.2943

Since d1 is positive, we add 0.5 to get 0.5 + 0.2943 = 0.7943

N(d2) = N(0.7296) = 0.2642 + 0.96(0.2673 – 0.2642) = 0.2672

We also need to add 0.5 to get 0.7672

Step 3: Determine the value of call

![]()

Step 4: Using Put Call Parity (PCP), determine the value of put option

On the assumption that one put option is bought per share:

Total value of Option = 27.75 million × 3.99kobo = ₦1,107,225

Overcharge by bank: ₦1,250,000 – ₦1,107,225 = ₦142,775

b. How a Decrease in the Following Variables Affects a Call Option

i. Volatility of the Stock Price

- A decrease in volatility will reduce the value of a call option. This is because a lower volatility means a lower probability of significant price movement, reducing the potential for the stock price to rise above the strike price, thus lowering the value of the option.

ii. Risk-Free Rate

- A decrease in the risk-free rate will increase the value of a call option. A lower risk-free rate reduces the present value of the strike price (since e-rT becomes larger), making the option more valuable as it is cheaper to exercise the option in the future.

- Tags: Call Option, Hedging, Options, Risk Management

- Level: Level 3

- Topic: Portfolio Management

- Uploader: Kofi