- 20 Marks

Question

LIKELY EFFECT LIMITED

Likely Effect Limited has shown a sincere intention to be IFRS compliant. Among a number of events and transactions, there is the need to change the accounting policies of the company in trying to comply with a few other standards. As the Consultant of the company, your attention was drawn to the fact that prior to 2013, the company had capitalized training costs.

According to IAS 38, training cost is regarded as an internally generated intangible asset and cannot be capitalized. Therefore, there is the need for a change of accounting policy which must be applied retrospectively.

The training costs capitalized in 2012 was N6m while the total for periods before 2012 was N12m.

Training costs incurred in 2013 is N4.5m. Retained earnings were N600m and N649m at the beginning and end of 2012 respectively. The corporate income tax rate is 30% for the relevant periods. Additional information available is given below:

| 2013 (N’M) | 2012 (N’M) | |

|---|---|---|

| Income tax expense | 24 | 21 |

| Profit after tax | 56 | 49 |

| Share capital | 50 | 50 |

Required:

(a) Advise the directors on the implication of the change in accounting standard relating to treatment of intangible assets and tax effect on the company. (5 Marks)

(b) Prepare statements of profit or loss and other comprehensive income and changes in equity showing a retrospective application of the change in policy. (7 Marks)

(c) Analyze the effects of the change in accounting policy on periods before 2013. (8 Marks)

Answer

(a) Implications of Change in Accounting Policy

Users of financial statements need to compare financial statements over time, consistent with the principle of comparability. A change in accounting policy, as necessitated by IAS 38, requires retrospective application:

- Training costs, now classified as expenses, cannot be capitalized as intangible assets.

- Retrospective application means adjusting prior periods’ financial statements and equity.

- For Likely Effect Limited, training costs capitalized in 2012 (N6m) and prior periods (N12m) will now be derecognized.

- This adjustment impacts retained earnings, reducing equity and altering profit figures for prior periods.

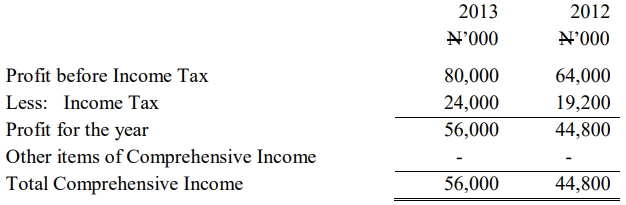

b. (i) LIKELY EFFECT LIMITED

Statement of Comprehensive Income for the Year ended 31 December, 2013

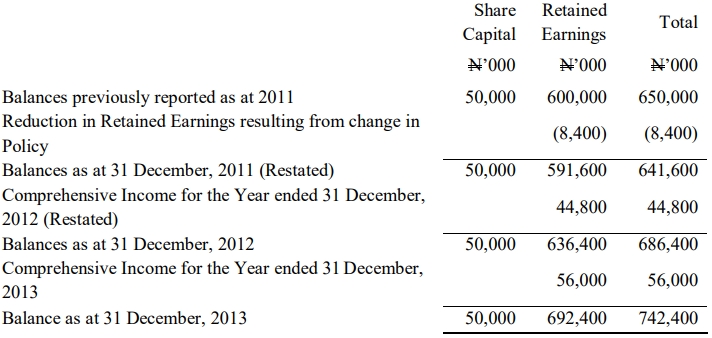

(ii) Statement of Changes in Equity for the year ended 31 December, 2013

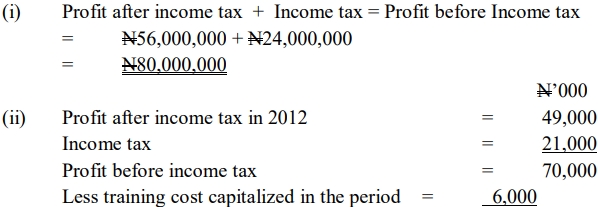

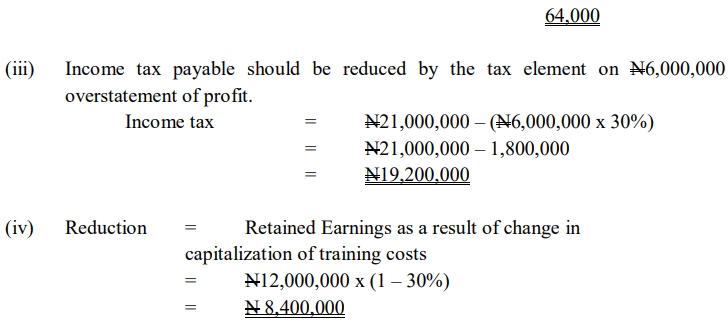

Workings:

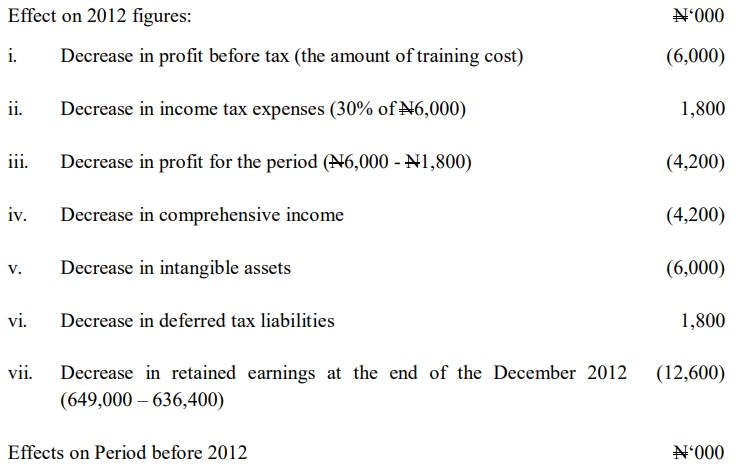

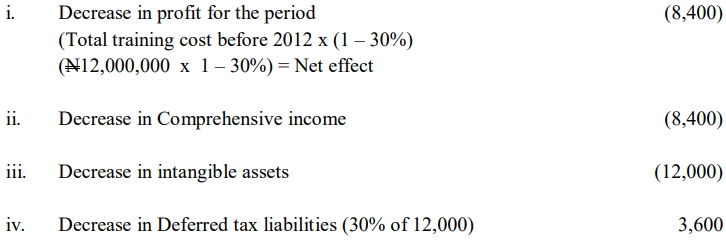

c. Effects of change in Accounting Policy on previous periods:

Apart from restatement of comparative figures for 2012 on the Statement of Comprehensive Income, the following items will be affected as analyzed below

- Uploader: Kofi