- 20 Marks

Question

Heritage Limited and Legacy Limited are two competitors in the merchandising and retailing sector of the economy. At a time when the sector is faced with escalating fuel prices and economic recession, both companies have shown resilience and adaptability. The financial statements of the companies for the year ended December 31, 2020, are as follows:

Statements of Profit or Loss for the Year Ended December 31, 2020:

| Item | Heritage Limited (N’000) | Legacy Limited (N’000) |

|---|---|---|

| Revenue | 150,000 | 700,000 |

| Cost of Sales | (60,000) | (210,000) |

| Gross Profit | 90,000 | 490,000 |

| Interest | 500 | 12,000 |

| Distribution Costs | 13,000 | 72,000 |

| Administrative Expenses | 15,000 | 35,000 |

| Total Expenses | 28,500 | 119,000 |

| Profit Before Tax | 61,500 | 371,000 |

| Income Tax Expense | (16,605) | (100,170) |

| Profit for the Year | 44,895 | 270,830 |

Statements of Financial Position as at December 31, 2020:

| Item | Heritage Limited (N’000) | Legacy Limited (N’000) |

|---|---|---|

| Assets: | ||

| Non-Current Assets: | ||

| Property | – | 500,000 |

| Plant and Equipment | 190,000 | 280,000 |

| Total Non-Current Assets | 190,000 | 780,000 |

| Current Assets: | ||

| Inventories | 12,000 | 26,250 |

| Trade Receivables | 37,500 | 105,000 |

| Bank | 500 | 22,000 |

| Total Current Assets | 50,000 | 153,250 |

| Total Assets | 240,000 | 933,250 |

| Equity & Liabilities: | ||

| Equity: | ||

| Share Capital | 156,000 | 174,750 |

| Retained Earnings | 51,395 | 390,830 |

| Total Equity | 207,395 | 565,580 |

| Non-Current Liabilities: | ||

| Long-Term Debt | 10,000 | 250,000 |

| Current Liabilities: | ||

| Trade Payables | 22,605 | 117,670 |

| Total Liabilities | 32,605 | 367,670 |

| Total Equity & Liabilities | 240,000 | 933,250 |

The Board of Directors of Patrimony Investments PLC is considering a proposal to buy into one of the companies to enhance the reported profit and stability of the company after the investment.

Required:

a. Assess the relative performance of the two companies for the year ended December 31, 2020, with three suitable ratios each for:

- Profitability and efficiency

- Liquidity and solvency

(8 Marks)

b. Draft a report on the computed ratios for the consideration of the Board of Directors of Patrimony Investments PLC to appropriately guide the Board in deciding on the proposal to buy into any one of the companies.

(12 Marks)

Answer

The Board of Directors

Patrimony Investment PLC

Ikeja, Lagos.

Report on Analysis of Investment Proposals

Above subject refers, please.

Kindly find attached comments and suggestions on the ratios calculated in (a) as follows:

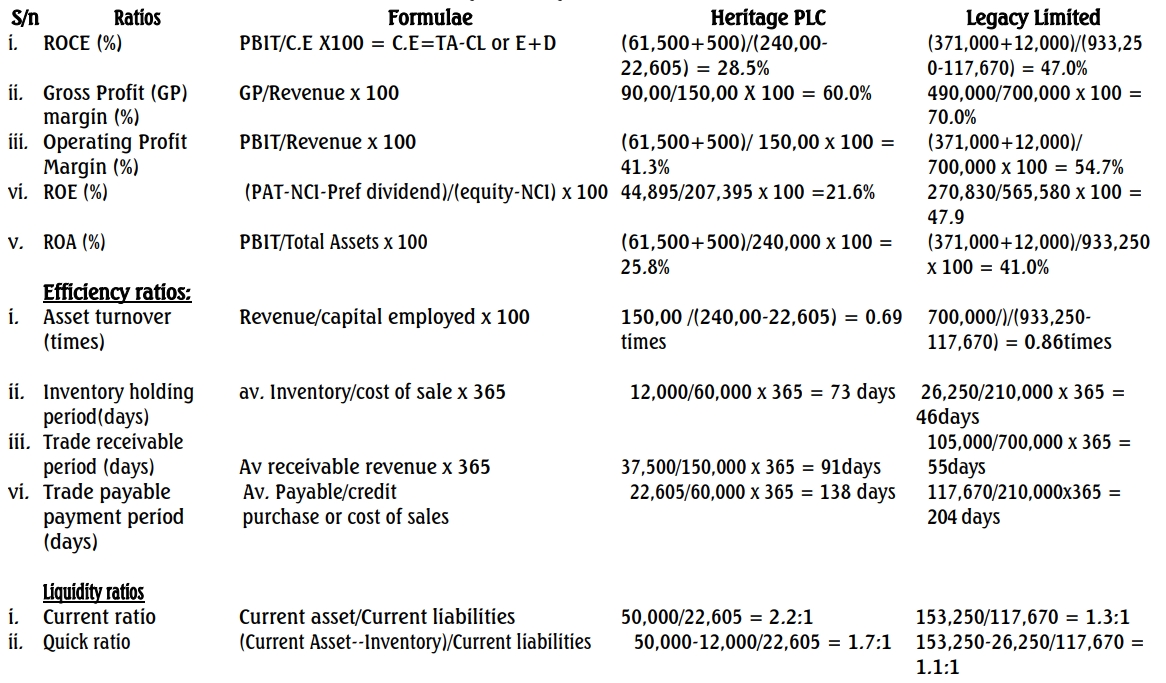

(i) Profitability and Efficiency

The ROCE achieved by Heritage Limited (28.5%) is substantially lower than that achieved by Legacy Limited (47%). This variation in performance is also noticeable in the gross profit percentage (60% compared to 70%) and net profit margin of 41.3% compared to 54.7%.

The variations in gross profit could be caused by differences in sales mix, inventory valuation methods, or markup. Since these entities operate in the same sector, it is unlikely that their selling prices differ significantly. However, Legacy Limited, as a much larger entity, may be able to negotiate better prices from its suppliers.

Legacy Limited demonstrated greater efficiency in the use of its assets as it turns the assets over 0.86 times against Heritage Limited’s 0.7 times. Similarly, Legacy Limited turns its inventory over within 46 days compared to the 73 days it takes Heritage Limited. Legacy Limited also exhibited greater efficiency in the collection of receivables, which is done within 55 days, as opposed to the 91 days it takes Heritage Limited. However, Legacy takes 204 days to settle its debt to suppliers, implying that the company secures more financing from suppliers compared to Heritage, which takes only 137 days to pay its suppliers.

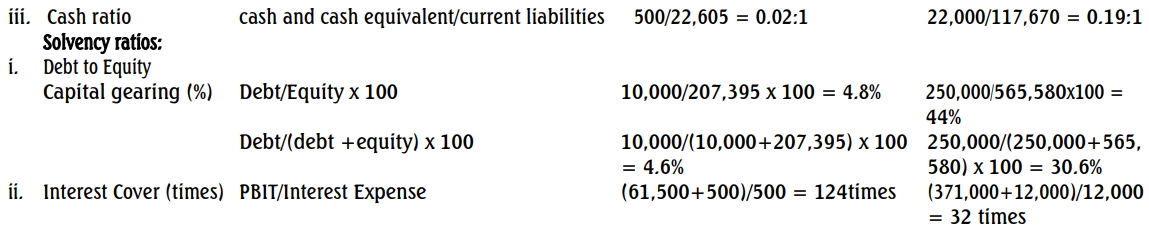

(ii) Liquidity and Solvency

Legacy Limited is much more highly geared than Heritage Limited (44% compared to 4.8%). Legacy Limited has the ability to raise debt more easily because it is a more profitable business than Heritage Limited. Additionally, Legacy Limited has property on which debt can be secured, whereas Heritage Limited does not possess such property.

The earnings of both companies can easily cover their interest payments, with Legacy Limited doing so 32 times and Heritage Limited 124 times.

(iii) Conclusion and Advice to the Board

Legacy Limited is more profitable and stronger in terms of asset quality than Heritage Limited.

Yours faithfully,

Analyst

- Uploader: Kofi