- 30 Marks

FM – May 2019 – L3 – Q1 – Mergers and Acquisitions

Evaluate the synergy expected from a proposed merger between Pako Plc. and RT Plc. using free cash flow analysis, and discuss limitations and alternatives.

Question

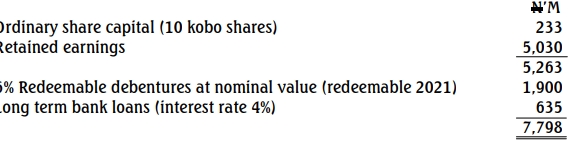

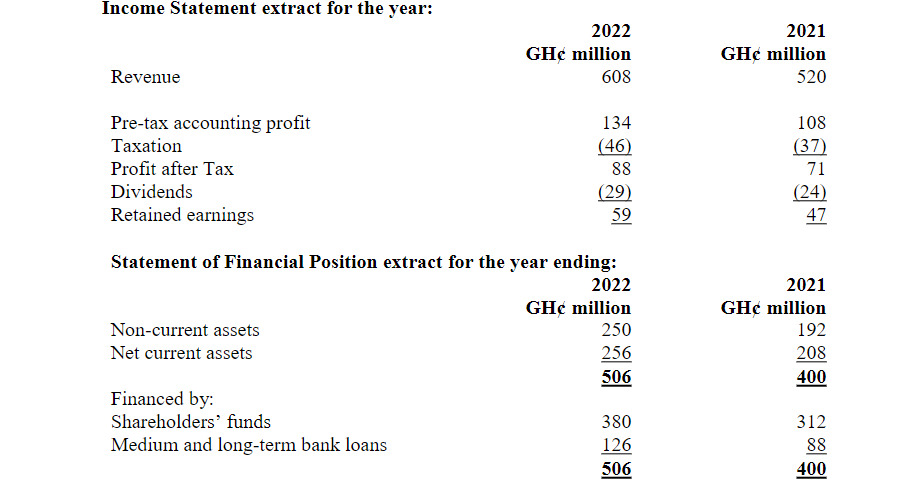

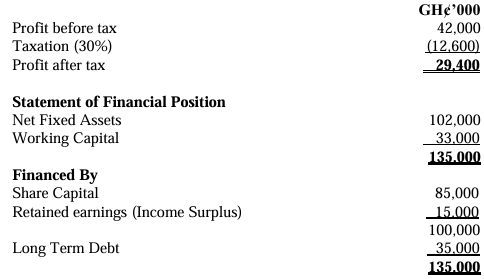

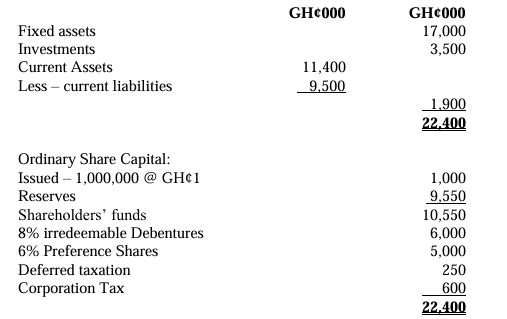

Pako Plc. will soon announce a take-over bid for Ronke Tina (RT) Plc., a company in the same industry. The initial bid will be an all-share bid of four Pako shares for every five RT Plc. shares. The most recent annual data relating to the two companies are shown below:

The take-over is expected to result in cost saving in advertising and distribution, reducing the operating costs (including depreciation) of Pako from 76% of sales to 70% of sales. The growth rate of the combined company is expected to be 6% per year for four years and 5% per year thereafter. RT’s debt obligations will be taken over by Pako. The corporate tax rate is expected to remain at 30%.

Sales and costs relevant to the decision may be assumed to be in cash terms.

Required:

a. Estimate how much synergy is expected to be created from the take-over, using free cash flow to the firm analysis for each individual company and the potential combined company. State clearly any assumptions that you make.

Note: The weighted average cost of capital of the combined company is assumed to be 9%. (20 Marks)

b. Discuss any five limitations of the above estimates. (5 Marks)

c. Explain, generally, three advantages and two disadvantages of expansion through merger and acquisition rather than through organic growth. (5 Marks)

(Total: 30 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Free Cash Flow, Growth Analysis, M&A, Synergy, WACC

- Level: Level 3

- Topic: Mergers and acquisitions