- 10 Marks

AT – March 2023 – L3 – Q5a – Business income – Corporate income tax

Compute the income tax payable by the trustees of Randy Koomson’s trust for the 2021 year of assessment.

Question

Randy Koomson, who hails from Cape Coast in the Central Region, died in January 2021 and left his businesses and estates with trustees, who happened to be non-residents. Randy Koomson has two children: Araba Koomson and Kwamina Koomson. These two children were made the beneficiaries, and each of them is entitled to 1/3 of the net distributable income of the trust with the rest for administrative expenses.

The terms of the trust deed provided for discretionary payments to the beneficiaries and donations towards worthwhile causes. During the year 2021, discretionary payments of GH¢300,000 each were made to the children.

Gross Profit, before discretionary payments and other expenses below, for the year 2021 was GH¢3,500,000.

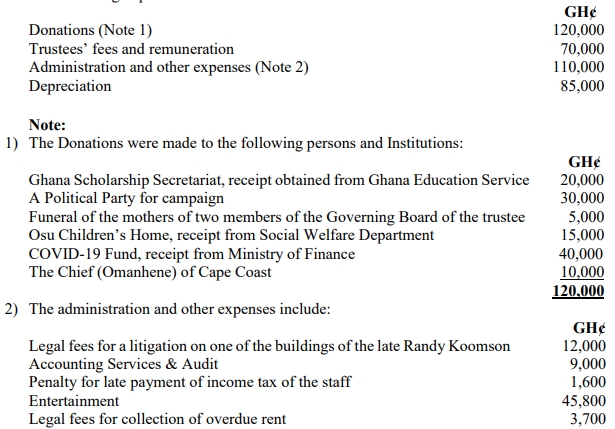

The following expenses were incurred:

The Ghana Revenue Authority has agreed on a capital allowance of GH¢72,550.

Required:

Compute the income tax payable by the trustees on the income for the 2021 year of assessment. (10 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Deductible expenses, Trust Income, Trustee tax

- Level: Level 3

- Topic: Business income - Corporate income tax

- Series: MAR 2023