- 30 Marks

ATAX – May 2022 – L3 – Q1 – Taxation of Companies

Determination of tax liabilities, treatment of donations, and exemptions of dividends based on CIT Act provisions.

Question

Dadinkowa Nigeria Limited has been in business since 2009 as a manufacturer of sugar cubes. The company sources its raw materials, sugar cane, from the Northern part of the country. However, due to local security challenges, the company has faced supply disruptions since 2016.

Additionally, the company has disagreements with tax authorities regarding the treatment of certain items (e.g., donations and dividend income) in their financial statements and returns. High overhead costs, especially energy expenses, have worsened operational challenges.

At a recent board meeting, the directors proposed either a temporary closure or relocating to a neighboring country if conditions do not improve in the next fiscal year. The General Manager shared this with you during your visit as the company’s tax consultant, seeking your advice to address these issues.

A scheduled meeting with the Managing Director requires you to prepare a comprehensive tax report addressing:

- Determination of the company’s tax liabilities for the relevant tax year.

- Analysis of the treatment of donations and exemptions of dividend income under the Companies Income Tax Act (CITA).

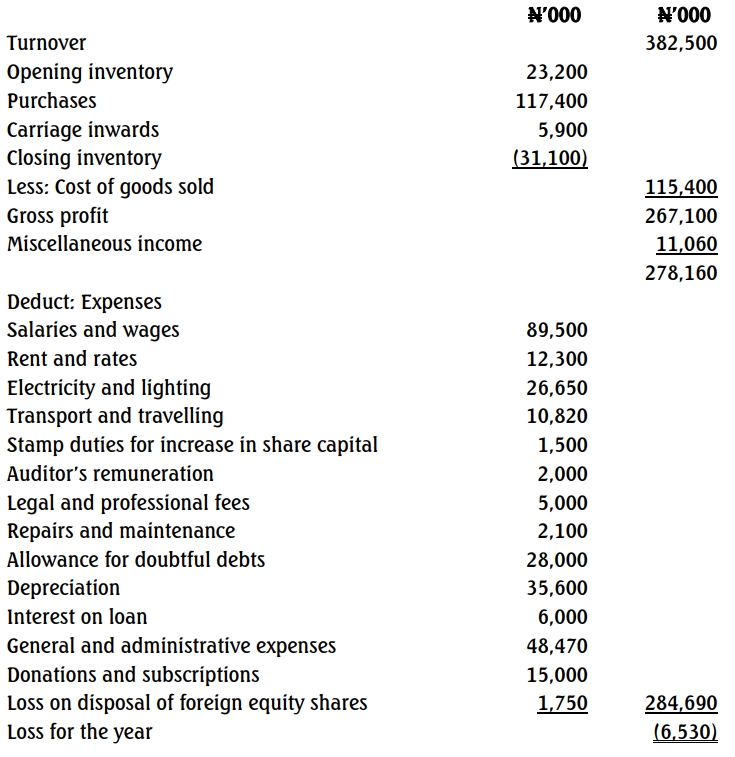

The profit or loss account for the year ended December 31, 2021, is as follows:

Profit or Loss Account:

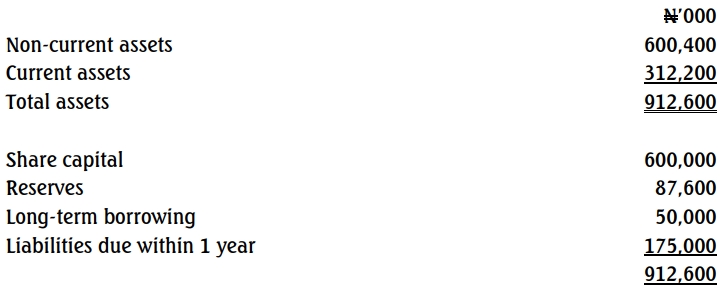

Extract from the company’s statement of financial position as at December 31, 2021 revealed:

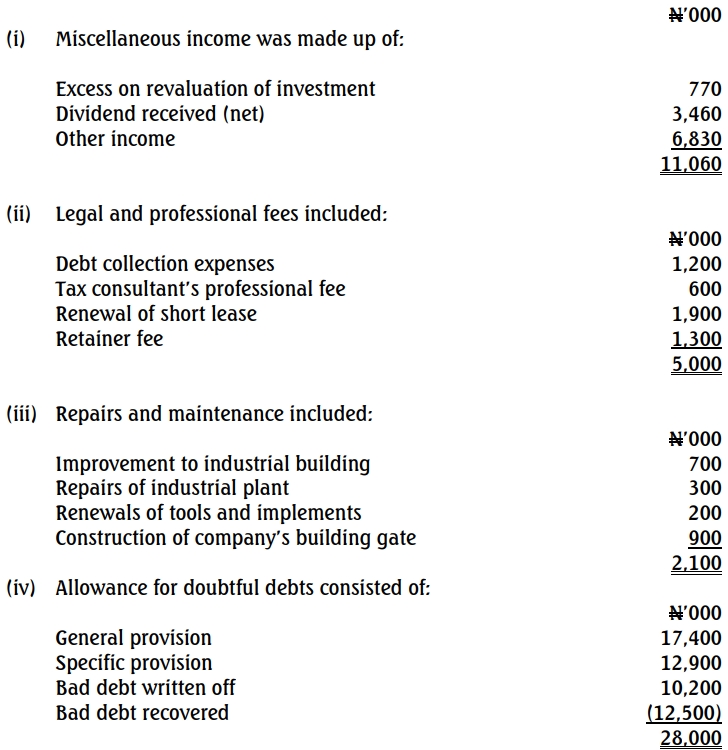

The following additional information was made available:

(v) Interest on loan was paid on a facility obtained from a licensed Nigerian deposit money bank at commercial interest rate.

(vi) General and administrative expenses were made up of:

(vii) Donations and subscriptions

Included in donations was N12,000,000 paid to a fund created by the Federal Government for victims of communal crisis that took place where the company is situated.

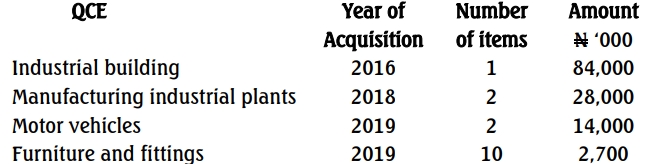

(viii) The tax written down values of the qualifying capital expenditure (QCE) items as at December 31, 2020 were:

(ix) Additions to QCEs during the year ended December 31, 2021 were:

(x) Unrelieved capital allowances brought forward were N15,200,000.

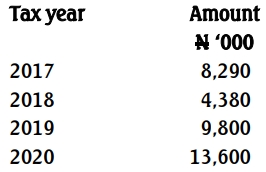

(xi) Unabsorbed losses from previous years were:

Required:

As the company’s Tax Consultant, you are to draft a report to the Managing Director for the scheduled meeting expected to hold next week. This is expected to address the following:

a. Determination of the company’s tax liabilities for the relevant tax year. (20 Marks)

b. Comment, in line with the provisions of Companies Income Tax Act Cap C21 LFN 2004 (as amended) on:

i. The treatment of donations made by the company during the year under review (5 Marks)

ii. Exemption of dividends from taxation (5 Marks)

Find Related Questions by Tags, levels, etc.