- 40 Marks

ATAX – May 2021 – L3 – Q1 – Taxation of Companies

Computation of CIT and TET for 2017-2019, advisory on AfCFTA impacts on trade, and evaluation of Country-by-Country Reporting obligations.

Question

DIY Limited was incorporated on June 12, 2010, and commenced commercial activities on October 1, 2011.

The primary activities of the company are the manufacture, distribution, and sale of solar panels for domestic use. DIY Limited has its main factory in Daura, Katsina State, Northern Nigeria, and distributors in Kaduna, Abeokuta, Onitsha, and Ilorin.

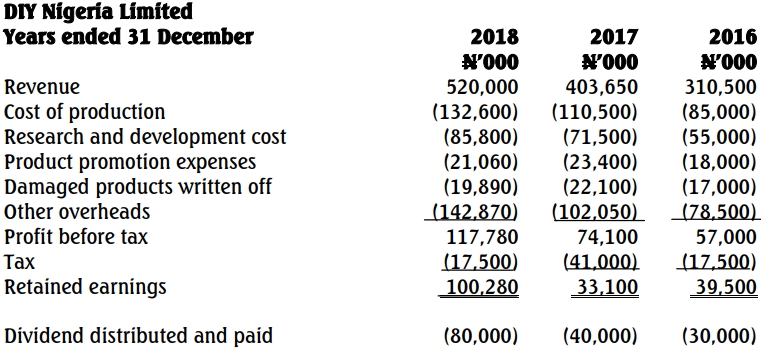

Extracts from the company’s audited financial statements for 2016 to 2018 are as follows:

Note:

- 20% of “other overheads” represent depreciation and amortization for each year.

- Capital allowances for the respective years represent 150% of depreciation and amortization.

Chief Musa Jugula (MJ), the owner and founder of DIY Limited, owns 70% of the shares of the company while the remaining 30% shares are currently held by his three children and two wives.

Chief MJ is considering expanding into Ghana, exploring either a branch or a subsidiary model. He is also interested in the African Continental Free Trade Area agreement and its implications compared to the ECOWAS region.

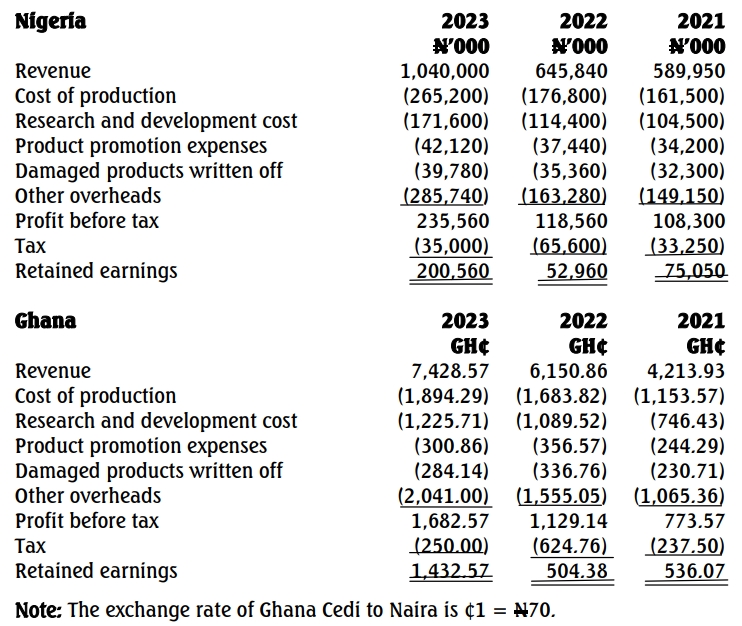

Forecast financial performance for 2021 to 2023:

Required:

a. Compute the Companies Income Tax (CIT) and Tertiary Education Tax (TET) payable by DIY Limited for 2017 to 2019 years of assessment and comment on any issues you consider as enablers or hindrances to investment promotion in Nigeria. Assume a tax written-down value of qualifying capital expenditure (QCE) of ₦230 million, unutilized losses of ₦28 million, and capital allowances brought forward of ₦50 million for the 2017 year of assessment.

b. As the Managing Partner of Poknos & Co, write a brief advice to Chief Musa Jugula about the African Continental Free Trade Area agreement and how the treaty compares to that of Economic Community of West African States (ECOWAS) region from the perspective of trade in goods. Your advice should cover both opportunities and challenges that may arise from the implementation of the African Continental Free Trade Agreement. (10 Marks)

c. Advise with reasons:

i. If DIY Limited is liable to prepare and submit Country-by-Country Reports (CbCR). (5 Marks)

ii. The relevant tax authority where the Country-by-Country Reports (CbCR) should be submitted, assuming it is applicable to the company. (5 Marks)

Find Related Questions by Tags, levels, etc.