- 1 Marks

FA – Nov 2013 – L1 – SA – Q39 – Accounting Concepts

Calculating annual depreciation using the straight line method.

Question

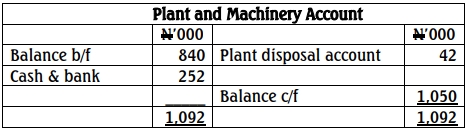

The information below relates to the plant and machinery account of Perfect Fit Designers for the year ended 31 December 2012:

What should be the amount of depreciation charged to the income statement during the year if the plant and machinery were depreciated at 20% per annum on a straight line basis?

Find Related Questions by Tags, levels, etc.

- Tags: Depreciation, Plant and Machinery, Straight-Line Method

- Level: Level 1

- Topic: Accounting Concepts

- Series: NOV 2013

Report an error