- 20 Marks

AAA – Nov 2018 – L3 – Q2 – Regulatory Investigations and Disciplinary Actions

Assessment of joint audit advantages, agenda setup, and addressing regulatory issues in audit planning

Question

Yusuf Olatunji & Co., (Chartered Accountants) have been auditors to XBC Bank Limited. There has been some regulatory and compliance issues for which the bank was sanctioned and paid penalties to both the Central Bank of Nigeria and the Financial Reporting Council of Nigeria. At the board of directors meeting to consider the last annual report audited by the firm, some of the problems caused by the auditors were raised. Following the reoccurrence of such issues, it was proposed that another audit firm be engaged in addition to the present firm. To achieve their objective, a bigger firm that has international affiliation was considered to take a leading position in a joint audit arrangement and to ensure appropriate compliance.

Your firm has been approached for the appointment. A meeting was scheduled between your firm, Yusuf Olatunji & Co., and the executive management of the bank. In preparation for the meeting, you are informed that you will address the meeting on the advantages and disadvantages of joint audit, being an area some members of the management team have expressed concerns.

After the meeting, your firm was subsequently appointed, and the necessary formalities were properly followed. Your partner has directed that you liaise with Yusuf Olatunji & Co. to obtain the necessary materials for the preparation of the audit and that you review your firm’s audit manual with respect to the concerns of management on joint audit.

Your assessment of the documents obtained from the other auditor revealed the following, amongst others:

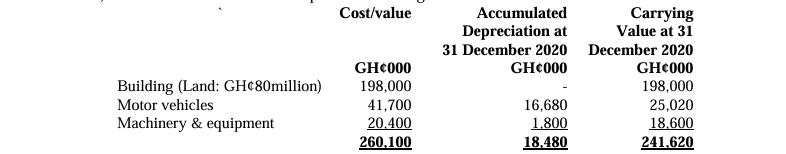

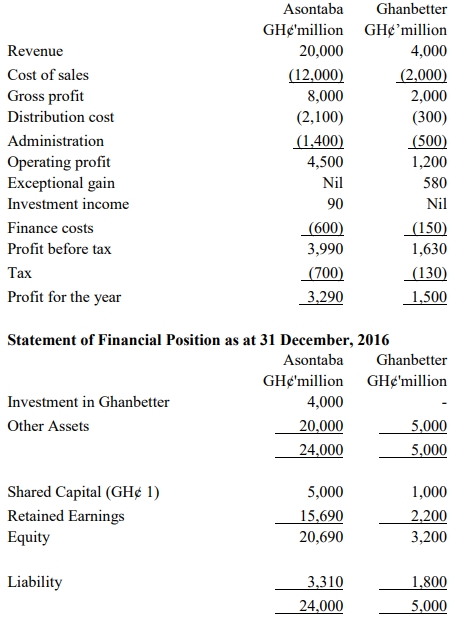

- Part of the penalty was on improper disclosure relating to a material property, plant, and equipment (PPE) acquired during the previous year and a substantial loan above the limit authorised for a sector of the economy;

- The classification of unresolved transactions as debit balances in the statement of financial position, resulting in an increase in operating profit and the payment of higher taxes than projected;

- The IT operations of the bank had weak controls such that it was possible for some staff to over-ride some of them;

- The net current assets have continued to fall and, in the preceding year, have fallen below industry average despite an increase in gross earnings.

Required:

a. Evaluate the advantages and disadvantages of joint audit. (8 Marks)

b. Prepare an agenda for the scheduled meeting between the two audit firms. (4 Marks)

c. Develop the appropriate audit approach to address each of the issues identified from the review of the documents obtained from Yusuf Olatunji & Co. (8 Marks)

Find Related Questions by Tags, levels, etc.