- 8 Marks

ATAX – May 2017 – L3 – Q6b – Corporate Tax Compliance and Reporting

Compute the Companies Income Tax liability for small businesses using the small business rate and explain the computations.

Question

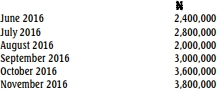

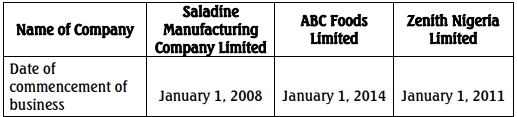

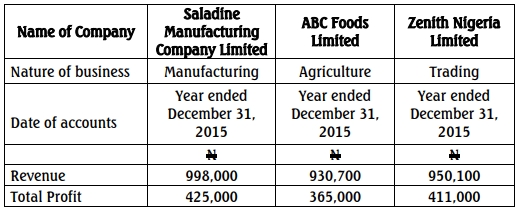

You have been provided with the following information in respect of THREE small businesses:

You are required to:

i. Compute the Companies Income Tax liability for each of the companies for the relevant assessment year, using the small business rate. (3 Marks)

ii. Give reasons for your computations. (5 Marks)

Find Related Questions by Tags, levels, etc.

Report an error