- 20 Marks

AA – Nov 2020 – L2 – Q5 – Audit Documentation

Review a workpaper, explain audit working paper ownership, and describe sampling risk and considerations for reducing sampling risk.

Question

Below is a workpaper prepared and reviewed by members of an audit engagement team.

Client: [Name not provided]

Subject: Trade Payables

Period End: [Not provided]

Objective: To ensure trade payables is fairly stated

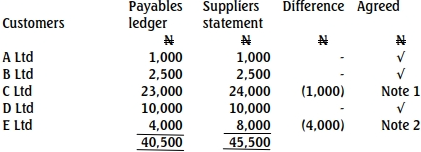

Work performed: Selected a sample of 5 trade payables balances as at 31 March and reconciled the supplier statements to the year-end trade payables ledger. Reconciling items were vouched to source documentation.

Results

Required:

a. Review the above workpaper and comment on the missing items. (8 Marks)

b. An accounts personnel at the client office requested that you give him your audit working papers. Explain the ownership, custody, and confidentiality of audit working papers. (3 Marks)

c. Explain sampling and sampling risk. (3 Marks)

d. In order to reduce sampling risk appropriately, ISA 530 requires the auditor to make certain considerations in designing a sample. Explain these considerations. (2 Marks)

e. Explain the advantages and disadvantages of statistical sampling. (4 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Sampling Risk, Statistical Sampling, Workpaper Review

- Level: Level 2

- Topic: Audit Documentation

- Series: NOV 2020