Question Tag: Sales Ledger

- 1 Marks

FA – May 2022 – L1 – SA – Q19 – Control Accounts

Identify the principal function of a sales ledger control account.

Question

The principal function of a sales ledger control account is to:

A. Serve as external check and provide quick information for the preparation of interim financial statements

B. Serve as internal check and provide quick information for the preparation of interim financial statements

C. Check sales fraud

D. Provide quick information for the control of salesmen’s activities

E. Provide quick information for the preparation of customer’s statements

Find Related Questions by Tags, levels, etc.

- Tags: Control Accounts, Interim Financial Statements, Sales Ledger

- Level: Level 1

- Topic: Control Accounts

- Series: MAY 2022

You're reporting an error for "FA – May 2022 – L1 – SA – Q19 – Control Accounts"

- 20 Marks

FA – Nov 2019 – L2 – SB – Q4 – Control Accounts

The question requires differentiating between receivables and payables control accounts, highlighting the uses of control accounts, and preparing sales and purchases ledger control accounts using provided transaction data.

Question

a. The Chief Executive Officer (CEO) of Favourite Gift Shop buys and sells gift items to both individuals and organisations. The CEO has close personal relationships with her business partners and knows the amount owed to her suppliers.

In a recent meeting held between the CEO and the Auditor, the Auditor brought up the issue of the unavoidable need for the business to maintain the relevant control accounts. The CEO is seriously considering adhering to the auditor’s recommendation but needs further clarification on the issue.

Required:

i. Differentiate between receivables control account and payables control account. (2 Marks)

ii. Highlight FOUR uses of control accounts. (4 Marks)

b. The following information is extracted from the books of Favourite Gift Shop for October 1, 2019:

| Transaction | Debit | Credit |

|---|---|---|

| Sales Ledger Balance | N7,200 (debit) | N45 (credit) |

| Bought Ledger Balance | N100 (debit) | N2,910 (credit) |

| Sales Day Book Total | N105,540 | |

| Purchases Day Book Total | N94,150 | |

| Returns Inwards | N4,710 | |

| Bank Draft Received | N13,500 | |

| Cheques Payment to Suppliers | N82,000 | |

| Cheques Returned | N3,750 | |

| Bad Debts Written Off | N3,200 | |

| Cash Sales | N180 | |

| Discount Allowed | N1,350 | |

| Discount Received | N2,835 | |

| Returns Outwards Day Book | X | |

| Purchases Ledger Contra | N780 | |

| Petty Cash Paid to Suppliers | N100 | |

| Drafts Issued to Suppliers | N6,450 | |

| Debit Balance in Sales Ledger Transferred to Purchases Ledger | N780 | |

| Discount Withdrawn by Suppliers | N435 | |

| SMS Alerts for Cheques Received from Customers | N42,500 | |

| Discount Disallowed | N450 | |

| October 31, 2019 Sales Ledger Balance | N24,765 (debit) | N290 (credit) |

| October 31, 2019 Bought Ledger Balance | N114 (debit) | N4,260 (credit) |

Required:

i. Prepare the sales ledger control account for the period. (7 Marks)

ii. Prepare the purchases ledger control account for the period. (7 Marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "FA – Nov 2019 – L2 – SB – Q4 – Control Accounts"

- 20 Marks

FA – July 2023 – L1 – Q3 – Control accounts and account reconciliations

Prepare a receivables control account and reconcile it with the schedule of receivables. Identify and explain six books of prime entry.

Question

a) The transactions below relate to Affram Ltd for the year ended 30 April 2022:

1 May 2021 balance b/d:

| Account | GHȼ |

|---|---|

| Sales Ledger Control Account | 180,000 Dr |

Totals for the year 1 May 2021 to 30 April 2022:

| Item | Amount (GHȼ) |

|---|---|

| Credit sales | 600,500 |

| Receipts from customers | 690,100 |

| Discount allowed | 12,000 |

| Irrecoverable debts | 5,400 |

| Sales returns | 4,600 |

| Dishonoured cheques from customers | 3,000 |

| Contras between sales and purchases | 14,000 |

The Sales Ledger Control Account balance failed to agree with the total receivables of GHȼ67,800 as shown by the Schedule of Receivables.

The following errors were subsequently discovered:

- The discount allowed total in the Cash Book had been overstated by GHȼ400.

- The total of sales in the Sales Journal had been understated by GHȼ3,000.

- A cheque received from a customer for GHȼ2,000, correctly processed through the books, had subsequently been dishonoured. This item had been correctly dealt with in the customer’s account, but no other entry has yet been made.

- Goods costing GHȼ5,000 had been returned by a customer. The transaction had been correctly recorded in the Sales Ledger Control Account, but this has not been entered in the customer’s account.

- Papa Yaw, a customer, has been declared bankrupt and his debt of GHȼ1,500 is to be written off. No entries have yet been made.

Required:

i) Prepare the Receivables Control Account for the year ended 30 April 2022. (8 marks)

ii) Prepare a statement reconciling the corrected balance on the Receivables Control Account with the corrected balance on the Schedule of Receivables. (3 marks)

b) Book-keeping is the process of recording financial transactions in the accounting records (the books) of an entity. Transactions are initially recorded in books of prime entry also known as books of original entry.

Required:

Identify SIX (6) books of prime entry and their functions. (9 marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "FA – July 2023 – L1 – Q3 – Control accounts and account reconciliations"

- 20 Marks

FA – May 2016 – L1 – Q2 – Control accounts and account reconciliations

Prepare a revised Sales Ledger Control Account, a corrected Schedule of Receivables, and discuss advantages of using control accounts.

Question

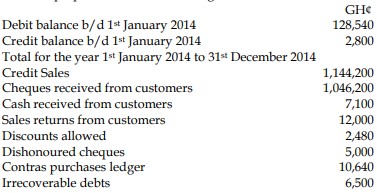

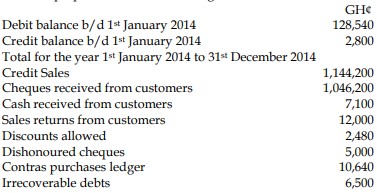

(a) The Sales Ledger Control Account of PC Ltd for the year ended 31st December 2014 has been prepared from the following information:

The Sales Ledger Control Account balance, which is part of the double-entry system, failed to agree with the total receivables of GH¢189,380 as shown by the Schedule of Receivables. The following errors were subsequently discovered:

i) A customer had returned goods to PC Ltd at the selling price of GH¢2,400. The goods had been bought on credit. No entries had been made to record the return of the goods in the accounts of PC Ltd.

ii) The discounts allowed column in the cash book had been overcast by GH¢1,080.

iii) No contra entry had been made in the receivables account in the sales ledger in respect of purchases by PC Ltd of goods at a list price of GH¢2,000. PC Ltd received a trade discount of 10% on these goods. This transaction had been correctly dealt with in the Sales Ledger Control Account.

iv) A credit sale of GH¢3,520 to JT Ltd was correctly recorded in the Sales Ledger Control Account, but no other entry had been made.

v) A cheque received from a customer for GH¢6,900, correctly processed through the books, had subsequently been dishonoured. No entries have yet been made to record this dishonoured cheque.

vi) DT Ltd, a customer, has recently been declared bankrupt and the debt of GH¢3,500 is to be written off, but no entries have yet been made.

Required:

a) Prepare a revised Sales Ledger Control Account for the year ended 31 December 2014. (9 marks)

b) Prepare a statement showing the correct total of the Schedule of Receivables for the year ended 31 December, 2014. (5 marks)

c) Discuss TWO advantages to PC Ltd of using control accounts. (6 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Accounting Errors, Control Accounts, Sales Ledger, Schedule of Receivables

- Level: Level 1

- Topic: Control accounts and account reconciliations

- Series: MAY 2016

You're reporting an error for "FA – May 2016 – L1 – Q2 – Control accounts and account reconciliations"

- 1 Marks

FA – May 2022 – L1 – SA – Q19 – Control Accounts

Identify the principal function of a sales ledger control account.

Question

The principal function of a sales ledger control account is to:

A. Serve as external check and provide quick information for the preparation of interim financial statements

B. Serve as internal check and provide quick information for the preparation of interim financial statements

C. Check sales fraud

D. Provide quick information for the control of salesmen’s activities

E. Provide quick information for the preparation of customer’s statements

Find Related Questions by Tags, levels, etc.

- Tags: Control Accounts, Interim Financial Statements, Sales Ledger

- Level: Level 1

- Topic: Control Accounts

- Series: MAY 2022

You're reporting an error for "FA – May 2022 – L1 – SA – Q19 – Control Accounts"

- 20 Marks

FA – Nov 2019 – L2 – SB – Q4 – Control Accounts

The question requires differentiating between receivables and payables control accounts, highlighting the uses of control accounts, and preparing sales and purchases ledger control accounts using provided transaction data.

Question

a. The Chief Executive Officer (CEO) of Favourite Gift Shop buys and sells gift items to both individuals and organisations. The CEO has close personal relationships with her business partners and knows the amount owed to her suppliers.

In a recent meeting held between the CEO and the Auditor, the Auditor brought up the issue of the unavoidable need for the business to maintain the relevant control accounts. The CEO is seriously considering adhering to the auditor’s recommendation but needs further clarification on the issue.

Required:

i. Differentiate between receivables control account and payables control account. (2 Marks)

ii. Highlight FOUR uses of control accounts. (4 Marks)

b. The following information is extracted from the books of Favourite Gift Shop for October 1, 2019:

| Transaction | Debit | Credit |

|---|---|---|

| Sales Ledger Balance | N7,200 (debit) | N45 (credit) |

| Bought Ledger Balance | N100 (debit) | N2,910 (credit) |

| Sales Day Book Total | N105,540 | |

| Purchases Day Book Total | N94,150 | |

| Returns Inwards | N4,710 | |

| Bank Draft Received | N13,500 | |

| Cheques Payment to Suppliers | N82,000 | |

| Cheques Returned | N3,750 | |

| Bad Debts Written Off | N3,200 | |

| Cash Sales | N180 | |

| Discount Allowed | N1,350 | |

| Discount Received | N2,835 | |

| Returns Outwards Day Book | X | |

| Purchases Ledger Contra | N780 | |

| Petty Cash Paid to Suppliers | N100 | |

| Drafts Issued to Suppliers | N6,450 | |

| Debit Balance in Sales Ledger Transferred to Purchases Ledger | N780 | |

| Discount Withdrawn by Suppliers | N435 | |

| SMS Alerts for Cheques Received from Customers | N42,500 | |

| Discount Disallowed | N450 | |

| October 31, 2019 Sales Ledger Balance | N24,765 (debit) | N290 (credit) |

| October 31, 2019 Bought Ledger Balance | N114 (debit) | N4,260 (credit) |

Required:

i. Prepare the sales ledger control account for the period. (7 Marks)

ii. Prepare the purchases ledger control account for the period. (7 Marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "FA – Nov 2019 – L2 – SB – Q4 – Control Accounts"

- 20 Marks

FA – July 2023 – L1 – Q3 – Control accounts and account reconciliations

Prepare a receivables control account and reconcile it with the schedule of receivables. Identify and explain six books of prime entry.

Question

a) The transactions below relate to Affram Ltd for the year ended 30 April 2022:

1 May 2021 balance b/d:

| Account | GHȼ |

|---|---|

| Sales Ledger Control Account | 180,000 Dr |

Totals for the year 1 May 2021 to 30 April 2022:

| Item | Amount (GHȼ) |

|---|---|

| Credit sales | 600,500 |

| Receipts from customers | 690,100 |

| Discount allowed | 12,000 |

| Irrecoverable debts | 5,400 |

| Sales returns | 4,600 |

| Dishonoured cheques from customers | 3,000 |

| Contras between sales and purchases | 14,000 |

The Sales Ledger Control Account balance failed to agree with the total receivables of GHȼ67,800 as shown by the Schedule of Receivables.

The following errors were subsequently discovered:

- The discount allowed total in the Cash Book had been overstated by GHȼ400.

- The total of sales in the Sales Journal had been understated by GHȼ3,000.

- A cheque received from a customer for GHȼ2,000, correctly processed through the books, had subsequently been dishonoured. This item had been correctly dealt with in the customer’s account, but no other entry has yet been made.

- Goods costing GHȼ5,000 had been returned by a customer. The transaction had been correctly recorded in the Sales Ledger Control Account, but this has not been entered in the customer’s account.

- Papa Yaw, a customer, has been declared bankrupt and his debt of GHȼ1,500 is to be written off. No entries have yet been made.

Required:

i) Prepare the Receivables Control Account for the year ended 30 April 2022. (8 marks)

ii) Prepare a statement reconciling the corrected balance on the Receivables Control Account with the corrected balance on the Schedule of Receivables. (3 marks)

b) Book-keeping is the process of recording financial transactions in the accounting records (the books) of an entity. Transactions are initially recorded in books of prime entry also known as books of original entry.

Required:

Identify SIX (6) books of prime entry and their functions. (9 marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "FA – July 2023 – L1 – Q3 – Control accounts and account reconciliations"

- 20 Marks

FA – May 2016 – L1 – Q2 – Control accounts and account reconciliations

Prepare a revised Sales Ledger Control Account, a corrected Schedule of Receivables, and discuss advantages of using control accounts.

Question

(a) The Sales Ledger Control Account of PC Ltd for the year ended 31st December 2014 has been prepared from the following information:

The Sales Ledger Control Account balance, which is part of the double-entry system, failed to agree with the total receivables of GH¢189,380 as shown by the Schedule of Receivables. The following errors were subsequently discovered:

i) A customer had returned goods to PC Ltd at the selling price of GH¢2,400. The goods had been bought on credit. No entries had been made to record the return of the goods in the accounts of PC Ltd.

ii) The discounts allowed column in the cash book had been overcast by GH¢1,080.

iii) No contra entry had been made in the receivables account in the sales ledger in respect of purchases by PC Ltd of goods at a list price of GH¢2,000. PC Ltd received a trade discount of 10% on these goods. This transaction had been correctly dealt with in the Sales Ledger Control Account.

iv) A credit sale of GH¢3,520 to JT Ltd was correctly recorded in the Sales Ledger Control Account, but no other entry had been made.

v) A cheque received from a customer for GH¢6,900, correctly processed through the books, had subsequently been dishonoured. No entries have yet been made to record this dishonoured cheque.

vi) DT Ltd, a customer, has recently been declared bankrupt and the debt of GH¢3,500 is to be written off, but no entries have yet been made.

Required:

a) Prepare a revised Sales Ledger Control Account for the year ended 31 December 2014. (9 marks)

b) Prepare a statement showing the correct total of the Schedule of Receivables for the year ended 31 December, 2014. (5 marks)

c) Discuss TWO advantages to PC Ltd of using control accounts. (6 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Accounting Errors, Control Accounts, Sales Ledger, Schedule of Receivables

- Level: Level 1

- Topic: Control accounts and account reconciliations

- Series: MAY 2016