Question Tag: Royalty

- 1 Marks

FA – May 2012 – L1 – SA – Q21 -Recording Financial Transactions

Identifying the least amount of royalty payable by a lessee.

Find Related Questions by Tags, levels, etc.

- Tags: Accounting for Royalties, Lease Agreements, Royalty

- Level: Level 1

- Topic: Recording Financial Transactions

- Series: MAY 2012

You're reporting an error for "FA – May 2012 – L1 – SA – Q21 -Recording Financial Transactions"

- 1 Marks

FA – Nov 2013 – L1 – SA – Q31 – Elements of Financial Statements

Identifying the accounting entries when royalty payable exceeds minimum rent.

Find Related Questions by Tags, levels, etc.

- Tags: Accounting Entries, Minimum Rent, Royalty

- Level: Level 1

- Topic: Elements of Financial Statements

- Series: NOV 2013

You're reporting an error for "FA – Nov 2013 – L1 – SA – Q31 – Elements of Financial Statements"

- 8 Marks

TX – May 2019 – L3 – Q5b – Petroleum Operations

Compute the royalty payable by a petroleum company and discuss the tax implications of production costs and the relevance of government interest in upstream operations.

Question

b) The following relates to Ablorh Ltd from petroleum operations relating to 2017 year of assessment:

Production (in barrels): 100,000,000

Selling Price per barrel ($): 100

Production cost per barrel ($): 50

Capital allowance agreed ($): 800,000

Required: i) Compute the royalty payable to the Government of Ghana by Ablorh Ltd and state the tax implication of production cost on Royalty. (5 marks)

ii) Explain THREE (3) relevance of initial interest of Government in the Upstream Petroleum Operations. (3 marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "TX – May 2019 – L3 – Q5b – Petroleum Operations"

- 20 Marks

AT – April 2022 – L3 – Q4 – Capital allowance | Business income – Corporate income tax

Calculate capital allowance and chargeable income for Joefel Company Ltd. Explain sources of revenue from upstream petroleum operations in Ghana.

Question

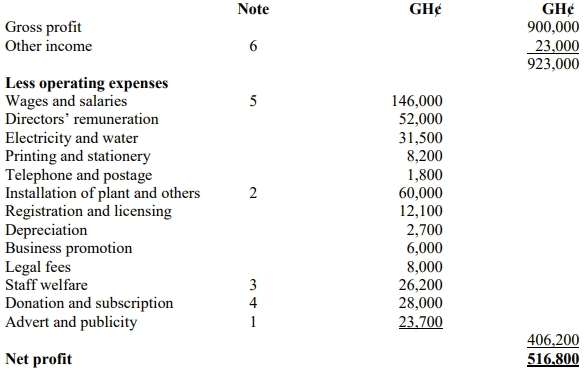

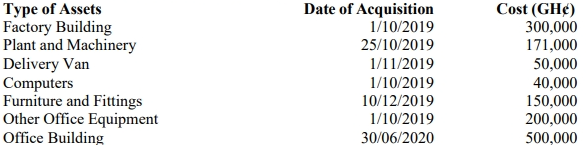

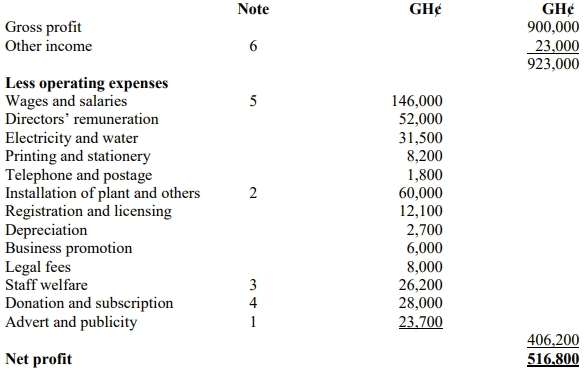

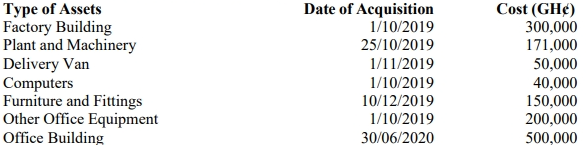

a) Joefel Company Ltd, manufacturer of fruit juice for local consumption commenced business on 1 October 2019, with accounting year-end at 31 December each year. The company submitted its accounts for 2019 and was assessed accordingly. The company submitted its tax returns for 2020 year of assessment to the Ghana Revenue Authority on 30 April 2021. Below are the details:

Additional information:

1) Advert and publicity

Radio and television 3,300

Newspaper advert 2,400

Permanent signboard at the company’s entrance in 2020 18,000

2) Installation of plant and others

Installation of plant 21,500

Heavy duty Generator bought in 2019 to support Plant and Machinery 20,500

General maintenance before the use of the plant 18,000

3) Staff Welfare

Staff medical bills 3,700

Safety wear for staff 10,500

Canteen Equipment purchased on 30 November 2020 12,000

4) Donation and Subscription

Goods given as gratis to customs officials 13,000

Donation of goods to SOS Children Village 10,000

Subscription to Association of Ghana Industries 5,000

5) Wages and Salaries

Old staff 120,000

Fresh graduates employed by Joefel Company Ltd. (Fresh graduates

constitute 1% of total workforce) 26,000

6) Other Income

Compensation from a customer for cancellation of a sale order 8,000

Compensation for loss of trading stock of the company 10,000

Compensation for cancellation of purchase order by supplier 5,000

Note 2) above has not been included in the plant and machinery acquired.

Required:

a

i) Compute the appropriate capital allowance for 2019 and 2020 years of assessment.

(8 marks)

ii) Calculate the chargeable income of the company for the 2020 year of assessment.

(6 marks)

b) Explain of the following sources of revenue accruing to the Government of Ghana from the upstream petroleum operations in Ghana:

i) Royalty.

ii) Carried Interest.

iii) Additional Interest.

iv) Additional Oil Entitlement.

(6 marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "AT – April 2022 – L3 – Q4 – Capital allowance | Business income – Corporate income tax"

- 12 Marks

AT – Nov 2020 – L3 – Q4a – Business income, Corporate income tax

Compute the tax payable by Kaka Ltd for the 2019 year of assessment, including capital allowances, fresh graduate incentives, and royalties.

Question

Kaka Ltd is a mining company that has been operating in Ghana for some time now. The following relates to Kaka Ltd’s 2019 year of assessment:

| Description | Amount (GH¢) |

|---|---|

| Revenue | 10,200,000 |

| Cost | 4,000,000 |

| Profit | 6,200,000 |

The following additional information is relevant and has been adjusted in arriving at the profit stated above:

- Depreciation, depletion, and amortization: GH¢2,000,000.

- Cost incurred in overburden stripping and shaft sinking during production to improve access amounted to GH¢800,000.

- Contribution towards a worthwhile cause is GH¢10,000. This was in support of a hole-in-heart child, duly acknowledged by the Ghana Health Service.

- Royalty of GH¢80,000 was paid without recourse to the revenue from production.

Additional information:

- An asset (Capital Asset) acquired in 2016 for GH¢1,000,000 was sold for GH¢200,000 in 2019.

- Capital allowance (written down value brought forward) on the assets as of 31 December 2018 was GH¢4,000,000.

- 10 fresh graduates were recruited in the 2019 year of assessment; 4 of them completed universities in the USA, while the others completed the University for Development Studies in Ghana. They were paid GH¢120,000 as salaries. The total workforce for 2019 was 60 employees.

Required: i) Compute the tax payable by Kaka Ltd.

(10 marks)

ii) The mining company indicated that it had an idle cash of GH¢100,000. If it adds it to its working capital, an additional income of GH¢10,000 would accrue but with an option to purchase Treasury Bills, the interest would remain at GH¢10,000.

Required:

Advise Management on the tax implication of the proposed investment.

(2 marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "AT – Nov 2020 – L3 – Q4a – Business income, Corporate income tax"

- 5 Marks

AT – May 2017 – L3 – Q5b – Business income – Corporate income tax

Calculate the royalty payable and compute the corporate tax payable by a mining company based on provided financial data.

Question

b) AB Ltd is a mining company and has the following set of data relating to the 2016 year of assessment:

| Item | Amount (GH¢) |

|---|---|

| Revenue | 5,000,000 |

| Cost of operation | 3,000,000 |

| Chargeable income | 2,000,000 |

From the above, the following came to light:

- Capital allowance of GH¢500,000 was added to the cost.

- Penalty of GH¢100,000 was imposed by the Minerals Commission for failure to follow standard operating guidelines.

- Loss from operation amounting to GH¢50,000 recorded in 2010 was added to the cost above.

- According to the accountant, the company is entitled to carryover its losses.

Required:

i) Calculate the Royalty payable, if any. (2.5 marks)

ii) Compute the corporate tax payable by AB Ltd. (2.5 marks)

(Total: 5 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Capital Allowance, Corporate Tax, Mining, Royalty, Tax computations

- Level: Level 3

- Topic: Business income - Corporate income tax

- Series: MAY 2017

You're reporting an error for "AT – May 2017 – L3 – Q5b – Business income – Corporate income tax"

- 5 Marks

AT – Nov 2023 – L3 – Q5b – Petroleum operations

Compute the government take from royalty, carried interest, and additional participation interest in petroleum operations.

Question

Nananom Petroleum Ghana Ltd produced 3,000,000 barrels of oil per month. The crude oil was sold at $70 per barrel. Royalty due is 5%, Carried Interest of 11%, and Additional Interest of 3.75%.

Required:

Compute the state or government take in the following:

i) Royalty

ii) Carried interest

iii) Additional participation interest

Find Related Questions by Tags, levels, etc.

- Tags: Additional Interest, Carried Interest, Government Take, Petroleum Operations, Royalty

- Level: Level 3

- Topic: Petroleum operations

- Series: NOV 2023

You're reporting an error for "AT – Nov 2023 – L3 – Q5b – Petroleum operations"

- 1 Marks

FA – May 2012 – L1 – SA – Q21 -Recording Financial Transactions

Identifying the least amount of royalty payable by a lessee.

Find Related Questions by Tags, levels, etc.

- Tags: Accounting for Royalties, Lease Agreements, Royalty

- Level: Level 1

- Topic: Recording Financial Transactions

- Series: MAY 2012

You're reporting an error for "FA – May 2012 – L1 – SA – Q21 -Recording Financial Transactions"

- 1 Marks

FA – Nov 2013 – L1 – SA – Q31 – Elements of Financial Statements

Identifying the accounting entries when royalty payable exceeds minimum rent.

Find Related Questions by Tags, levels, etc.

- Tags: Accounting Entries, Minimum Rent, Royalty

- Level: Level 1

- Topic: Elements of Financial Statements

- Series: NOV 2013

You're reporting an error for "FA – Nov 2013 – L1 – SA – Q31 – Elements of Financial Statements"

- 8 Marks

TX – May 2019 – L3 – Q5b – Petroleum Operations

Compute the royalty payable by a petroleum company and discuss the tax implications of production costs and the relevance of government interest in upstream operations.

Question

b) The following relates to Ablorh Ltd from petroleum operations relating to 2017 year of assessment:

Production (in barrels): 100,000,000

Selling Price per barrel ($): 100

Production cost per barrel ($): 50

Capital allowance agreed ($): 800,000

Required: i) Compute the royalty payable to the Government of Ghana by Ablorh Ltd and state the tax implication of production cost on Royalty. (5 marks)

ii) Explain THREE (3) relevance of initial interest of Government in the Upstream Petroleum Operations. (3 marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "TX – May 2019 – L3 – Q5b – Petroleum Operations"

- 20 Marks

AT – April 2022 – L3 – Q4 – Capital allowance | Business income – Corporate income tax

Calculate capital allowance and chargeable income for Joefel Company Ltd. Explain sources of revenue from upstream petroleum operations in Ghana.

Question

a) Joefel Company Ltd, manufacturer of fruit juice for local consumption commenced business on 1 October 2019, with accounting year-end at 31 December each year. The company submitted its accounts for 2019 and was assessed accordingly. The company submitted its tax returns for 2020 year of assessment to the Ghana Revenue Authority on 30 April 2021. Below are the details:

Additional information:

1) Advert and publicity

Radio and television 3,300

Newspaper advert 2,400

Permanent signboard at the company’s entrance in 2020 18,000

2) Installation of plant and others

Installation of plant 21,500

Heavy duty Generator bought in 2019 to support Plant and Machinery 20,500

General maintenance before the use of the plant 18,000

3) Staff Welfare

Staff medical bills 3,700

Safety wear for staff 10,500

Canteen Equipment purchased on 30 November 2020 12,000

4) Donation and Subscription

Goods given as gratis to customs officials 13,000

Donation of goods to SOS Children Village 10,000

Subscription to Association of Ghana Industries 5,000

5) Wages and Salaries

Old staff 120,000

Fresh graduates employed by Joefel Company Ltd. (Fresh graduates

constitute 1% of total workforce) 26,000

6) Other Income

Compensation from a customer for cancellation of a sale order 8,000

Compensation for loss of trading stock of the company 10,000

Compensation for cancellation of purchase order by supplier 5,000

Note 2) above has not been included in the plant and machinery acquired.

Required:

a

i) Compute the appropriate capital allowance for 2019 and 2020 years of assessment.

(8 marks)

ii) Calculate the chargeable income of the company for the 2020 year of assessment.

(6 marks)

b) Explain of the following sources of revenue accruing to the Government of Ghana from the upstream petroleum operations in Ghana:

i) Royalty.

ii) Carried Interest.

iii) Additional Interest.

iv) Additional Oil Entitlement.

(6 marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "AT – April 2022 – L3 – Q4 – Capital allowance | Business income – Corporate income tax"

- 12 Marks

AT – Nov 2020 – L3 – Q4a – Business income, Corporate income tax

Compute the tax payable by Kaka Ltd for the 2019 year of assessment, including capital allowances, fresh graduate incentives, and royalties.

Question

Kaka Ltd is a mining company that has been operating in Ghana for some time now. The following relates to Kaka Ltd’s 2019 year of assessment:

| Description | Amount (GH¢) |

|---|---|

| Revenue | 10,200,000 |

| Cost | 4,000,000 |

| Profit | 6,200,000 |

The following additional information is relevant and has been adjusted in arriving at the profit stated above:

- Depreciation, depletion, and amortization: GH¢2,000,000.

- Cost incurred in overburden stripping and shaft sinking during production to improve access amounted to GH¢800,000.

- Contribution towards a worthwhile cause is GH¢10,000. This was in support of a hole-in-heart child, duly acknowledged by the Ghana Health Service.

- Royalty of GH¢80,000 was paid without recourse to the revenue from production.

Additional information:

- An asset (Capital Asset) acquired in 2016 for GH¢1,000,000 was sold for GH¢200,000 in 2019.

- Capital allowance (written down value brought forward) on the assets as of 31 December 2018 was GH¢4,000,000.

- 10 fresh graduates were recruited in the 2019 year of assessment; 4 of them completed universities in the USA, while the others completed the University for Development Studies in Ghana. They were paid GH¢120,000 as salaries. The total workforce for 2019 was 60 employees.

Required: i) Compute the tax payable by Kaka Ltd.

(10 marks)

ii) The mining company indicated that it had an idle cash of GH¢100,000. If it adds it to its working capital, an additional income of GH¢10,000 would accrue but with an option to purchase Treasury Bills, the interest would remain at GH¢10,000.

Required:

Advise Management on the tax implication of the proposed investment.

(2 marks)

Find Related Questions by Tags, levels, etc.

You're reporting an error for "AT – Nov 2020 – L3 – Q4a – Business income, Corporate income tax"

- 5 Marks

AT – May 2017 – L3 – Q5b – Business income – Corporate income tax

Calculate the royalty payable and compute the corporate tax payable by a mining company based on provided financial data.

Question

b) AB Ltd is a mining company and has the following set of data relating to the 2016 year of assessment:

| Item | Amount (GH¢) |

|---|---|

| Revenue | 5,000,000 |

| Cost of operation | 3,000,000 |

| Chargeable income | 2,000,000 |

From the above, the following came to light:

- Capital allowance of GH¢500,000 was added to the cost.

- Penalty of GH¢100,000 was imposed by the Minerals Commission for failure to follow standard operating guidelines.

- Loss from operation amounting to GH¢50,000 recorded in 2010 was added to the cost above.

- According to the accountant, the company is entitled to carryover its losses.

Required:

i) Calculate the Royalty payable, if any. (2.5 marks)

ii) Compute the corporate tax payable by AB Ltd. (2.5 marks)

(Total: 5 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Capital Allowance, Corporate Tax, Mining, Royalty, Tax computations

- Level: Level 3

- Topic: Business income - Corporate income tax

- Series: MAY 2017

You're reporting an error for "AT – May 2017 – L3 – Q5b – Business income – Corporate income tax"

- 5 Marks

AT – Nov 2023 – L3 – Q5b – Petroleum operations

Compute the government take from royalty, carried interest, and additional participation interest in petroleum operations.

Question

Nananom Petroleum Ghana Ltd produced 3,000,000 barrels of oil per month. The crude oil was sold at $70 per barrel. Royalty due is 5%, Carried Interest of 11%, and Additional Interest of 3.75%.

Required:

Compute the state or government take in the following:

i) Royalty

ii) Carried interest

iii) Additional participation interest

Find Related Questions by Tags, levels, etc.

- Tags: Additional Interest, Carried Interest, Government Take, Petroleum Operations, Royalty

- Level: Level 3

- Topic: Petroleum operations

- Series: NOV 2023