- 30 Marks

PM – May 2018 – L2 – Q1 – Divisional Performance Measurement and Transfer Pricing

Differentiate responsibility centres, explain divisional structure, recommend transfer prices, and consider qualitative factors.

Question

DASET DRINKS NIGERIA PLC.

(30 MARKS)

Daset Drinks Nigeria Plc. has been operating in the Nigerian food and beverages

industry as an entity with three distinct factories across the country. One of the

factories bottles soft drink while the other two produce bottles and crown corks for

the soft drink factory.

The company has recently been experiencing problems with its performance

evaluation system across the three factories. Each factory manager is of the

opinion that his factory is the one contributing the most to the overall performance

of the company.

In a recent management retreat, the guest speaker, a performance management

expert, emphasised the need to develop Key Performance Indicators (KPI) for each

of the factories and departments in the company. According to him, this will

enhance performance evaluation of all the managers in the company and will also

make performance management easier. He suggested that the company should

adopt a divisional structure whereby each of the factories will become an

autonomous division with responsibilities for investment, revenues, profits and

costs.

At the last Executive Management meeting, after the retreat, the company‟s top

management decided to adopt the recommendations of the guest speaker. The top

management agreed transfer prices acceptable to each of the divisional managers

and also the needs to decide whether the two factories manufacturing bottles and

corks cocks could sell to external markets.

The top management has mandated you, as the company‟s management

accountant, to supply necessary data that will assist them in taking appropriate

decisions.

Financial data collected about the company‟s operations are as follows:

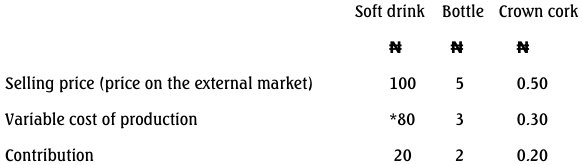

The costs and selling prices of the divisions are:

This includes costs of bottle and crown cork. To produce one bottle of soft drink

requires one bottle and one crown cork.

The bottling division has the choice to buy its bottle and crown cork requirements

from the external market.

The variable costs of production for external sales and internal transfers are the

same and bottles and crown corks are being transferred to the bottling division at

these costs.

For brand protection, the soft drink factory is not willing to buy bottles and crown

corks from any external supplier.

Required:

a. Differentiate among an investment centre, a profit centre, a revenue centre

and a cost centre, in a divisional organisation giving one example of each.

(8 Marks)

b. Explain a divisional structure, stating the problems associated with this type

of structure in an organisation. (8 Marks)

c. Advise the top management on the transfer prices that will maximise the

company‟s profit and be acceptable to the factory managers.

(10 Marks)

d. Discuss TWO qualitative factors that the top management needs to consider

in taking these decisions. (4 Marks)

Find Related Questions by Tags, levels, etc.