- 20 Marks

AT – July 2023 – L3 – Q4 – Business income – Corporate income tax

Computing chargeable income and identifying relevant assumptions for a retail company.

Question

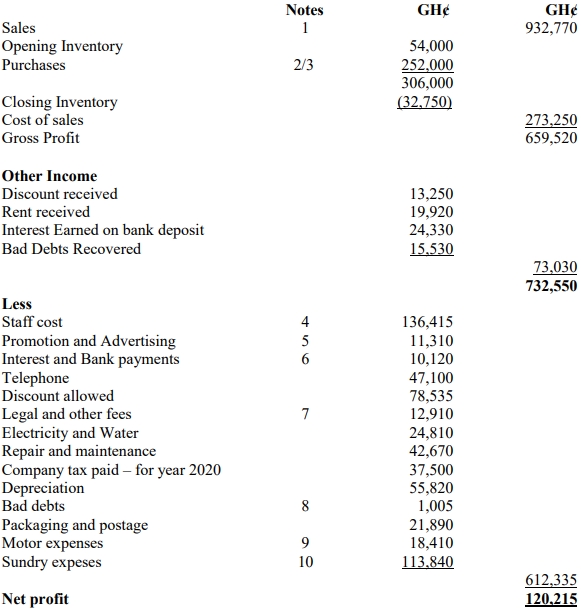

The following relates to the financial records of Konadu Yiadom Company Ltd submitted to the Ghana Revenue Authority for the year ended 31 December 2021. The company is into retail operations.

Notes:

- The sales figure includes GH¢21,500 from the sale of old shop fittings which were replaced by new fittings during the year. The profit on the sale of the shop fittings was GH¢3,770.

- Following completion of the accounts, the accountant received an invoice dated 14 December 2021 in respect of goods for resale, which were delivered in late December. This invoice was not recorded, and you have been informed that the total amount on the invoice, including VAT, was GH¢15,110. VAT included on the invoice was GH¢440. All levies are inclusive.

- In June 2021, the company recognized the need to offer a special after-sales service to its customers. The company hired a new staff member and purchased a machine costing GH¢3,500 for the purpose. The local district assembly provided a grant to aid the purchase of the machine to the tune of GH¢1,250. The company included the cost of the machine in the purchases figure.

- Staff cost is the total wages and salaries paid to the staff. GH¢37,000 was paid to fresh graduates employed during the year. They constitute 4% of the total workforce for the year 2021.

- Promotion and Advertising is made up of:

- Managing Director’s wedding reception: GH¢2,800

- Refreshment during the opening of a new shop: GH¢5,000

- Sample product to invited guests during the opening of the new shop: GH¢3,510

- Interest and Bank Payments are made up of:

- Interest on loan used to purchase stock for the business: GH¢3,020

- Overdraft interest on the business account: GH¢7,100

- Legal Fees are made up of:

- Court fine resulting from traffic accident: GH¢3,950

- Defense of company driver for careless driving: GH¢3,830

- Litigation on business plot of land (90% chance of success): GH¢5,130

- Bad Debts are made up of:

- Debt collection (Pursuing bad debts): GH¢455

- Decrease in general bad debts provision: (GH¢1,250)

- Increase in specific bad debts provision: GH¢1,800

- Motor Expenses are made up of:

- Lease of a delivery van: GH¢11,500

- Van running expenses: GH¢6,910

- Sundry Expenses are made up of:

- Trade subscriptions: GH¢16,000

- Support to elect a local Assembly Member: GH¢8,000

- Provision for replacement of windows in the office: GH¢4,000

- Gifts to customers during Christmas: GH¢6,000

- Customer’s claim on defective goods: GH¢27,240

- Provision for staff redundancy cost: GH¢25,000

- Cost of investigating cash fraud: GH¢5,600

- Investigation to acquire a new company: GH¢22,000

Additional Information:

The Ghana Revenue Authority has assessed and granted capital allowance of GH¢57,000 for the 2021 year of assessment.

Required:

You are required to compute the chargeable income for Konadu Yiadom Company Ltd for the 2021 year of assessment. Indicate clearly all necessary assumptions.

Find Related Questions by Tags, levels, etc.

- Tags: Business income, Corporate Tax, Retail Operations, Tax computation

- Level: Level 3

- Topic: Business income - Corporate income tax

- Series: JULY 2023

Report an error