- 20 Marks

FA – July 2023 – L1 – Q4 – Preparation of limited liability company financial statements

Prepare the statement of profit or loss and statement of financial position for a limited liability company using the provided trial balance and adjustments.

Question

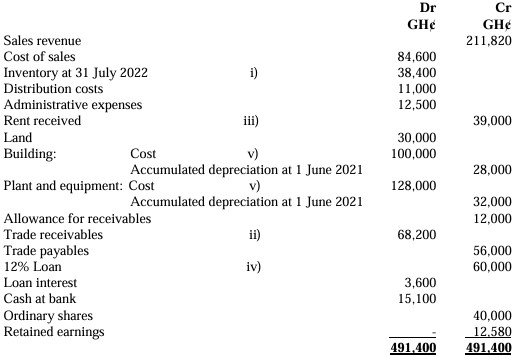

The following trial balance relates to Pakro Ltd at 31 July 2022:

The following matters remain to be adjusted for in preparing the financial statements for the year ended 31 July 2022:

- The cost of inventory of GHȼ 38,400 for the year ended 31 July 2022 was based on an inventory count on 4 August 2022. Between 31 July 2022 and 4 August 2022, the following transactions took place:

| Item | GHȼ |

|---|---|

| Purchases of goods | 8,000 |

| Sales of goods (profit margin 20% on sales) | 12,000 |

| Goods returned by Pakro Ltd to a supplier | 800 |

- Trade receivables totaling GHȼ24,000 are to be written off and allowance for receivables is to be adjusted to GHȼ8,000. The irrecoverable debt expense is to be included in administrative expenses.

- Pakro Ltd receives rent for subletting part of its building. The rent, which is receivable quarterly in advance, was received as follows:

| Date of receipt | Period covered | GHȼ |

|---|---|---|

| 1 July 2021 | 3 months to 30 September 2021 | 7,200 |

| 1 October 2021 | 3 months to 31 December 2021 | 7,200 |

| 30 December 2021 | 3 months to 31 March 2022 | 9,000 |

| 4 April 2022 | 3 months to 30 June 2022 | 9,000 |

| 1 July 2022 | 3 months to 30 September 2022 | 9,000 |

- The loan of GHȼ60,000 was taken out on 1 January 2022 with annual interest of 12%. The interest is payable in equal instalments on the first day of April, July, October, and January in arrears. The loan is repayable in full during the financial year ended 31 July 2026.

- Depreciation is to be provided for as follows:

- Buildings 2.5% per year on cost

- Plant and equipment 25% per year on cost

- 70% of the depreciation is to be charged in cost of sales, and 15% each in distribution costs and administrative expenses.

- Current year income tax charged was GHȼ18,105.

Required:

a) Prepare the Statement of Profit and Loss for the year ended 31 July 2022. (10 marks)

b) Prepare the Statement of Financial Position as at 31 July 2022. (10 marks)

Find Related Questions by Tags, levels, etc.

Report an error