- 20 Marks

PM – Mar/Jul 2020 – L2 – Q4 – PM – Mar/Jul 2020 – L2 – Q4 – Economic Value Added (EVA) and Regulatory ROCE for Ibok Power Nigeria Limited

Evaluate the performance of Ibok Power Nigeria Limited using EVA and regulatory ROCE, discussing impacts on performance management.

Question

Ibok Power Nigeria Limited (IPN) is a power utility company providing power distribution services to the public and businesses of Southern Nigeria. The company was formed when the government-owned Power Holding Company of Nigeria was broken up into regional utility companies (one of which was IPN) and sold into private ownership over four years ago.

As a vital utility for the economy of Nigeria, power services are a government-regulated industry. The regulator is principally concerned that IPN does not abuse its monopoly position in the regional market to unjustifiably increase prices. The majority of services (80%) are controlled by the regulator, who sets an acceptable return on capital employed (ROCE) level and ensures that the pricing of IPN within these areas does not breach this level. The remaining services, such as the provision of meters and contract repair services, are unregulated, and IPN can charge a market rate for these. The regulator calculates its ROCE figure based on its own valuation of the capital assets being used in regulated services and the operating profit from those regulated services.

The target pre-tax ROCE set by the regulator is 6%. If IPN were to breach this figure, then the regulator could fine the company. In the past, other such companies have paid fines amounting to millions of naira.

The board of IPN is trying to drive the performance for the benefit of shareholders. This is a new experience for many at IPN, who left the public sector four years ago. In order to better communicate the objective of maximising shareholders’ wealth, the board has decided to introduce economic value added (EVA) as the key performance indicator.

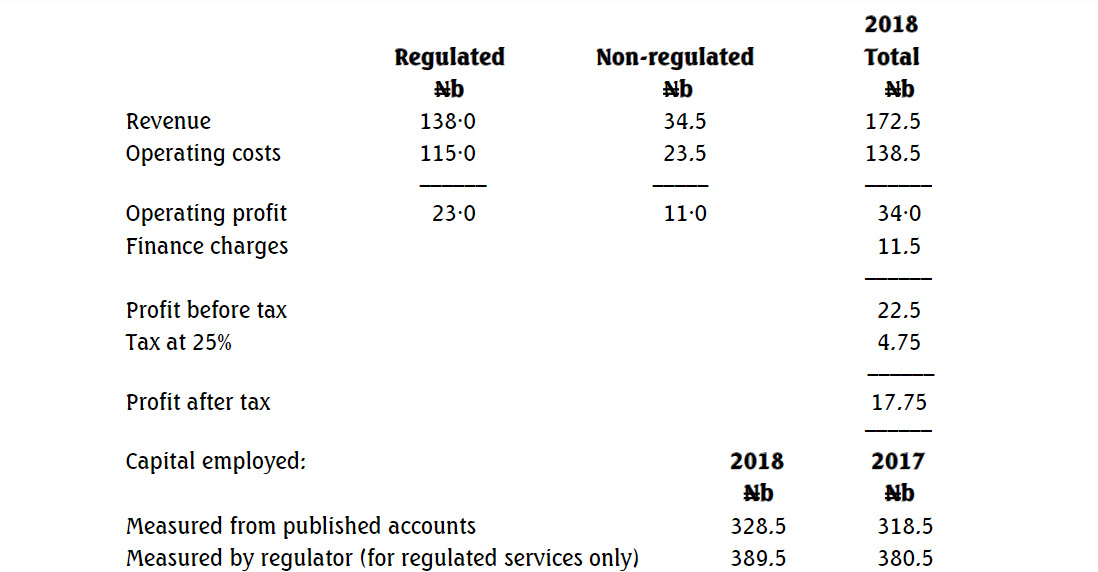

The finance director has provided the following financial information for the year ending September 30, 2018:

Ibok Power Services

Notes:

(i)

(ii) Economic depreciation is assessed to be N41.5bn in 2018. In previous years, economic and accounting depreciation were assumed to be the same.

(iii) Tax is the cash paid in the current year (N4.5bn) and includes an adjustment of N0.25bn for deferred tax provisions. No deferred tax balance existed before 2018.

(iv) The provision for doubtful debts was N2.25bn in 2018.

(v) The research and development project is not capitalised and is expected to benefit the company in the long-term. 2018 is the first year of this project.

(vi) IPN’s cost of capital is as follows:

Equity: 16%

Debt (pre-tax): 5%

(vii) Capital structure: 40% equity, 60% debt.

Required:

(a) Evaluate the performance of IPN using EVA. (13 Marks)

(b) Assess whether IPN meets its regulatory ROCE target and comment on the impact of such a constraint on performance management at IPN. (7 Marks)

Find Related Questions by Tags, levels, etc.