- 20 Marks

FA – July 2023 – L1 – Q1 – Non-current assets and depreciation | The IASB’s Conceptual Framework

Describe the elements of financial statements per the IASB framework and compute depreciation using different methods, adjusting net profit accordingly.

Question

a) Describe the FIVE (5) main elements of financial statements in accordance with the IASB’s Conceptual Framework. (10 marks)

b) Bimbila Ltd commenced business on 1 June 2020 and reported the following net profits during its first two years in business:

| GHȼ | |

|---|---|

| 1 June 2020 to 31 May 2021 | 135,000 |

| 1 June 2021 to 31 May 2022 | 140,000 |

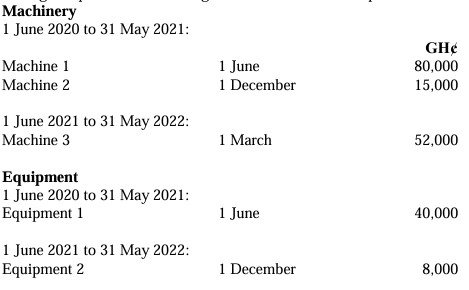

During this period the following non-current assets were purchased on the dates shown:

Bimbila Ltd has a policy to depreciate machinery at 25% per annum on cost (straight line method) and equipment at 20% per annum on cost (straight line method), rates being charged for each month of ownership. Bimbila Ltd is now considering using the reducing balance method, with the following rates applying to the balance at the end of each year:

- Machinery: 20%

- Equipment: 15%

A full year’s depreciation is charged irrespective of the date of purchase.

Required:

i) Calculate the total depreciation for the years ended 31 May 2021 and 31 May 2022 using the original method (straight line) and rates for:

- Machinery (2 marks)

- Equipment (1 mark)

ii) Calculate the total depreciation for the years ended 31 May 2021 and 31 May 2022 using the alternative method (reducing balance) and rates for:

- Machinery (2 marks)

- Equipment (1 mark)

iii) Prepare a statement to show the net profit which would have been reported for each of the years ended 31 May 2021 and 31 May 2022 if the reducing balance method had been used. (4 marks)

Find Related Questions by Tags, levels, etc.