- 20 Marks

TAX – May 2015 – L2 – SB – Q4 – Taxation of Partnerships and Sole Proprietorships

Calculate the chargeable income of each partner before and after the admission of a new partner and determine the basis period.

Question

The Managing Partner of Aarinola Sunkanmi & Co., a firm of Estate Surveyors and Valuers based in Lagos, has invited you to calculate the Chargeable income of each of the firm’s partners after the admission of Mariam in 2014.

The information relating to the Partnership are as follows:

(a) The firm makes up its accounts up to 31 December of each year.

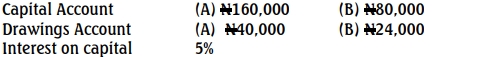

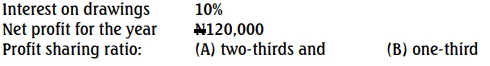

(b) Extracts from the books of account for the year ended 31 December 2014, are listed below:

| Description | Amount (₦) |

|---|---|

| Net profit for the year | 1,380,000 |

| Depreciation | 450,000 |

| Capital Allowances for the year | 366,300 |

| Balancing Allowance | 72,500 |

| Balancing Charge | 75,480 |

| Profit on sale of fixed assets | 77,500 |

| Legal expenses for successfully defending one of the partners for professional misconduct | 14,000 |

(c) Other information:

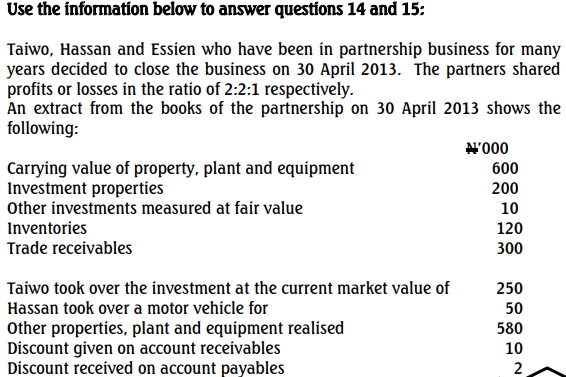

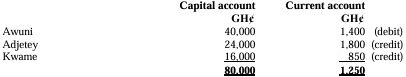

(i) The THREE partners are Aarinola, Olasunkanmi and Murphiefe.

(ii) Profit sharing ratio is as follows:

- Aarinola: 2

- Olasunkanmi: 1

- Murphiefe: 1

(iii) Aarinola and Murphiefe received ₦15,000 each as interest on loan per annum.

(iv) Salaries paid to each partner are as follows:

- Aarinola: ₦140,000 per annum

- Olasunkanmi: ₦60,000 per annum

- Murphiefe: ₦60,000 per annum

(v) Olasunkanmi ceased to be a partner on 30 June 2014. Mariam was admitted on 1 July 2014. Mariam’s salary was fixed at ₦60,000 per annum. She also received interest on capital of ₦10,000 per annum.

(vi) Included in travelling expenses is the sum of ₦12,000 paid towards the annual vacation of Aarinola, the Principal Partner.

(vii) On Mariam’s admission in July 2014, the profit sharing ratio was changed to:

- Aarinola: 10

- Murphiefe: 7

- Mariam: 3

Required:

a. Compute the Chargeable Income of each partner: i. Prior to admission of Mariam (9 Marks)

ii. Post-admission of Mariam (9 Marks)

b. State the basis period for the existing partners. (2 Marks)

Find Related Questions by Tags, levels, etc.