- 20 Marks

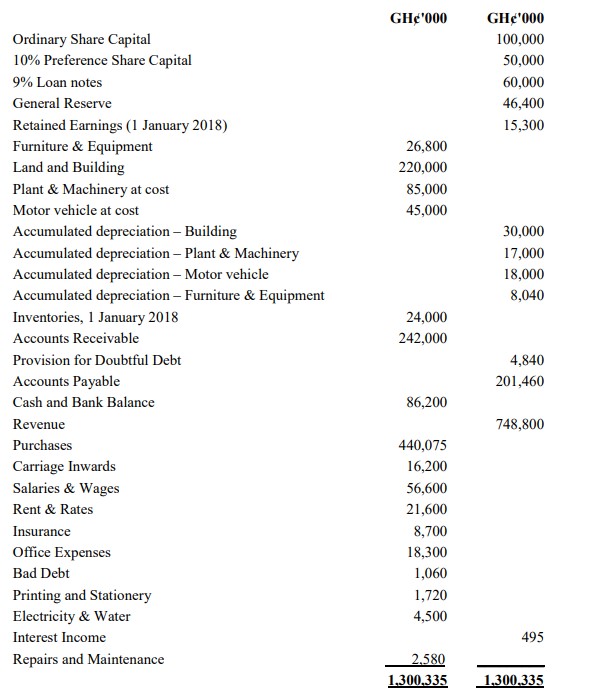

FA – May 2019 – L1 – Q1 – Accruals and prepayments | Non-current assets and depreciation | Preparation of limited liability company financial statements

Prepare the Statement of Profit or Loss and the Statement of Financial Position for Nhyiraba Ltd, incorporating adjustments for depreciation, accruals, and provisions.

Question

The trial balance below was extracted from the ledger of Nhyiraba Ltd as at 31 December 2018.

The following additional information is provided:

i) Allowance is to be made for depreciation on the non-current assets on a straight-line method at the following rates:

- Building: 3%

- Plant & Machinery: 20%

- Motor Vehicle: 20%

- Furniture & Fittings: 10%

ii) The value of land included in Land and Building is GH¢20,000,000.

iii) The following payments were made in advance:

- Rent: GH¢4,320,000

- Insurance: GH¢1,740,000

iv) One year interest is due on the loan notes.

v) Provision for doubtful debt is to be adjusted so that it is 3% of trade receivables.

vi) Allowance is to be made for audit fees of GH¢3,600,000.

vii) Directors’ fees of GH¢4,500,000 were due at the year-end.

viii) The cost of closing inventories at 31/12/2018 was GH¢43,740,000. However, due to a market recession, the net realizable value of the goods is GH¢37,430,000.

ix) The directors have recommended a transfer of GH¢20,000,000 to the general reserve.

x) The year’s preference dividend is to be provided for.

xi) Current year income tax charged was GH¢9,630,000.

xii) Authorised share capital comprises:

- 50,000,000 10% preference shares at GH¢1 each GH¢50,000,000.

- 250,000,000 ordinary shares at GH¢0.5 each GH¢100,000,000.

Required:

a) Prepare Nhyiraba Ltd’s Statement of Profit or Loss for the year end 31 December 2018. (10 marks)

b) Prepare Nhyiraba Ltd’s Statement of Financial Position as at 31 December 2018. (10 marks)

Find Related Questions by Tags, levels, etc.