- 20 Marks

FA – Nov 2023 – L1 – Q2 – Preparation of Partnership accounts

Adjust the net profit or loss of a partnership firm and prepare the revised current accounts and statement of financial position.

Question

Adu, Boateng, and Dogbe are trading in partnership under an agreement which provides for interest on partners’ capital accounts at the rate of 10% per annum, annual salaries of GHȼ7,500 and GHȼ4,000 for Boateng and Dogbe respectively, and the balance of the profit or loss shared among Adu, Boateng, and Dogbe in the proportion 5:3:2 respectively.

Partners’ cash drawings for the year ended 30 April 2021 were as follows:

| Partner | Amount (GHȼ) |

|---|---|

| Adu | 8,000 |

| Boateng | 5,000 |

| Dogbe | 6,000 |

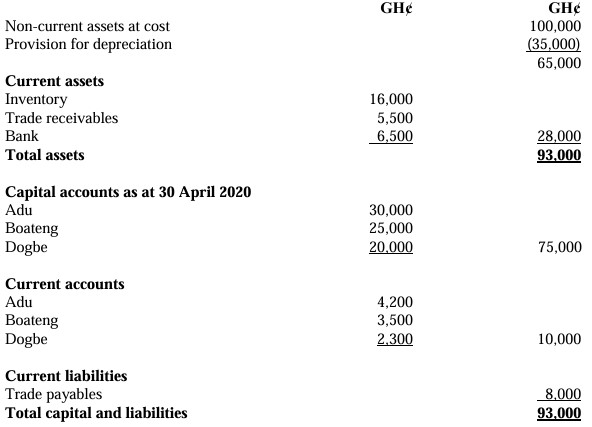

The draft Statement of Financial Position as at 30 April 2021 of Adu, Boateng, and Dogbe is as follows:

After the preparation of the draft final accounts for the year ended 30 April 2021, which disclosed a net loss of GHȼ10,500, it was discovered that:

- The partners’ cash drawings for the year under review have been debited to purchases.

- On 1 November 2020 it was agreed that Boateng should increase his partnership capital from GHȼ25,000 by transferring to the partnership a freehold property bought by Boateng five years earlier at a cost of GHȼ10,000 and currently valued at GHȼ30,000. Although the appropriate debit entry has been made in the non-current asset account, the corresponding credit entry appeared in the profit and loss appropriation account.

- The partners’ salaries for the year ended 30 April 2021 have been debited to staff salaries and credited to the relevant partners’ current accounts.

The partners have now decided that an allowance for receivables should be 4% of trade receivables.

Required:

a) Compute the revised net profit or loss of the partnership for the year ended 30 April 2021. (5 marks)

b) Prepare the revised partners’ current accounts for the year ended 30 April 2021. (Note: the partners’ current accounts should commence with the balances shown in the draft partnership Statement of Financial Position as at 30 April 2021). (7 marks)

c) Redraft the Statement of Financial Position of the partnership as at 30 April 2021. (8 marks)

Find Related Questions by Tags, levels, etc.