- 20 Marks

AT – May 2016 – L3 – Q2 – Business Income – Corporate

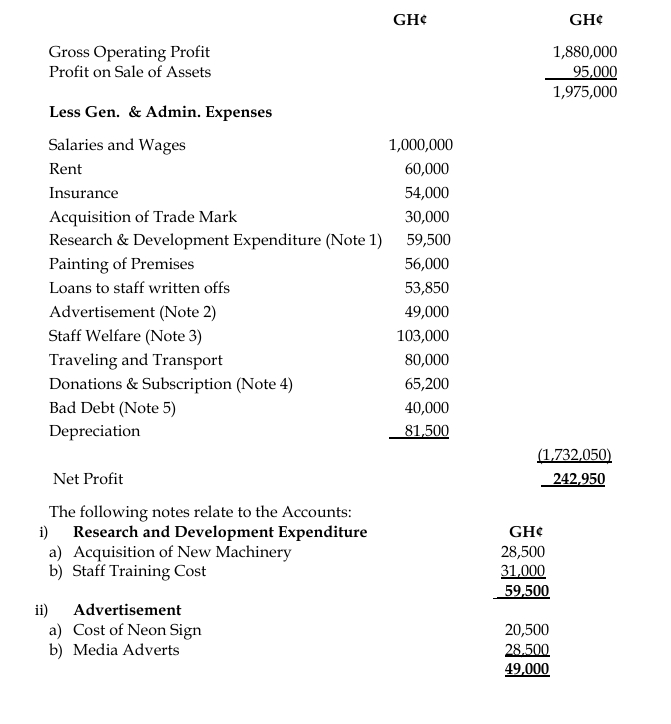

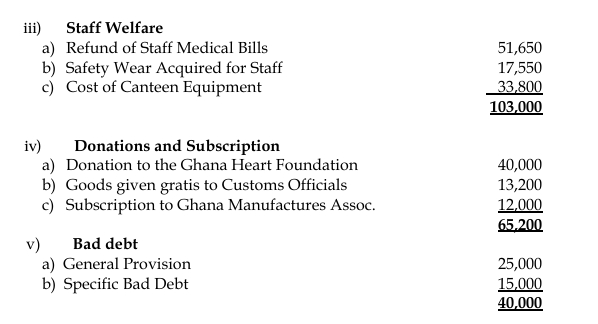

This question asks for the computation of chargeable income based on the profit and loss account details for a manufacturing company for the 2014 Year of Assessment.

Question

Below is the Profit or Loss Accounts of Osu Mart Ltd, a manufacturing company in Accra for the year ended 31st December 2014, submitted to the Commissioner of Domestic Tax Revenue Division of the Ghana Revenue Authority on 30th April 2015.

a) Compute the chargeable income of the company for the 2014 Year of Assessment. (18 marks)

b) State the significance of the Auditor’s Certificate to the Examination of Accounts. (2 marks)

Find Related Questions by Tags, levels, etc.

Report an error