- 30 Marks

ATAX – May 2019 – L3 – Q1b – Petroleum Profits Tax (PPT)

Assess and compute the assessable profit, chargeable profit, chargeable tax, and total tax payable for a petroleum company, based on financial data.

Question

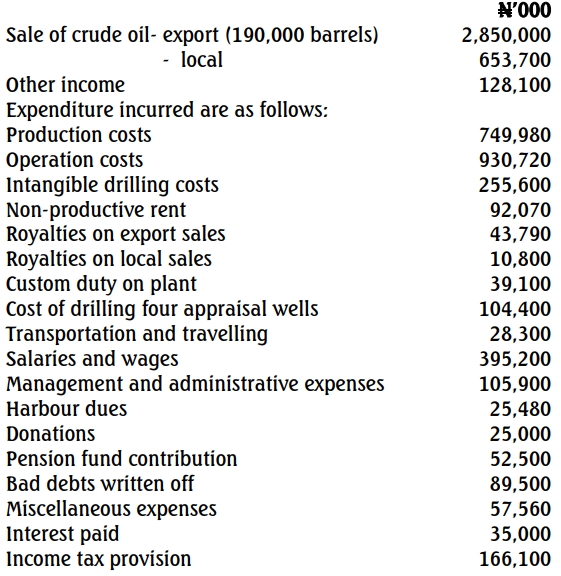

b. Priceless Oil Limited commenced crude oil production in Nigeria in 2006. The company has provided the following financial report for the year ended December 31, 2018:

Additional Information:

- Posted price for exported crude oil averaged $52/barrel (at an exchange rate of ₦306 to $1).

- Included in other income: ₦38,000,000 from crude transportation (cost: ₦16,250,000).

- Natural gas contract with Tommy Limited: value ₦655,000,000, load factor 54%.

- Depreciation of ₦120,250,000 was included in production costs.

- Qualifying capital expenditures:

| Type | Date | Location | Amount (₦) |

|---|---|---|---|

| Storage tank | March 12, 2018 | On-shore | 23,500,000 |

| Plant and equipment | November 15, 2018 | Continental Shelf of 130 metres of water depth |

75,000,000 |

- Capital allowances brought forward: ₦33,700,000; for the year: ₦88,500,000.

- Admin expenses include ₦3,500,000 stamp duties for debentures.

- Specific bad debts written off: ₦39,500,000.

- Donations were wholly expended for petroleum operations.

- ₦12,250,000 was paid to retrieve petroleum-related data (included in miscellaneous expenses).

- ₦20,500,000 interest was paid to an associate company at market rate.

Prepare and submit a report on the following computations:

i. Assessable profit (12 Marks)

ii. Chargeable profit (6 Marks)

iii. Chargeable tax (6 Marks)

iv. Total tax payable (6 Marks)

Find Related Questions by Tags, levels, etc.

Report an error