- 20 Marks

ATAX – Nov 2016 – L3 – Q3 – Capital Gains Tax (CGT)

Computes chargeable gains, capital gains tax, and implications of disposing part of a company’s assets.

Question

Obioma and Sons Limited, a company based in Emene – Enugu, has been producing vegetable oil since 2015. It has been a leading name in the production of a popular brand of household vegetable oil known as “Abop,” which is in high demand.

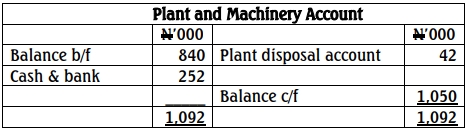

Given the fact that the company is doing very well, it secured funds from its bankers and bought additional Plant and Machinery in excess of its immediate needs on June 1, 2013 for N24,600,000. The Finance Director convinced the Board to dispose part of the plant and machinery to boost the company’s working capital. Consequently, on December 31, 2015, the company sold part of the Plant and Machinery for N37,925,000 and spent N5,125,000 as expenses incidental to the sale. The market value of the remaining Plant and Machinery was N15,375,000 as at December 31, 2015.

However, the issue of the tax implications of these transactions is worrisome to the Managing Director, who is visibly disturbed that the Federal Inland Revenue Service (FIRS) might come after the company.

As the tax consultant to the company, you are required to:

a) State any FOUR Chargeable Assets. (2 Marks)

b) State any FOUR conditions for granting Roll-Over Relief. (8 Marks)

c) Compute the Chargeable Gains on the asset sold. (4 Marks)

d) Compute the Capital Gains Tax. (2 Marks)

e) Compute the new cost of the remaining asset. (4 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Asset Disposal, Capital Gains, Chargeable assets, Plant and Machinery, Roll-Over Relief

- Level: Level 3

- Topic: Capital Gains Tax (CGT)