- 30 Marks

FR – Nov 2022 – L2 – Q1 – Financial Performance Ratios

This question asks for the computation of key financial ratios and an analysis of the viability of acquiring controlling interests in two companies.

Question

There has been agitation to stop importation of containers from China, to increase patronage of local industries. The Board of Favour PLC is planning to acquire 75% controlling interests in either Grace Limited or Blessing Limited which produce better and cheaper containers locally. As a trainee working in

Obokun Chartered Accountants, the Managing Partner has requested you to carry out performance score cards of the companies using accounting ratios to assess the viability of the acquisition.

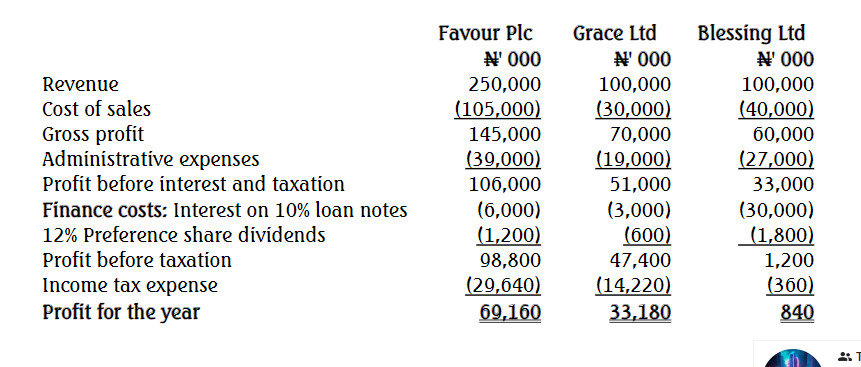

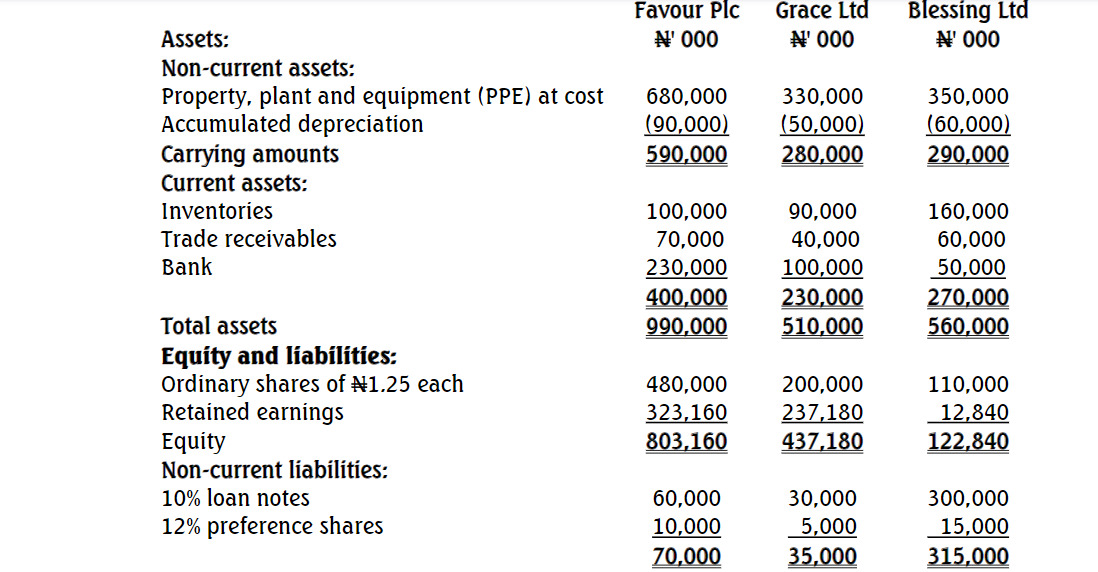

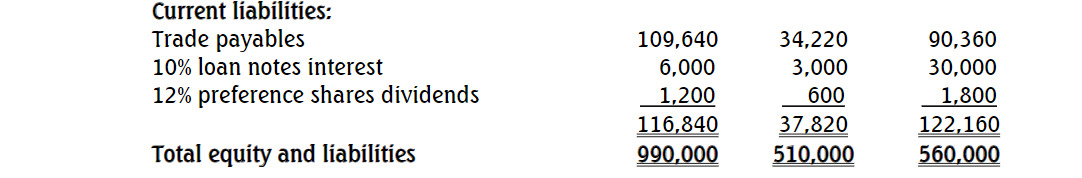

Statement of comprehensive income for the year ended December 31, 2020:

Additional Information:

(i) Inventories as at December 31, 2019 were N60 million, N30 million and N50 Million and the current market prices, 30 kobo, 28 kobo and 10 kobo

for Favour Plc, Grace Limited and Blessing Limited respectively.

(ii) Purchases for cash within 365 days in the year 2020 were 10%, 20% and 40% of cost of sales for Favour Plc, Grace Limited and Blessing Limited

respectively.

Required:

a. Calculate the following ratios for Grace Limited and Blessing Limited.

i. Net profit margin

ii. Quick ratio

iii. Debt equity ratio

iv. Proprietary ratio

v. Earnings yield

vi. Net asset per share

b. Draft a technical report titled “Performance Scorecard‟ of Blessing Limited and Grace Limited and advise Favour Plc in which of the two companies it should acquire 75% controlling interests. (10 Marks)

c. The Chief Financial Officer (CFO) of Favour Plc noted that the records of Blessing Limited and Grace Limited are maintained using block chain technologies.

Required: Discuss the type of records that a company can maintain in blockchain and state TWO benefits of making use of this technology. (10 Marks)

Find Related Questions by Tags, levels, etc.