- 20 Marks

FA – Nov 2014 – L1 – SB – Q5 – Partnership Accounts

Preparing a statement of profit or loss and partners’ current accounts for a partnership.

Question

Garuba and Ngozi have been together in partnership for several years in a newspaper publishing business, sharing profits and losses in the ratio 3:2 after charging salaries of N3,000,000 per annum for each partner.

On 1 September 2013, Bola was admitted into the partnership on the following terms:

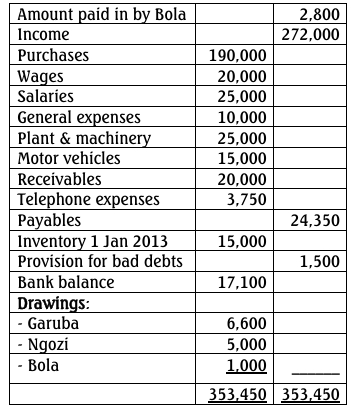

i. That he pays N2,800,000 to the original partners.

ii. He would be entitled to a salary of N2,700,000 per annum and a 20% share of profits after charging all salaries.

Garuba and Ngozi are to continue their old profit-sharing ratios, and Bola’s 20% share of profit is guaranteed at a minimum of N1,500,000 per annum.

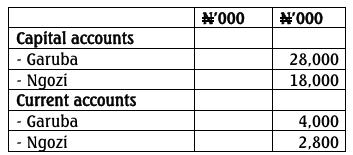

On 31 December 2013, the following balances were extracted from the partnership books of Garuba, Ngozi, and Bola:

Additional Information:

i. Provision for doubtful debts should be maintained at 5% of receivables.

ii. Inventory at 31 December 2013 was valued at N12,000,000.

iii. Depreciation on plant and machinery to be 20% per annum and on motor vehicles 25% per annum.

Required:

a. Prepare the Statement of Profit or Loss for the year ended 31 December 2013 accounting for Bola on a pro-rata time basis. (10 Marks)

b. Prepare the Partners’ Current Accounts for the period. (10 Marks)

(Total 20 Marks)

Find Related Questions by Tags, levels, etc.