- 20 Marks

FA – Mar 2023 – L1 – Q2 – Bad and doubtful debt | Control accounts and account reconciliations

Prepares control accounts, allowance for doubtful debts, revaluation account, partners' capital accounts, and adjusted financial position for a partnership.

Question

a) The following were extracted from the books of Pele Ltd by the close of December 2021:

| Account | GH¢ |

|---|---|

| Receivables ledger control account | 71,400 |

| Payables ledger control account | 56,100 |

During the year 2022 the following transactions occurred:

| Transaction | GH¢ |

|---|---|

| Cash received from customers | 47,700 |

| Cash paid to suppliers | 48,750 |

| Sales on credit | 72,300 |

| Purchases on credit | 54,750 |

| Sales returns | 2,850 |

| Purchase returns | 1,050 |

| Discounts received from suppliers | 600 |

| Settlement discount claimed by customer | 450 |

| Bad debts written off | 4,050 |

| Customer and supplier accounts settled by contra | 3,150 |

At 1 January 2022, the start of Pele Ltd’s financial year, the balance on the allowance for doubtful debts account was GH¢9,450. At 31 December 2022, the company’s management decided that the revised balance should be 10% of the year-end accounts receivable.

Required:

i) Prepare the receivables ledger control account and payables ledger control account for the year ended December 2022 and hence determine the balances at 31 December 2022. (7 marks)

ii) Prepare the allowance for doubtful debts account and bad debt expense account showing the necessary entries in respect of the financial year ended 31 December 2022. (3 marks)

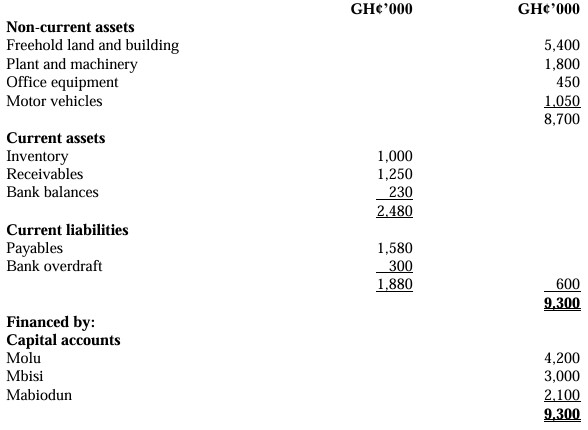

b) Molu, Mbisi, and Mabiodun have been in practice under the name Moba Partners for many years sharing profits and losses in the ratio of 4:3:3. Mbisi decided to retire on 31 December 2022 due to her relocation to Spain. The Statement of Financial Position as at 31 December 2022 was as shown below:

Additional Information:

- Interest should be charged on partners’ drawings at 5%. Each of the partners had withdrawn GH¢600,000 from the account.

- Interest on partner’s capital account to be credited at 6%. Partners’ accounts for the purpose of the interest calculation are to be taken as follows: Molu GH¢2,100,000, Mbisi GH¢1,050,000, Mabiodun GH¢1,500,000.

- Mbisi received GH¢240,000 paid by cheque immediately.

- Goodwill was valued at GH¢3,000,000 and was to be retained in the books.

- Other assets and liabilities were valued as follows:

- Freehold land and buildings: GH¢6,000,000

- Plant and machinery: GH¢2,400,000

- Office equipment: GH¢350,000

- Motor vehicles: GH¢1,560,000

- Discount to be received from creditors amounted to GH¢270,000.

- 20% of the receivables were irrecoverable.

- 15% of inventory was obsolete.

- The balance due to Mbisi is to be kept in the firm as a loan.

Required:

i) Prepare the revaluation account. (2 marks)

ii) Prepare the partners’ capital accounts. (4 marks)

iii) Prepare the adjusted statement of financial position. (4 marks)

Find Related Questions by Tags, levels, etc.