Lagelu Plc. (LP) is a very successful entity. The company has consistently followed a business strategy of aggressive acquisitions, looking to buy companies that it believes were poorly managed and hence undervalued. LP can be described as a modern-day conglomerate with business interests stretching far and wide.

Its board of directors has chosen the takeover targets with care. LP has maintained its price earnings (P/E) ratio on the stock market at 12.2.

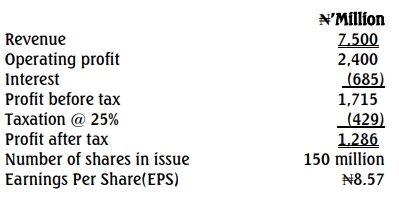

LP’s figures show a profit after tax of ₦4,430 million, and it has 375 million shares.

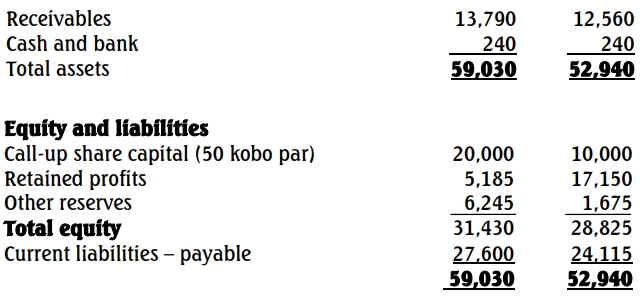

Lam Technical (LT) is a well-established owner-managed business. It has had its ups and downs in financial terms, corresponding directly with the state of the global economy. Since 2001, its profits have fallen each year, with the 2017 results as stated below:

With economists predicting an upturn in the global economy, LT’s management team feels that revenue will increase by 6% per annum up to and including year 2021. The company’s operating profit margin is not expected to change in the foreseeable future.

Operating profits are shown after deducting non-cash expenses (including tax-allowable depreciation) of ₦650m. This is expected to increase in line with sales. However, the company has recently spent ₦1,050m on the purchase of non-current assets, and LT’s management believes this will need to increase by 10% per annum until year 2021 to enable the company to remain competitive.

LT is currently financed by debt and equity. It has maintained a constant debt-to-total-asset ratio of 40% and has no intention to change this financing mix in the near future.

The company has a cost of equity of 17% and a weighted average cost of capital of 12%.

Assume a tax rate of 25% in all cases.

Some of LT’s major shareholders are not so confident about the future and would like to sell the business as a going concern. The minimum price they would consider would be the fair value of the shares plus a 10% premium. LT’s Chief Financial Officer believes the best way to find the fair value of the shares is to discount the forecast Free Cash Flows to the firm, assuming that beyond the year 2021, these will grow at a rate of 3% per annum indefinitely.

Required:

a. Prepare a schedule of forecast Free Cash Flows to the firm for each of the years from December 31, 2018, to 2021. (5 Marks)

b. Estimate the fair value of LT’s equity on a per-share basis. (6 Marks)

c. LP intends to make an offer to LT based on a share-for-share swap. LP will exchange one of its shares for every two LT shares. Assuming that LP can maintain its price earnings (P/E) ratio of 12.2, calculate the percentage gain in equity value that will be earned by both groups of shareholders. (6 Marks)

d. What factors should the LT shareholders consider before deciding whether to accept or reject the offer made by LP? (3 Marks)