- 6 Marks

FR – May 2017 – L2 – Q2c – Financial Reporting Standards and Their Applications

Explain deferred tax, identify reasons for deferred tax increase, and explain overprovision in the income statement.

Question

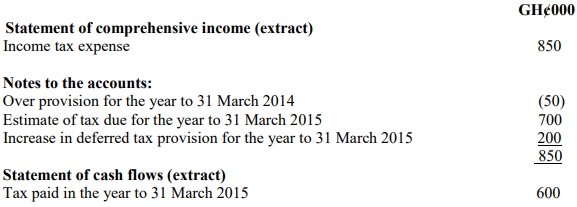

The draft financial statements for the year ended 31 March 2015 for Kobby Ltd include the following:

Required:

i) Explain how deferred tax arises.

(2 marks)

ii) Identify the most likely reason for the increase of GH¢200,000 in the deferred tax provision for the year to 31 March 2015.

(2 marks)

iii) Explain what the over provision of GH¢50,000 in the income statement represents.

(2 marks)

Find Related Questions by Tags, levels, etc.

- Tags: Deferred Tax, IAS 12, Income Tax, Overprovision, Taxation

- Level: Level 2

- Topic: Financial Reporting Standards and Their Applications

- Series: MAY 2017

Report an error