- 7 Marks

CR – May 2023 – L3 – Q7b – Segment Reporting (IFRS 8)

Advise on reportable operating segments based on IFRS 8 criteria for Jafuwara PLC

Question

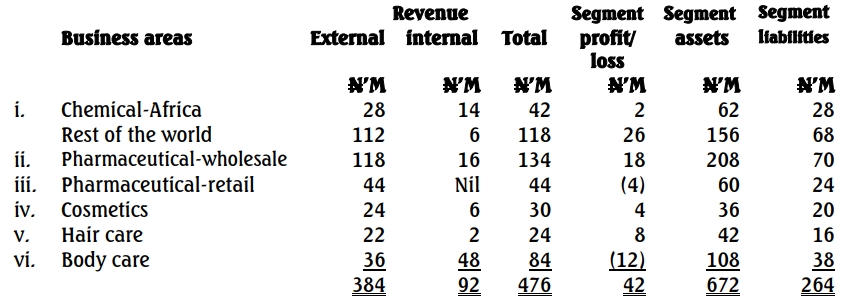

Jafuwara PLC is a public limited company trading in six business areas, each reported separately in its internal accounts provided to the Chief Operating Decision Maker (CODM). The results of these segments for the year ended December 31, 2021, are as follows:

Operating Segment Information as at Dec. 31, 2021

Required:

Draft a report addressed to the directors of Jafuwara PLC advising them on which of the operating segments constitute a ‘reportable’ operating segment for the year ended December 31, 2021, in accordance with IFRS 8. (7 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: CODM, IFRS 8, Operating segments, Reportable Segments

- Level: Level 3

- Topic: Segment Reporting (IFRS 8)

Report an error