- 16 Marks

TAX – May 2021 – L1 – SB – Q2a – Tax Administration and Enforcement

Calculation of taxes payable in Nigeria by Atlat Airline Limited for the relevant assessment year.

Question

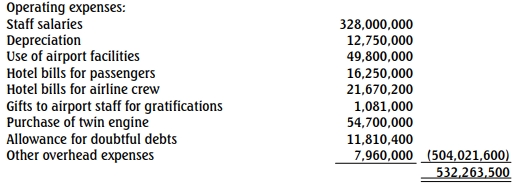

Atlat Airline Limited was incorporated in New York, USA, on June 6, 1993. It is engaged in the carriage of mails, passengers, and livestock into and out of Nigeria. The company’s worldwide statement of profit or loss as at December 31, 2018, has revealed the following:

| Description | Amount (N) |

|---|---|

| Income from passengers flown from New York to Nigeria | 510,720,000 |

| Income from passengers loaded and flown out of Nigeria | 241,305,000 |

| Income from cargo loaded into aircraft to Nigeria from other routes | 181,300,100 |

| Income from cargo freight from Nigeria to New York | 102,960,000 |

| Total Income | 1,036,285,100 |

Additional information:

(i) The Federal Inland Revenue Service is satisfied that the tax authority in New York computes and assesses a company which operates an aircraft on a basis not materially different from that prescribed by Companies and Allied Matters Act Cap C21 LFN 2004 (as amended).

(ii) The tax authority in New York has certified the adjusted profit and depreciation allowance ratios.

(iii) Out of the overhead expenses, N2,194,500 relates to disallowable expenses.

Required:

Compute the taxes payable in Nigeria by Atlat Airline Limited for the relevant assessment year. (16 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Airline Taxation, Income Tax, Operating Expenses, Tax computation

- Level: Level 1

- Topic: Tax Administration and Enforcement

- Series: MAY 2021