- 20 Marks

CR – Nov 2024 – L3 – Q1 – Consolidated Financial Statements

Prepare the consolidated statement of financial position for Okaekwei PLC, considering acquisitions and fair value adjustments.

Question

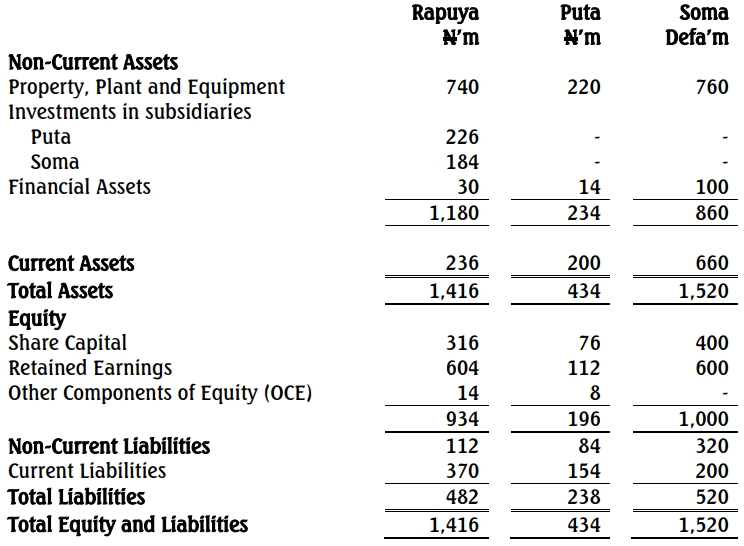

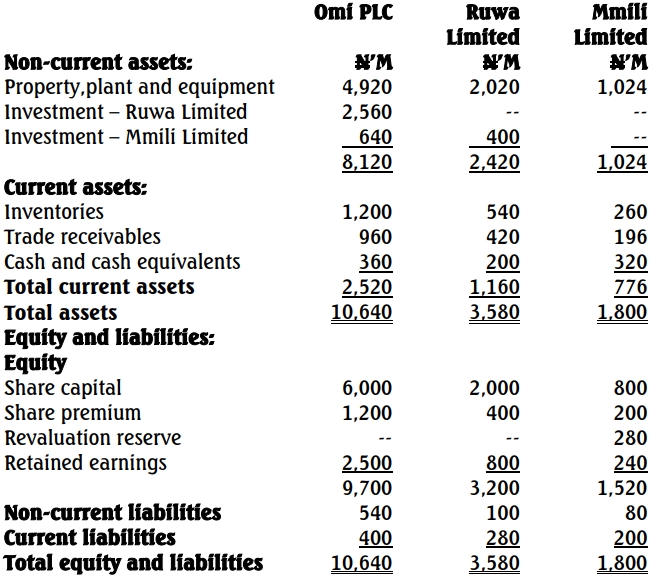

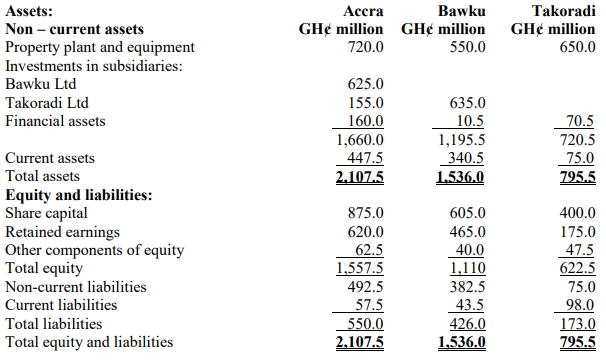

The following financial statements relate to Okaekwei PLC (Okaekwei), Ablekuma PLC (Ablekuma), and Katamanso PLC (Katamanso), three companies operating in the manufacturing industry.

Statement of Financial Position as at 31 October 2024

| Description | Okaekwei (GH¢’000) | Ablekuma (GH¢’000) | Katamanso (GH¢’000) |

|---|---|---|---|

| Non-current assets: | |||

| Property, plant and equipment | 88,307 | 53,657 | 82,875 |

| Investments | 102,500 | 78,095 | – |

| Total Non-current Assets | 190,807 | 131,752 | 82,875 |

| Current assets: | |||

| Inventory | 9,492 | 4,618 | 14,642 |

| Trade receivables | 4,573 | 8,101 | 18,085 |

| Cash and Bank | 11,625 | 4,599 | 30,056 |

| Total Current Assets | 25,690 | 17,318 | 62,783 |

| Total Assets | 216,497 | 149,070 | 145,658 |

| Equity & Liabilities: | |||

| Share capital (GH¢1) | 106,250 | 63,750 | 61,625 |

| Retained earnings | 38,607 | 42,361 | 27,025 |

| Other component of equity | 3,825 | 3,060 | 2,678 |

| Total Equity | 148,682 | 109,171 | 91,328 |

| Liabilities: | |||

| Non-current liabilities | 40,851 | 20,327 | 31,582 |

| Current liabilities | 26,964 | 19,572 | 22,748 |

| Total Liabilities | 67,815 | 39,899 | 54,330 |

| Total Equity & Liabilities | 216,497 | 149,070 | 145,658 |

Additional Information:

-

Acquisition of Katamanso:

- On 1 November 2023, Ablekuma acquired 60% of the ordinary shares of Katamanso at a cost of GH¢55 million.

- Due diligence costing GH¢0.25 million was undertaken and included in the investment cost.

- Retained earnings and other components of equity of Katamanso at acquisition were GH¢21.6 million and GH¢1.65 million, respectively.

-

Fair Value Adjustments:

- A fair value exercise was conducted, with a building’s fair value exceeding its carrying value by GH¢1.2 million (remaining useful life: 20 years).

- The financial statements of Katamanso do not yet reflect this adjustment.

- Non-controlling interest is measured using the proportionate share of identifiable net assets.

-

Acquisition of Ablekuma by Okaekwei:

- On 1 November 2022, Okaekwei purchased 80% of the ordinary shares of Ablekuma for GH¢92 million.

- The investment value reflects the fair value of the subsidiary at 31 October 2024.

- Retained earnings and other equity components at acquisition: GH¢29.6 million and GH¢2.32 million.

-

Deferred Tax on Fair Value Adjustments:

- Deferred tax is to be provided at 25% on temporary differences arising from fair value adjustments.

-

Intragroup Transactions:

- On 1 June 2024, Ablekuma sold inventory (cost: GH¢2 million) to Katamanso for GH¢1.8 million.

- As of 31 October 2024, these goods were still in Katamanso’s inventory, valued at the purchase cost. The fair value of the inventory at year-end was GH¢1.78 million.

-

Intragroup Transfer of PPE:

- On 1 August 2024, Okaekwei transferred a production machine to Ablekuma at GH¢2 million (carrying value: GH¢2.4 million).

- The remaining useful life was five years, but Ablekuma depreciates it over four years.

- Okaekwei harmonizes accounting policies upon consolidation.

Required:

Prepare the Consolidated Statement of Financial Position of Okaekwei PLC as at 31 October 2024.

(All workings are to be rounded to the nearest thousand).

Find Related Questions by Tags, levels, etc.

Report an error

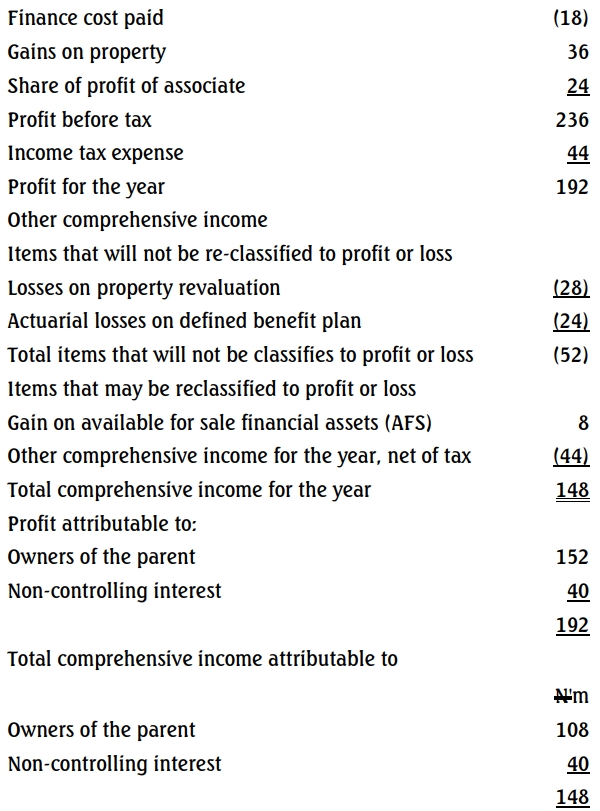

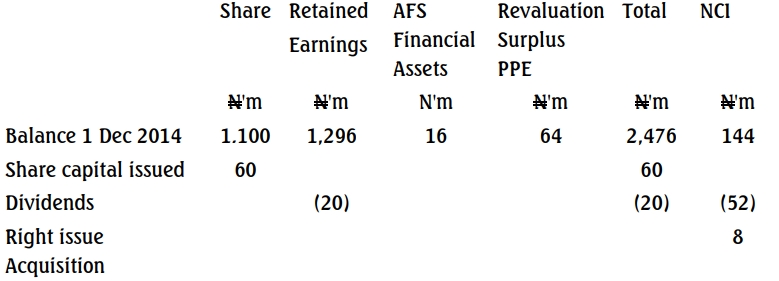

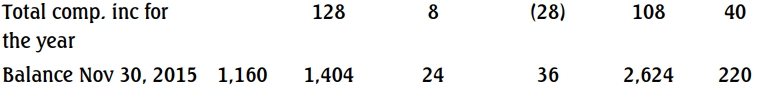

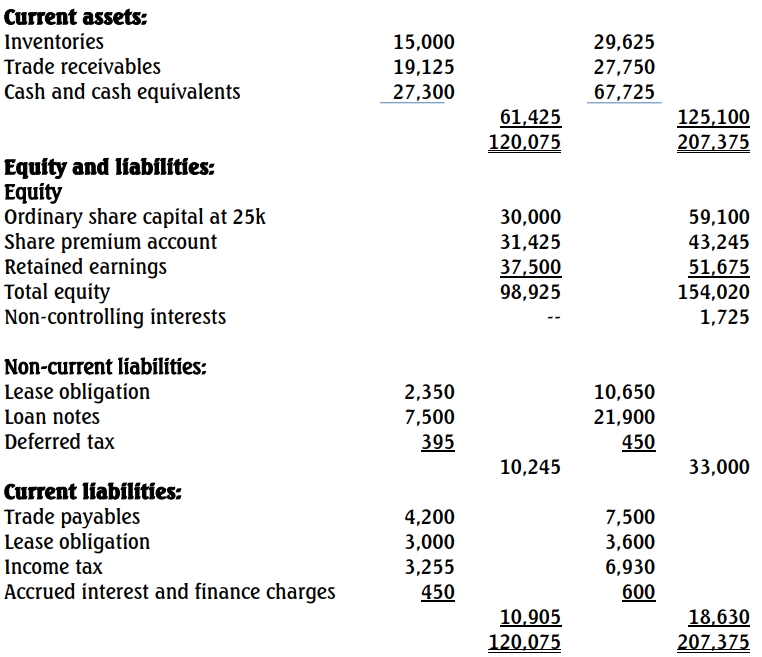

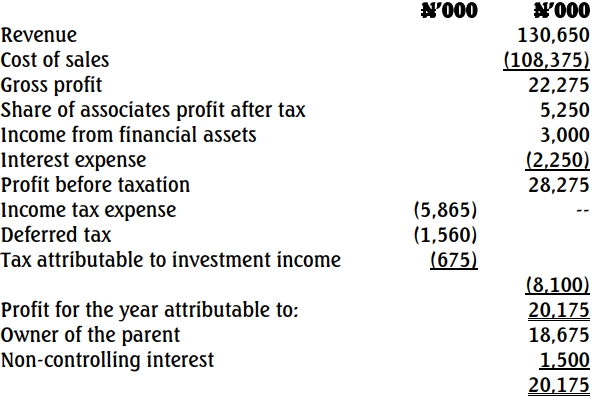

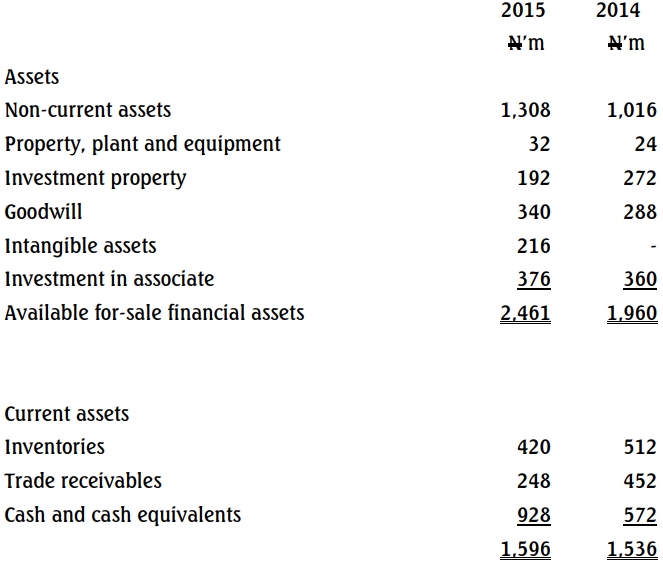

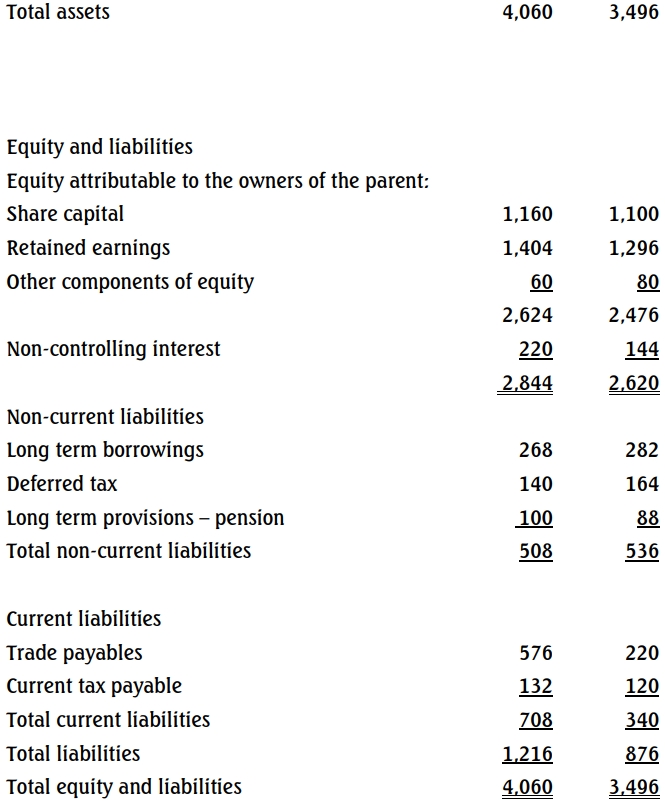

Joy-land Group: Statement of comprehensive income for the year ended November 30, 2015.

Joy-land Group: Statement of comprehensive income for the year ended November 30, 2015.