- 20 Marks

ATAX – Nov 2018 – L3 – Q2 – Taxation of Specialized Businesses

Calculation of petroleum profits tax for Olu Oil Limited considering local and export crude oil sales, gas contracts, and various expenses.

Question

Olu Oil Limited has been in the oil prospecting business in one of the major oil fields in the Niger Delta region of Nigeria since 2009. The company has provided the following operational results for the year ended December 31, 2015:

(i) Type of crude oil and sales statistics:

- Bonny Light: 35,000 barrels exported at 39º API

- Bonny Medium: 25,200 barrels exported at 35º API

- Forcados: 16,300 barrels exported at 32º API

Price per barrel:

- Bonny Light: $52.03 at 35º API

- Bonny Medium: $49.04 at 35º API

- Forcados: $48.29 at 35º API

Adjustment for API variance: Actual realized price was arrived at after adjusting for the variance in API. Thus, for every API, $0.03 was the variance in price at 35º API.

(ii) Local sales of crude oil: 32,750 barrels of crude oil was produced and sold in the domestic market at the rate of N345 per barrel.

(iii) Natural gas sales from two contracts:

| Contract | Value (N) | Load Factor |

|---|---|---|

| Obi Ltd | 42,285,000 | 62 |

| Oba Ltd | 27,775,000 | 74 |

(iv) Miscellaneous income: N125,800,300, including N105,500,000 from the sale of refined petroleum products. Attributable expenses of N88,240,000 were included in management and administrative expenses.

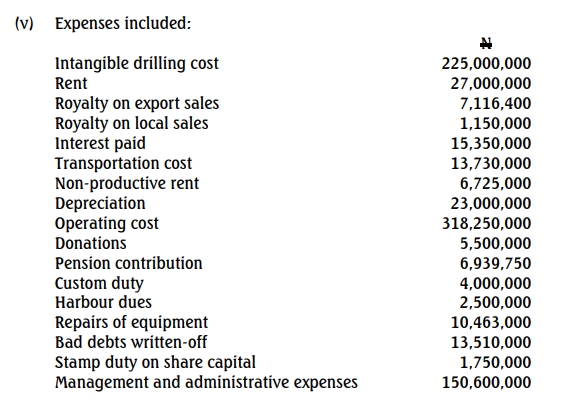

(vi) Miscellaneous income included N105,500,000, from the sale of refined petroleum products. An equivalent attributable expenses of N88,240,000 was included in management and administrative expenses.

(vii) Interest paid included N5,350,000, which was paid to Prince Limited, an associated company.

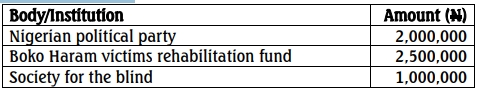

(viii) Donations included:

(ix) The pension scheme was approved by the Joint Tax Board.

(x) Exchange loss on remittance amounting to N3,200,000 was included in management and administrative expenses.

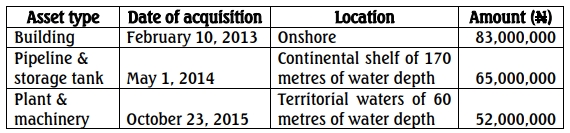

(xi) The schedule of qualifying capital expenditure includes:

(xii) Capital allowances brought forward was N12,700,000.

(xiii) The rate of exchange was N360 to a US Dollar.

(xiv) NNPC provides the relevant schedule as follows:

Required:

Evaluate the transactions and advise the management on:

(a.) Assessable profit (14 Marks)

(b.) Chargeable profit (2 Marks)

(c.) Chargeable tax (2 Marks)

(d.) Total tax liability payable (2 Marks)

Find Related Questions by Tags, levels, etc.