- 14 Marks

AT – NOV 2018 – L3 – Q2C – Business income – Corporate income tax, Tax administration in Ghana

Calculate taxable income and tax payable for an individual with multiple income sources, and identify tax compliance issues for a private practice.

Question

c) Kate Oppong, a physically challenged, works for the Ministry of Health as an eye surgeon and optician based at Komfo Anokye Teaching hospital in Kumasi. She dedicates most of her free time to her private practice, as well as writing books and articles for the Ghana Medical Journal. Kate is also part of the medical team for the local NGO and Sight Restoration, which is involved in cataract surgery for the disadvantaged members of society in remote rural areas.

Kate’s private practice is located in Kumasi and has a staff complement of six employees who are all full time workers. Kate only attends to the patients at her private practice strictly by appointment and her patient base has been steadily growing due to her experience and dedication.

In terms of her service contract with Sight Restoration, Kate is required to participate in all the cataract operations scheduled for the year. Her service contract is for a year, subject to renewal as and when donor support is available.Sight Restoration’s field staff, of which Kate is one, are paid a predetermined monthly salary plus an attendance allowance which is paid only after each cataract operation. The field staff is also entitled to a one-off representation allowance for participating in scheduled seminars.

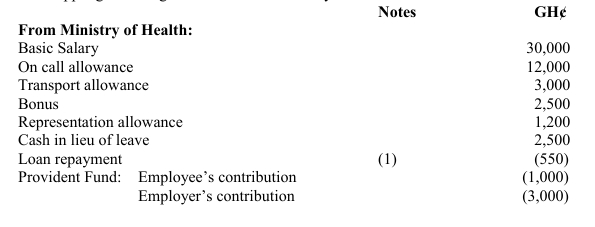

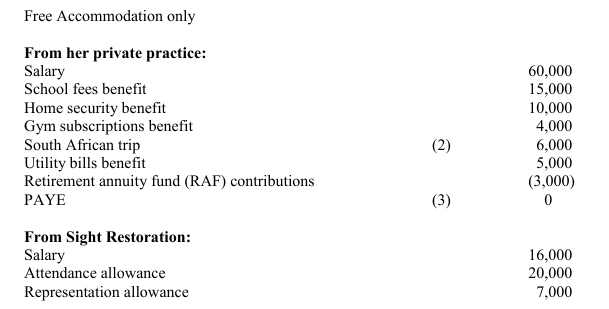

Kate Oppong’s earnings and deductions for the year ended 31 December 2017 were:

Notes:

- This amount is part repayment of the interest free personal loan of GH¢12,000 advanced to Kate on 1 January, 2017, repayable over two years. The Bank of Ghana interest rate for the year ended 31 December 2017 was constant at 20%.

- This amount was fully expended towards the travelling costs for Kate and her minor son for his medical treatment in South Africa.

- No employees tax (PAYE) or corporate income tax was paid in respect of the amounts paid to the employees of the private practice (including Kate) or the profits from the practice. This was because in Kate’s opinion her operations were ‘private’ and as such not subject to tax and also because she believed that she was already contributing her fair tax share from her other two employers.

- Kate is a single parent and takes care of her single son in the senior high school. She also takes full responsibility of her aged mother.

Required:

i) State the Ghana Revenue Authority’s (GRA) requirements which have been breached by Kate Oppong and consequences of the breach based on the information given in note (3). (5 marks)

ii) Calculate the taxable income of and income tax payable by Kate Oppong for the year ended 31 December 2017. Note: All computations should be rounded to a whole cedi. (9 marks)

Find Related Questions by Tags, levels, etc.