- 15 Marks

TAX – May 2024 – L2 – SA – Q5 – Value Added Tax (VAT)

Compute VAT payable by Havillah Manufacturing Limited and identify VAT-exempt goods and services.

Question

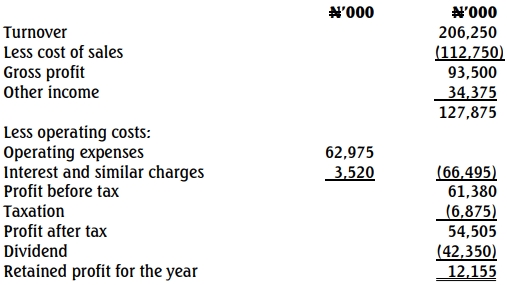

Havillah Manufacturing Limited, engaged in manufacturing perfumes and other cosmetic products, has the following profit or loss statement for the year ended September 30, 2021:

Additional Information:

- Turnover includes N64,350,000 from export sales and N141,900,000 from local sales.

- Cost of Sales includes:

- Opening inventory (VAT inclusive): N24,915,000

- Closing inventory (VAT inclusive): N40,865,000

- Purchase of raw materials: N94,600,000

- Freight charges: N20,570,000

- Other direct materials: N13,530,000

- Plant and machinery purchased for N24,750,000 is included in opening inventory, VAT inclusive.

- VAT and withholding tax remitted during the year amounted to N2,173,180 and N1,787,500, respectively.

Required: a. Compute the net VAT payable by Havillah Manufacturing Limited for the year. (10 Marks)

b. State FIVE VAT-exempt goods. (2½ Marks)

c. State FIVE VAT-exempt services. (2½ Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Exempt Goods, Exempt Services, Manufacturing, Net VAT Payable, VAT

- Level: Level 2

- Topic: Value-Added Tax (VAT)

- Series: MAY 2024

Report an error