- 20 Marks

AAA – Nov 2021 – L3 – Q4 – Audit Completion and Final Review

Discuss auditor responsibilities for detecting misstatements in different reporting periods and associated audit procedures.

Question

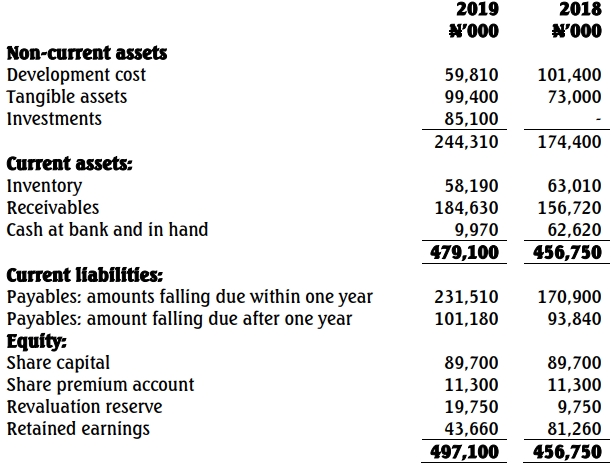

Your firm is the auditor of Sharp Electronics Co. Plc, a listed company, which assembles electronic home appliances for sale on retail and wholesale bases. The electronic appliances parts are purchased from within and outside the country. The extract from the statement of financial position of the company is as follows:

Sharp Electronics Co. Plc – Statement of Financial Position

You have been asked by the partner in charge of the audit to consider your firm’s audit responsibilities with respect to subsequent events, and the associated audit procedures for such matters.

Required:

a. Discuss the responsibilities of the auditors for detecting misstatements in the financial statements during the following periods:

i. From the end of the reporting period up to the date of the audit report. (8 Marks)

ii. After the date of the audit report and before financial statements are issued. (6 Marks)

iii. After the financial statements have been issued. (3 Marks)

b. State the details of the work you will carry out in period (a)(ii) above to identify significant subsequent events affecting the financial statements. (5 Marks)

Find Related Questions by Tags, levels, etc.