- 30 Marks

AT – Nov 2014 – L3 – SA – Q1 – Tax Administration and Dispute Resolution

Explain penalties for non-compliance, compute profit and tax liabilities, and detail exemptions from minimum tax liability.

Question

The Tax Consultants, ABFR Consult, received an e-mail from Mrs. Deboh Komo, Managing Director of Deboko Nigeria Limited. Extracts of her e-mail are as follows:

- The company was incorporated on 1 February 2007.

- It commenced business as importers of new engines for tricycles on 1 May 2009.

- The Directors chose 30 June as the year-end and made the first financial statements up to 30 June 2010.

- The company did not file any tax returns to date due to a general lull in business activities.

- The tax monitoring section of the Federal Inland Revenue Service (FIRS) visited the company on 2 September 2014, uncovering non-compliance.

- No tax registration was done, and no returns were filed.

- The Accounts Officer advised the company to register for all statutory payments, including Value Added Tax (VAT) and Companies Income Tax, but the management delayed.

- The company pleaded for leniency, but the FIRS insisted on full compliance with tax laws.

Additional Information:

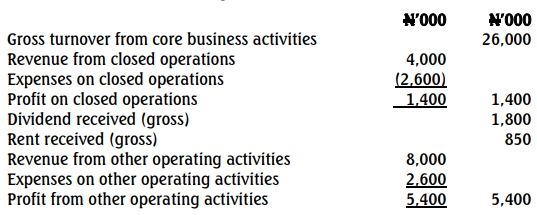

- Statement of Profit or Loss and Other Comprehensive Income:

| Period Ended | 30/06/13 (₦’000) | 30/06/12 (₦’000) | 30/06/11 (₦’000) | 30/06/10 (₦’000) |

|---|---|---|---|---|

| Operating Profit/(Loss) | 1,060 | 960 | 720 | (504) |

| Depreciation | 380 | 120 | 120 | 153 |

| Staff Loans Written Off | – | – | – | 40 |

| Stamp Duties on Incorporation | – | – | – | 16 |

| Sales Tax | 120 | 80 | 44 | 40 |

| Donations to Christian Association | 60 | – | – | 10 |

| Specific Bad Debts Written Off | 28 | – | – | 14 |

- Statement of Financial Position:

| Item | 30/06/13 (₦’000) | 30/06/12 (₦’000) | 30/06/11 (₦’000) | 30/06/10 (₦’000) |

|---|---|---|---|---|

| Paid-Up Capital | 30,000 | 15,000 | 15,000 | 15,000 |

| Deposit for Shares | 25,000 | 10,000 | 5,000 | – |

| Net Assets | 101,500 | 84,110 | 76,700 | 66,000 |

| Revenue | 210,500 | 180,400 | 162,000 | 104,000 |

| Gross Profit | 16,400 | 14,200 | 12,800 | 10,200 |

- Capital Allowances Agreed:

| Year of Assessment | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|

| Capital Allowances | 140 | 150 | 150 | 250 | 200 | 300 |

Requirement:

(a) Explain the penalties for late submission of annual returns to the FIRS. (4 Marks)

(b) Compute the Total Profit and Tax Liabilities of the company for the relevant years of assessment. (24 Marks)

(c) Explain the conditions for exemption from minimum tax liability under the Companies Income Tax Act CAP C21 LFN 2004 (as amended). (2 Marks)

Find Related Questions by Tags, levels, etc.

- Tags: Late Returns, Minimum Tax, Penalties, Profit Computation, Tax Compliance, Tax liabilities

- Level: Level 3

- Topic: Tax Administration and Dispute Resolution

- Series: NOV 2014

Report an error